As the meme token market fizzles, PEPE whales are forced to accept huge losses. New reports showed that two more whales gave up today.

PEPE whales sell with serious losses after latest drop

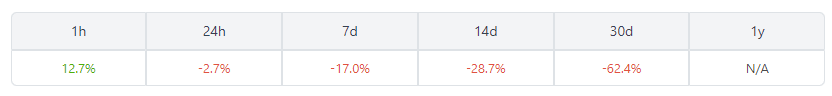

Things are turning around for Pepe (PEPE), which debuted in April and has soared over 1000% for weeks. Binance and Coinbase lawsuits of the week led to additional depreciation. Solana and BNB, which the SEC declared securities under the lawsuit, fell around 9%, while PEPE fell 3%. Still, the recent depreciation is serious:

In this environment, data from Lookonchain revealed that at least two new whales suffered more significant losses. One of them sold a total of 375.8 billion PEPEs, with a loss of $142,000 (worth around 76 ETH) today. Another whale sold about 257 billion PEPE (worth $306,000) at a loss of about $35,000.

Whales/SmartMoneys are selling $PEPE.

A whale deposited 649B $PEPE($761K) 1 hr ago.

0x4614 who made 1,182 $ETH($2.2M) on $PEPE sold 375.8B $PEPE($306K) at a loss of 76 $ETH($142K) 1 hr ago.

0x6544 who made $352K on $PEPE sold 257.9B $PEPE($306K) at a loss of $35K 4 hrs ago. pic.twitter.com/w8crgva6S0

— Lookonchain (@lookonchain) June 5, 2023

Dogecoin price also defeated the sales in the market

Dogecoin, which had a tough time in the Pepe rally in the April-May period, is now approaching a three-month low. Its price is currently trading around $0.06824, down 4% on the day.

But the bigger problem in DOGE’s case lies in ‘whale indifference’. During the month of May, the whales’ savings were under $2 billion. At the time of writing, the volume has dropped to $1.5 billion.

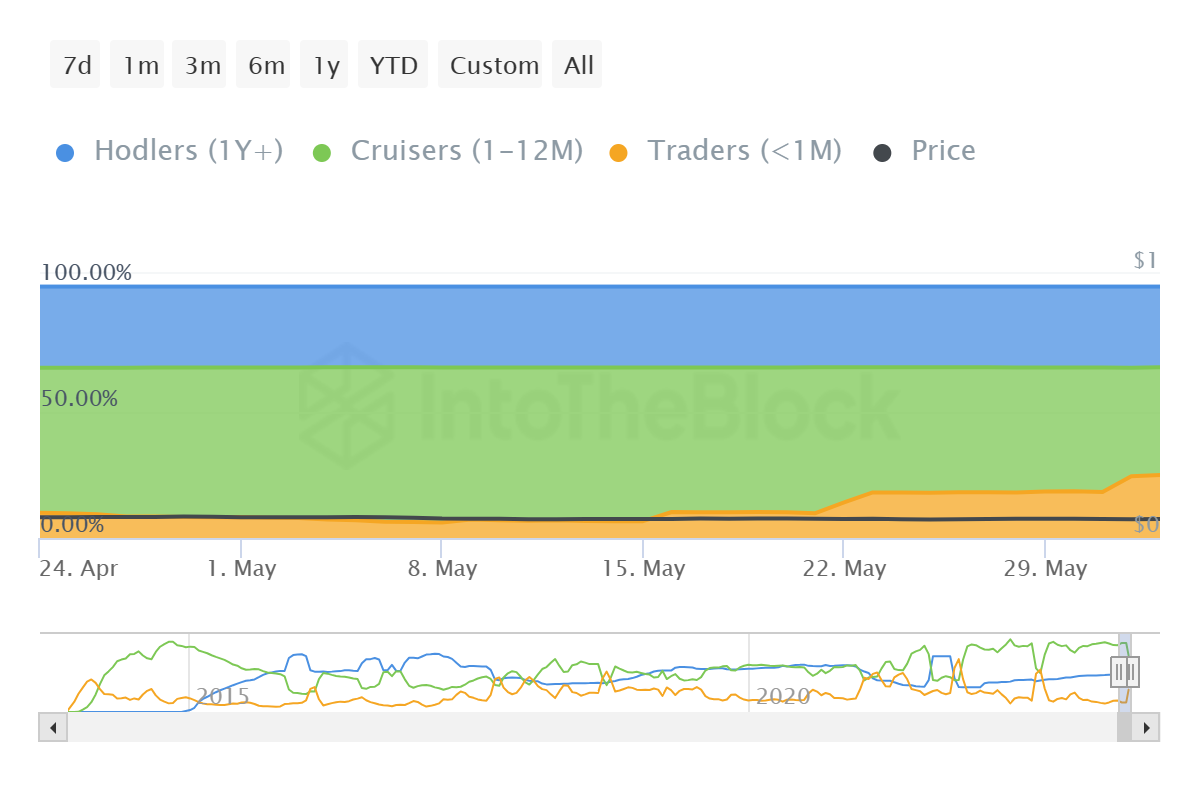

Also, Dogecoin is losing the trust of its investors faster than it can hold. This inference emerged with the decline in the number of long-term investors. The change in supply can be observed in their dominance, which has dropped from 60% in early May to 42.85% now. Thus, the lost supply moved to short-term holders who had held their DOGE for less than a month. This class of whales currently manages over 25% of the entire circulating supply.

What altcoin are whales after?

