Gold is currently trading above $1,780. However, GraniteShares CEO and Founder Will Rhind says the current situation is one of the worst environments for gold. GoldSilver senior precious metals analyst Jeff Clark explains the relationship between recession and inflation with gold. Meanwhile, market analyst Pablo Piovano predicts a correction.

“As competitors of gold, stock and bond markets also fell”

The FOMC is raising interest rates faster than most, if not all, advanced economies in the world. That’s why Will Rhind notes that the US dollar has risen. But he says gold is performing well against other assets. Rhind explains:

Equity and bond markets fell in terms of being a viable competitor to gold. Commodities has been one of the top spots this year. Cryptocurrencies, on the other hand, disappeared from the competitive environment.

Will Rhind: It’s a distraction tactic!

On July 21, the White House issued a statement claiming that the two-quarters drop in GDP does not necessarily mean a recession. Rhind comments on the White House statement:

This is consistent with some of the things the Biden administration has said about inflation. There have been various officials trying to explain why inflation is good for us. On the subject of the recession, they say, ‘this is not an official recession unless we say so’. It’s a distraction tactic.

The Biden administration pointed out that the US labor market is strong and unemployment is low. But Rhind sees this as a lagging indicator. “If you were able to raise a large amount of capital last year, a few more years might not be filtered out for larger layoffs or restructurings,” Rhind says.

Jeff Clark: The Fed is a marketing machine!

cryptocoin.com Fed Chairman Jerome Powell stated last week that the US economy is not in recession. Biden administration officials seem to agree, including National Economic Council Director Brian Deese and Treasury Secretary Janet Yellen. Powell also noted that he did not rule out the possibility of further rate hikes after the FOMC raised its benchmark target by 75 basis points. Jeff Clark, senior precious metals analyst at GoldSilver, comments:

The Fed is a marketing machine. It is not necessarily a truth machine. They will downplay bad news and try to keep the economy strong and encourage people. They will not cause any panic.

“Gold rises in six of the last eight recessions”

Clark says recessions and inflation have historically been good for gold. The analyst notes that the difference between the 10-year Treasury rates and the 2-year Treasury rates, also known as the yield curve, is a ‘bellwether’ that indicates a recession.

Jeff Clark said, “Every time that number went negative, after that we went into a recession. “This indicator has predicted every single recession since 1980,” he says. Currently, St. Louis Fed reports that the difference between 10-year and 2-year returns is -0.22. One of Clark’s preferred investment assets as a safe haven during the recession is gold. The analyst says:

I went back and looked at every recession in the past fifty years. The US has had eight of these, and gold has risen in six of the last eight recessions. In the two he fell, the declines were very slight, like single digits.

Is gold a good inflation hedge?

US inflation hit 9.1 percent in June, the highest level since 1981. But gold can’t keep up with the pace. The precious metal fell 2.3% year on year. Clark says this is because gold is lagging behind inflation. In this context, he comments:

I go back to the last time we had really high inflation. Of course it was the 1970s and I looked at the correlation between the movement of gold and the movement in the CPI. The correlation is really high. But what I discovered in the second half of the seventies was that there was a lag from rising inflation to moving gold prices. He finally responded and of course went over the roof at the time.

But Clark warns that there are factors beyond GDP and CPI that affect gold prices. “In the big picture, I’m not just looking at inflation. “I am looking at any crisis that will push more and more investors into the gold market,” he says.

Pablo Piovano: A fix is coming

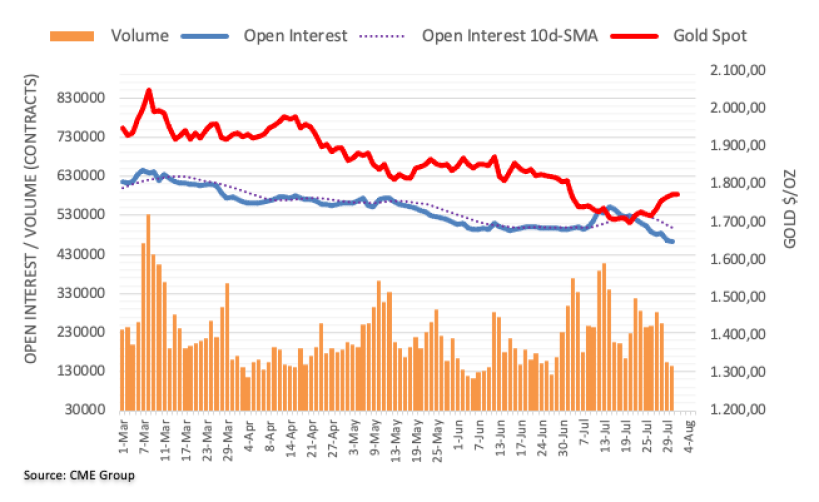

Open interest on gold futures markets fell for the second straight session on Monday. This time it fell to more than 4,000 contracts, according to advanced pressure from CME Group. Along the same lines, volume fell for the third consecutive session and is now down by about 10.5k contracts.

Market analyst Pablo Piovano notes that Monday’s rise in gold prices was amid declining open interest and volume. According to the analyst, this is an indication that a possible corrective downside could be formed in the very near term. The analyst says that so far, price action in the yellow metal has been limited to the $1,780 mark.