Two weeks after Etheruem’s Shapella upgrade, the crypto options market is signaling a higher perceived risk of downside volatility in the smart contract blockchain’s native token, ether (ETH), than market leader bitcoin (BTC).

On Tuesday, options tied to ether and bitcoin signaled a bias for puts or bearish bets that offer the purchaser protection against price slides. However, the demand for puts in the ether market was stronger than in the bitcoin market.

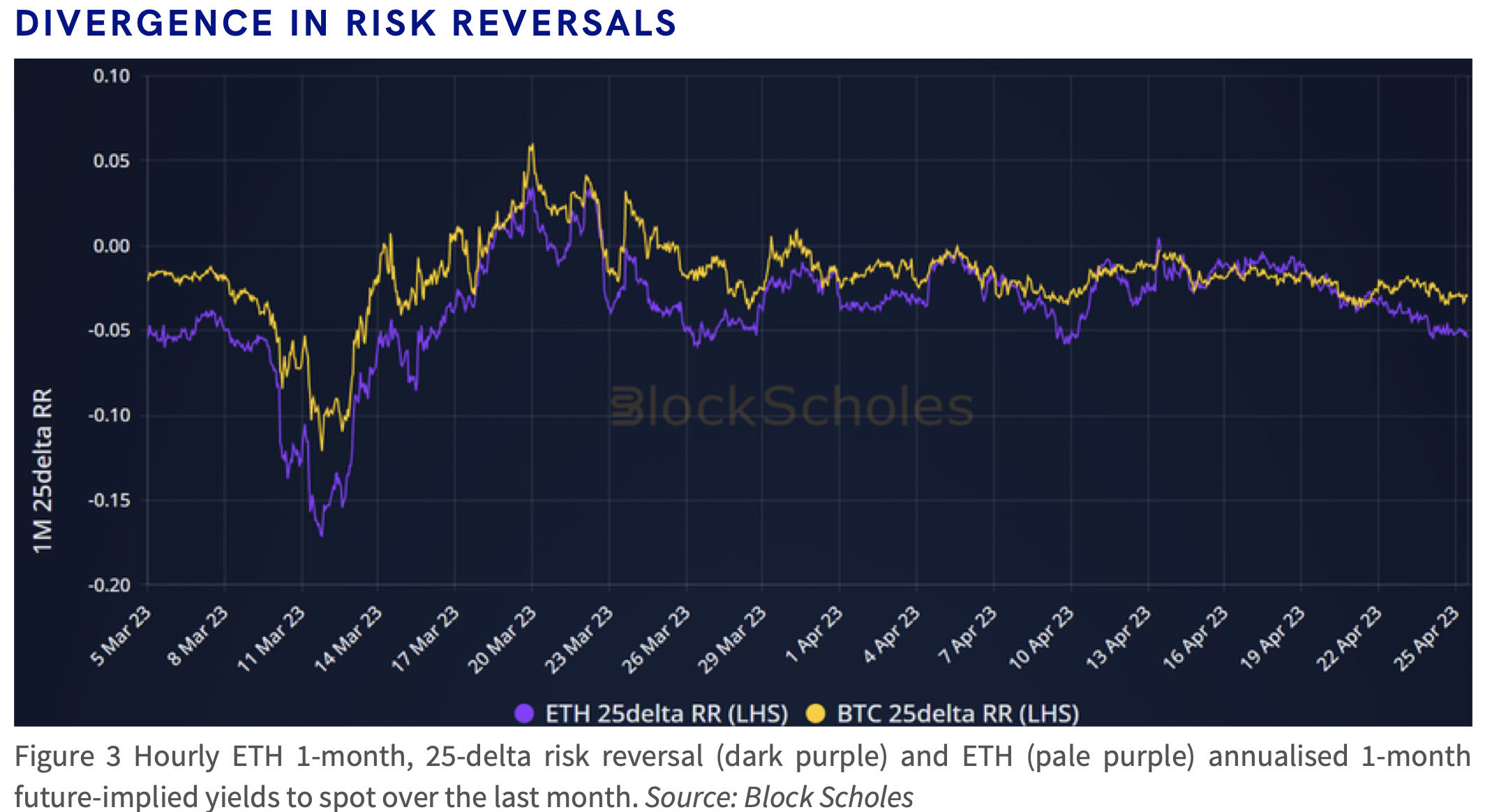

While ether’s one-month bearish out-of-the-money (OTM) puts traded at a five volatility points premium to bullish OTM calls, bitcoin’s OTM puts traded at a three-point premium to calls, according to options 25-delta risk reversal data tracked by crypto derivatives analytics firm Block Scholes.

“ETH’s [risk reversal] skew has now reversed its post-Shapella recovery relative to BTC options, now pricing OTM puts at a 5 vol premium to calls at a 1-month tenor,” Andrew Melville, research analyst at Block Scholes, wrote in a research note on Tuesday.

“This suggests a return to the slightly more negative sentiment assigned to ETH that we have commented on throughout this year,” Melville added.

Implied volatility refers to investors’ expectations for price turbulence over a specific period. An increase in IV represents an uptick in demand for options and lifts options premiums.

Risk reversals track the spread between implied volatility for OTM puts and calls, telling observers in which direction market volatility is more likely. An option is OTM when the underlying asset’s market price is below the set price (strike price), in the case of bullish calls, or above the set price, in the case of bearish puts.

The blue line represents ETH’s one-month risk reversal while the yellow represents bitcoin’s gauge. (Block Scholes) (Block Scholes)

Barring the post-Shapella week, ether’s one-month risk reversal has consistently hovered below bitcoin’s risk reversal, signaling a relative stronger bias for puts.

Risk reversals in both markets had recovered to almost zero from negative, signaling a bearish-to-neutral shift in sentiment after the Shapella hard fork went live on April 12.

Recommended for you:

- NFT-Linked Sandals Worn by Steve Jobs Sell for $218,000

- Cory Doctorow’s Web3 Rallying Cry: ‘Seize the Means of Computation’

- There Will Be No Lessons Learned From FTX

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

The upgrade opened withdrawals of staked ether, de-risking the popular passive investing strategy of depositing coins in the network in return for rewards. Ether rallied to an 11-month of $2,140 following the upgrade but has since pulled back to under $1,900.