Gold prices could not make a convincing move in both directions last week. However, according to market analyst Eren Sengezer, it is possible to trigger an important reaction of August inflation data from the USA. The analyst also notes that the technical appearance of gold points to the lack of recovery acceleration.

What happened in the markets last week?

Interests to the rising, further suppressed the gold

Since the US financial markets were closed due to the workers’ holiday, the trading action was suppressed on Monday. With the transaction volumes return to normal levels on Tuesday, the avoidance of risk in the markets became apparent. Thus, the dollar began to collect power and caused the gold to fall. In addition, increasing concerns about a deepening energy crisis in the euro zone provided additional support for the dollar.

Meanwhile, on Tuesday, ISM reported that the Services PMI rose from 56.7 to 56.9 in July in July. The employment index has returned to over 50 expansion zones. Paid Prices Index, the inflation component, fell from 72.3 to 71.5 with a slight decrease to 71.5. Following this data, the Fed’s probability of increasing 75 basis points in September increased more than 70 %. This further repressed the US treasury bond returns.

Gold prices on Friday to the highest level of a week

Data from China showed that imports and exports increased at a softer speed in August than expected in August on Wednesday. Disappointed trade figures, in the first half of the day forced the gold to survive. However, the yellow metal reversed its direction in the American session. The Federal Reserve’s beige book showed that US companies have made progress in labor supply and price pressure in July. This caused DXY to move away from the highest level of twenty years in 110.78.

Kriptokoin.comAs you have followed, on Thursday, the European Central Bank (ECB) increased key interest rates as expected by 75 basis points. ECB President Christine Lagarde took a cautious stance on future interest rate hikes. However, 10 -year US bond return rose by more than 10 %. This caused gold damage. On the other hand, gold prices, despite the dull performance of the dollar, noted daily losses. In his speech the same day, FOMC President Jerome Powell reiterated that they should act strongly in inflation. Besides, he said that history has warned politics against early relaxation. However, these statements had no permanent impact on the performance of the dollar against their rivals.

Before the weekend, the positive change witnessed in the sense of risk triggered a deep dollar sale. With this effect, gold prices increased to the highest level of a week at $ 1,729,55. However, towards the end of the European session, making some profit limited the gains of the precious metal.

What’s for gold prices on the agenda of the next week?

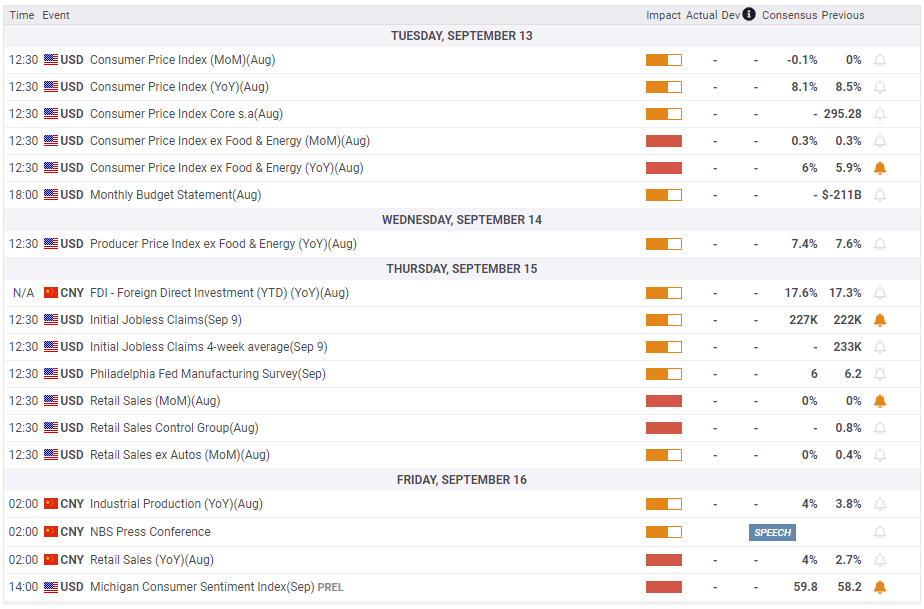

The event of the week for gold prices: US CPI data

The US Office of Working Statistics will publish August Consumer Price Index (CPI) data on Tuesday. Expectations are that CPI decreases 0.1 %on a monthly basis. Excluding variable food and energy prices, the core CPI is expected to remain unchanged at 0.3 %. In September, FOMC policy makers refrained to approve an interest rate hike of 75 basis points in September. Therefore, according to the analyst, a soft inflation report is possible to increase the possibility of 50 basis points. The analyst makes the following assessment:

In this scenario, the US T-Tahvil returns sharply and underneath it is likely to trigger a decisive rally. On the other hand, CPI data, which is stronger than expected, can provide an interest rate increase of 75 basis points. This may not allow gold to return to the north. However, the markets have already accepted a large increase. Therefore, it is worth noting that the potential gains of the dollar will remain limited.

Thursday and Friday data are important for gold

August retail sales figures will be announced on Thursday in the US economy. However, the analyst does not consider investors react to these data because they are not set to price changes. On Friday, in August, industrial production and retail sales data from China will be looked at to gain a new momentum. Both data are expected to produce a stronger expansion than recorded in July. According to the analyst, if these figures are disappointed, investors will lose the hope of a stable recovery in gold demand. Therefore, it is likely that gold will have difficulty finding demand.

Finally, Michigan University’s Flash September Consumer Sensitivity Index report will be published on Friday. Market participants are likely to pay attention to the long -term inflation expectations component of the questionnaire rather than the Trust Index title. Analyst sees possible that the decline in 5-10 years of consumer inflation expectations will damage the dollar. However, an unexpected increase will help to strengthen the dollar and gain weight on gold prices.

Gold prices technical view

After a calm start to last week, gold prices fell. However, he managed to survive over $ 1,700. Gold expanded the upper correction of the dollar before the weekend faced intensive sales pressure. In this respect, it reached the highest level of ten days near $ 1,730 on Friday. Nevertheless, gold prices could not maintain the rise momentum. Therefore, it closed the week with little changes below $ 1,720. Market analyst Eren Sengezer analyzes the technical appearance of gold for next week.

Following this week’s unstable price movement, the short -term technical appearance of gold points to the neutral/decline tendency. The relative power index (RSI) indicator in the daily graph has not yet reached 50. This shows that although gold struggles to collect rise momentum, it has more upward correctional rooms.

In the upward direction, $ 1,740 (20 -day SMA, 50 -day SMA) stands as a key resistance. With a day closing above this level, additional gains towards $ 1,760 and $ 1,790 are possible. $ 1,700 remains intact as a significant support. If gold falls below this level and starts to use it as resistance, bears will probably target $ 1,680 and $ 1,675.