Dear cryptocurrency investors, 2023 has been a test of patience for us. Let’s take a look at what has happened since the beginning of the year.

According to the decision of their meeting in May, the Fed’s balance sheet narrowing decision (reducing the amount of money circulating in the market) and parallel interest rate increases, which officially started in June 2022, affected all money markets as well as cryptocurrency markets and became the official beginning of the bear market. I say official because various technical and onchain analyzes previously gave signals that the market was weak.

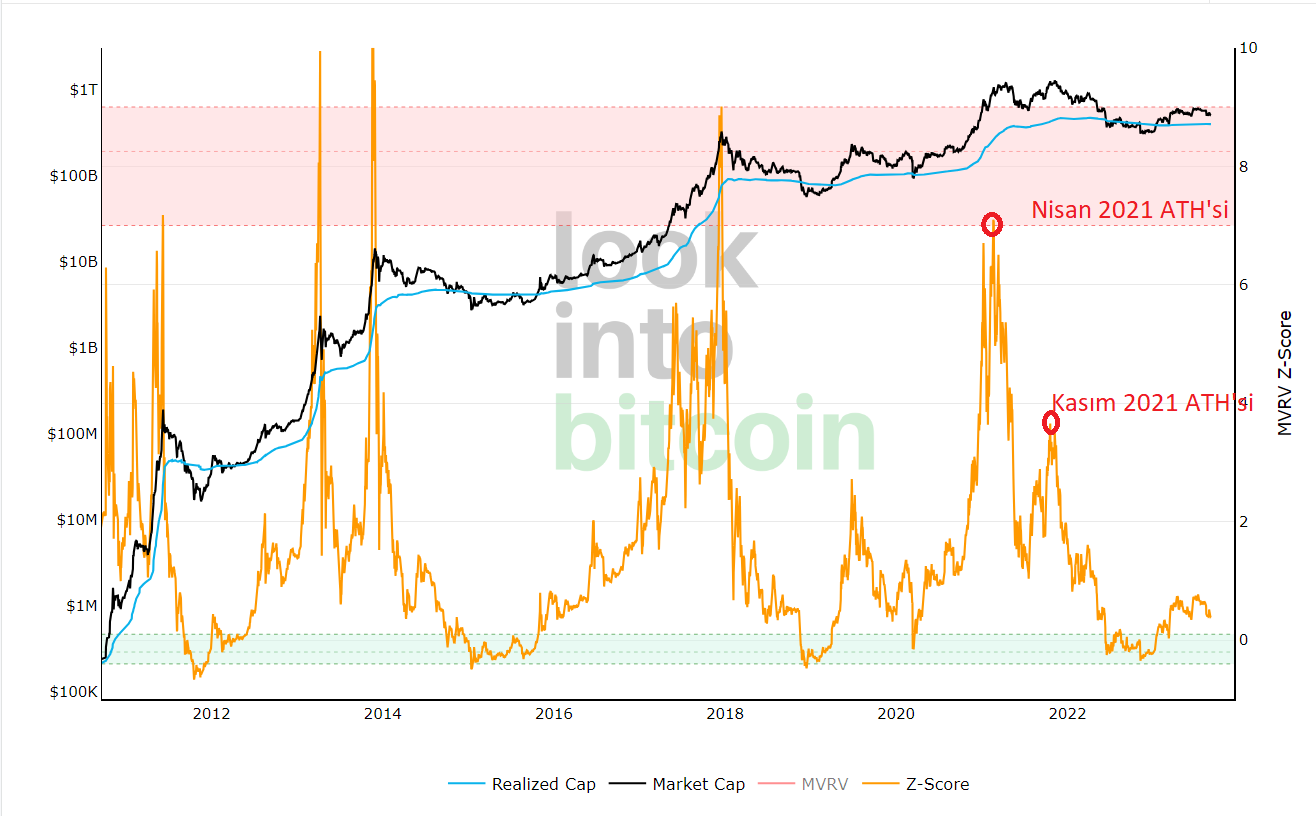

Bitcoin: MVRV Z-Score Chart

Official Balance Sheet Representation of the decision and beginning of the contraction on the BTC chart

We stepped into 2023 with the irregularities involving the CEO of the FTX exchange, which followed the deterioration of the global economy, the bankruptcy of the stock exchange, and the subsequent bankruptcy of various cryptocurrency companies.

According to various onchain charts we followed in January 2023, Bitcoin had reached its bottom levels.

BTC, which started to gain momentum in January, experienced serious withdrawals on the BTC side in early March as the news of the US selling its Bitcoins spread. Then, as we followed from CryptoPNZ, on March 13, Binance exchange CEO CZ’s statement to purchase BTC and ETH with BUSD worth 1 billion dollars, and in addition to this, the rescue package initiated by the USA due to bank crises (they printed money), Bitcoin and revived the cryptocurrency markets.

Unfortunately, the cryptocurrency market, which exhibited an upward trend until mid-April, entered a downward trend again with the FUD news in the following periods and the SEC’s constant attack on cryptocurrency exchanges.

In June, the spot Bitcoin ETF application made by BlackRock company and the positive news flow, and the subsequent victory of Ripple against the SEC, revived the cryptocurrency market.

Currently, there is a serious lack of volume. I think that in a case that cryptocurrency exchanges win against the SEC, cryptocurrency markets will again attract investors.