Massive Bitcoin Trade on Hyperliquid Following Trump’s Announcement

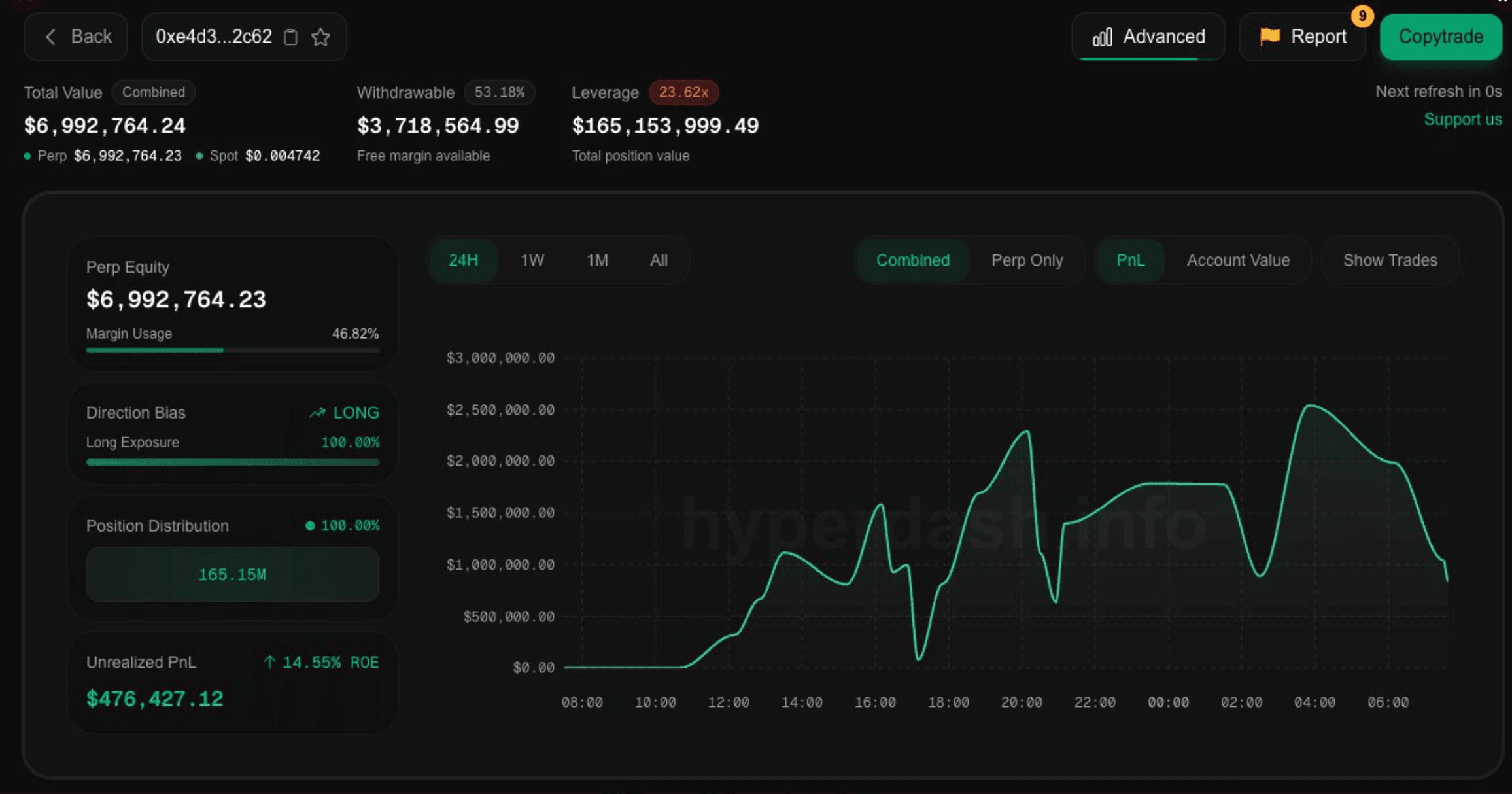

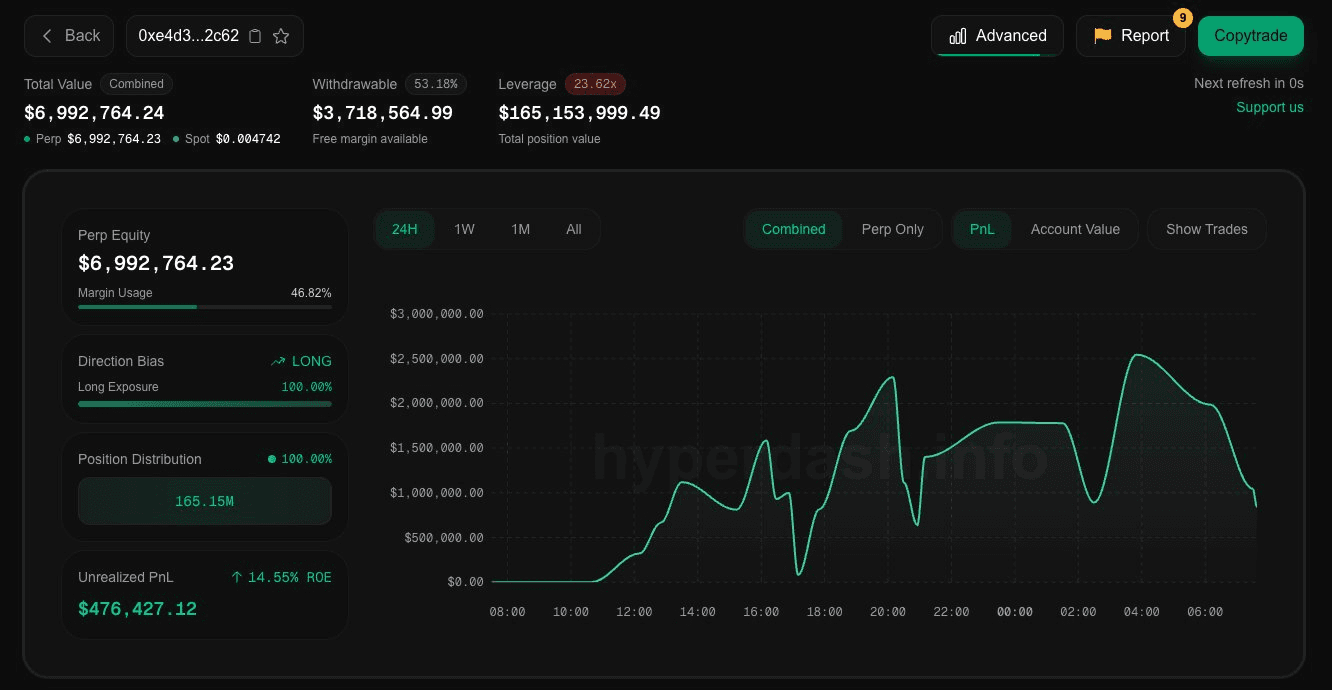

A trader on the decentralized derivatives platform Hyperliquid executed a staggering $200 million long position on bitcoin (BTC) using a hefty 50x leverage this past Sunday. This bold move resulted in a profit of approximately $6.8 million after a market-wide rally was ignited by U.S. President Donald Trump, who revealed the nation’s plans for a crypto reserve.

The trader initially utilized $4 million in collateral to set up the trade, which was perilously close to liquidation at one point, being just a $50 swing away from triggering a margin call. The entry price for the position was at $85,908, with a liquidation threshold set at $84,752. Instead of facing liquidation, BTC surged by more than 11%, climbing from $85,000 to an impressive $97,255 after Trump made a reference to the crypto reserve on his social media platform, Truth Social.

However, despite the success of the BTC trade, the trader may have backed the wrong horse in the broader market. Notably, ADA (Cardano) and XRP (Ripple) experienced remarkable gains of 47% and 18% respectively, showcasing the diverse reactions in the crypto market.

Trump’s announcement caught many by surprise, especially due to the inclusion of cryptocurrencies like XRP, SOL (Solana), and ADA in the reserve. Prominent figures in the crypto community, such as Coinbase CEO Brian Armstrong and Bitwise CEO Hunter Horsely, expressed their disbelief, as they had anticipated that the U.S. reserve would be exclusively focused on bitcoin. Meanwhile, supporters of Ripple and Cardano celebrated their unexpected inclusion on social media platforms.

Some skeptics on social media have speculated whether the trader had insider knowledge regarding the reserve’s content, though it’s still uncertain whether the position was a hedge against market volatility or if the trader believed that BTC had reached its bottom after a significant correction from $109,000 to lows of $78,000 in the weeks following Trump’s inauguration.

Ultimately, the trader has now closed the long position, successfully realizing a profit of around $6.8 million.