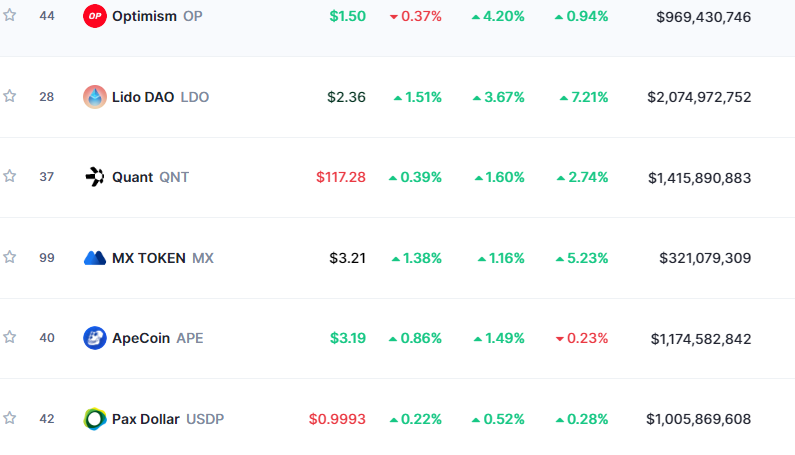

An indirect answer to this question can be given by the recent increase in Optimism (OP) price. OP is currently on the rise despite the sharp sell-off caused by the SEC lawsuits.

Previously, its price dropped 14% on June 5, then recovered in a short time. Technical analysis shows that the next target will be $1.82 after OP price breaks $1.48 with the latest move. Such a move would yield a total gain of around 20% from the current price.

On-chain data supports Optimism (OP) rise

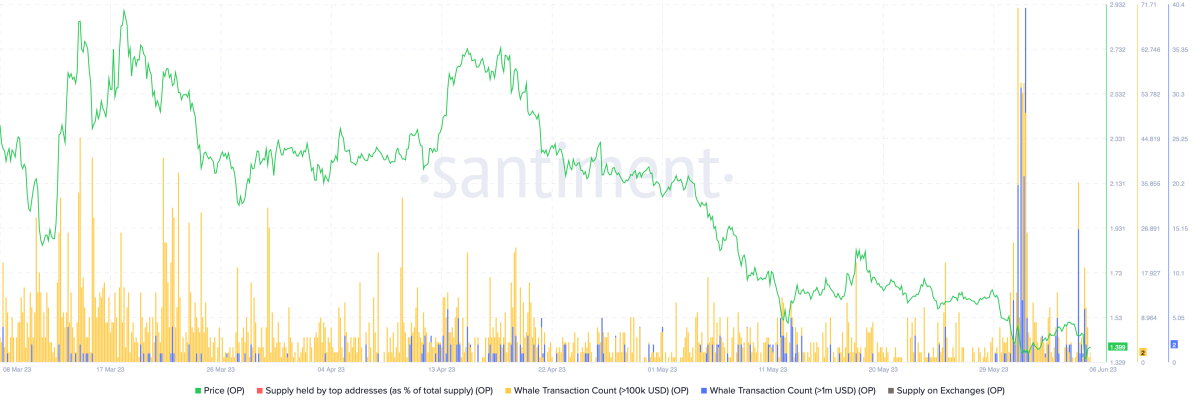

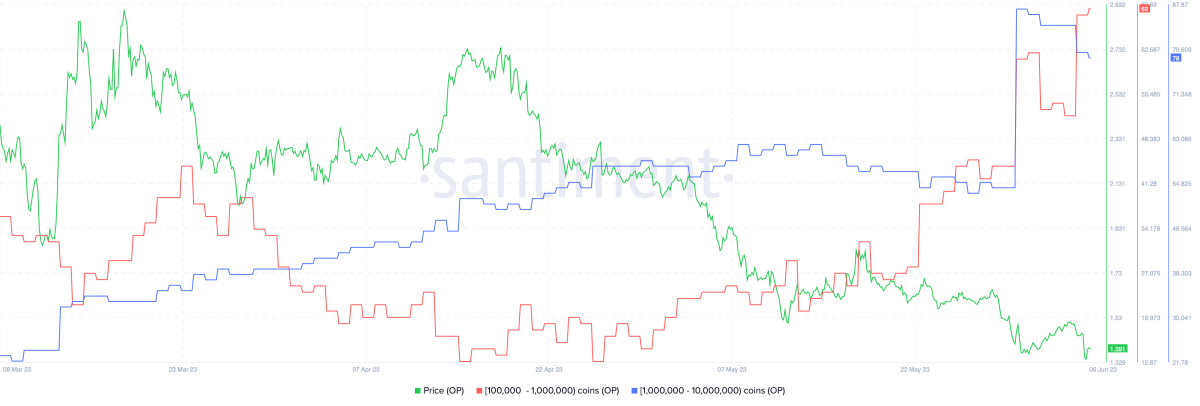

One of the most important metrics is Whale Transactions. As the name suggests, this index tracks transactions worth more than $100,000. In the Santiment chart below, Yellow bars follow transactions worth over $100,000 and blue bars follow transactions worth over $1 million. As the chart shows, there was a big spike on May 31st and June 1st after Optimism price dropped 24%. Obviously, this index is interpreted as whales buying the dive.

Also, the Supply Distribution chart shows that whales holding 100,000 to 1 million OPs have been on a buying spree since May 14. Their numbers have increased from 21 to 69, marking a 228% increase.

Similarly, addresses holding 100,000-1 million OPs jumped from 54 on May 30 to 78 on June 6. These patterns show that they expect a bullish future for Optimism price.

Although all signs point to bullish for OP price, the SEC case still calls for caution. The SEC-Binance lawsuit that surfaced yesterday resulted in $311 million in liquidation. cryptocoin.com The second lawsuit of the day against Coinbase triggered additional losses. Technical analysis shows that in an extreme bear situation, initial support for OP traders is at $1.34. A break of this level and a daily candle below will lead the bears to $1.06.