Ether’s options market flipped bullish on Monday, showing a bias for strength in Ethereum’s native token for the first time in over six months.

-

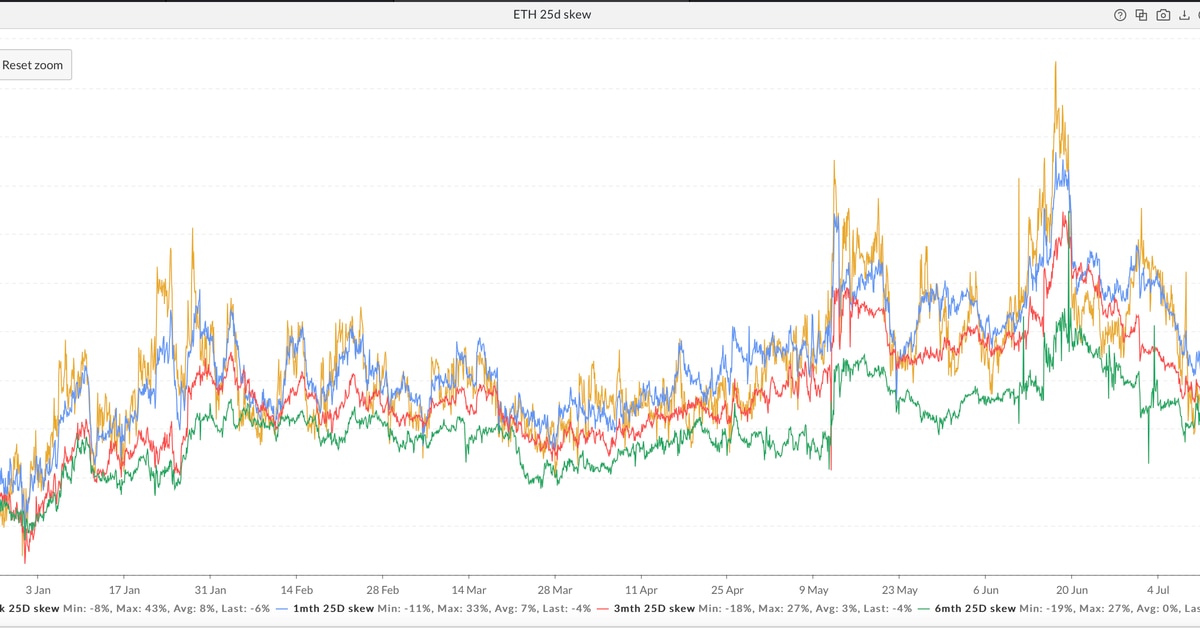

The six-month put-call skew, which measures the cost of puts (bearish bets) relative to calls (bullish bets), slipped below zero and fell to -4%, the lowest figure since Jan. 3, data provided by analytics platform Skew shows.

-

The negative turn indicates that the premium paid by call buyers in return for protection against upside moves over six months is now greater than the cost paid by put buyers for insurance against bearish moves.

-

The one-week, one- and three-month put-call skews have seen a similar drop below zero, also their first since early January, in a sign of renewed relatively stronger demand for short-term and medium-term bullish bets.

-

The change in sentiment validates ether’s ongoing rally, supposedly triggered by developers recently announcing Sept. 19 as a tentative date for the completion of Ethereum’s long-awaited transition from the proof-of-work consensus mechanism to the proof-of-stake mechanism.

-

Ether (ETH) topped $1,500 early Monday, hitting its highest level since June 12, according to CoinDesk data. The cryptocurrency has gained 35% in seven days, outperforming bitcoin’s 11% rise by a wide margin.

-

The impending network upgrade, dubbed the “Merge” or Ethereum 2.0, promises to make ether a deflationary currency and Ethereum an environmentally friendly smart contract blockchain.

-

“At this point, some traders are buying large amounts of call options (usually expiring within a week) and buying the underlying [asset] in the spot market,” Griffin Ardern, volatility trader from crypto asset management firm Blofin, said.

-

“To hedge their risk, options market makers [who sold calls to investors] need to buy spot or go long futures, which will push prices up further quickly when liquidity is insufficient,” Ardern added.

-

Options market makers are entities entrusted with ensuring healthy liquidity levels on exchanges. Market makers are usually on the opposite side of investors’ trades and run a direction-neutral exposure by constantly buying and selling the underlying assetin spot/derivatives markets.