Happy Thanksgiving to my fellow Yankees! For the rest of you, I’m counting on you to keep an eye on Twitter in case someone else files for bankruptcy. But today, we’re looking at FTX’s first bankruptcy hearing.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Taking no prisoners

The narrative

FTX (finally) had its first day hearing on Tuesday, letting the company’s lawyers finally get a better sense of just what was going on with the bankrupt crypto exchange.

Why it matters

FTX’s collapse has kicked off the most complicated bankruptcy process so far for the crypto ecosystem, with 102 different court dockets and a first day hearing that took well over a week to schedule. Millions of people’s money is at risk, and that’s ignoring the broader contagion concerns within the crypto ecosystem.

Breaking it down

I live-tweeted FTX’s first day hearing on Twitter, but I wanted to highlight a few key takeaways.

-

Much of the hearing echoed the first-day filing that we saw last week. FTX is being investigated by state and federal regulators, it’s still unclear just what exactly FTX has in terms of assets and liabilities and “FTX was in the control of a small group of inexperienced and unsophisticated individuals. And unfortunately, the evidence seems to indicate that some or all of them are also compromised individuals,” an attorney for FTX said.

-

The lawyers representing FTX and its new leadership are taking no prisoners. James Bromley of Sullivan & Cromwell told a judge, “you have witnessed probably one of the most abrupt and difficult collapses in the history of corporate America,” calling the FTX worldwide organization Sam Bankman-Fried’s “personal fiefdom” and alleging gross mismanagement.

-

Once again, customer privacy is going to become a big question. Like we saw in the Celsius bankruptcy case, the parties are going to try and find a balance between publishing the names, addresses and email addresses of all the creditors (including FTX’s customers) and, well, not doing that. “There certainly is a pull and tug here between the right to privacy and the right to everybody involved,” Judge John Dorsey of the Bankruptcy Court for the District of Delaware said.

-

The jurisdictional fight between the U.S. and The Bahamas is at a cease-fire – at least for now. The Bahamas-appointed joint provisional liquidators have agreed to allow for FTX Digital Markets’ Chapter 15 bankruptcy in the Southern District of New York to be transferred to Delaware to join the other 101 Chapter 11 bankruptcy cases.

-

Sam Bankman-Fried, the now-former CEO, cannot stop talking. He spoke to a Vox reporter last week, he spoke to Tiffany Fong of Celsius call leak fame and he wrote a letter to his former employees earlier on Tuesday – which he couldn’t even share directly because it turns out he no longer has access to his company’s Slack.

Biden’s rule

Changing of the guard

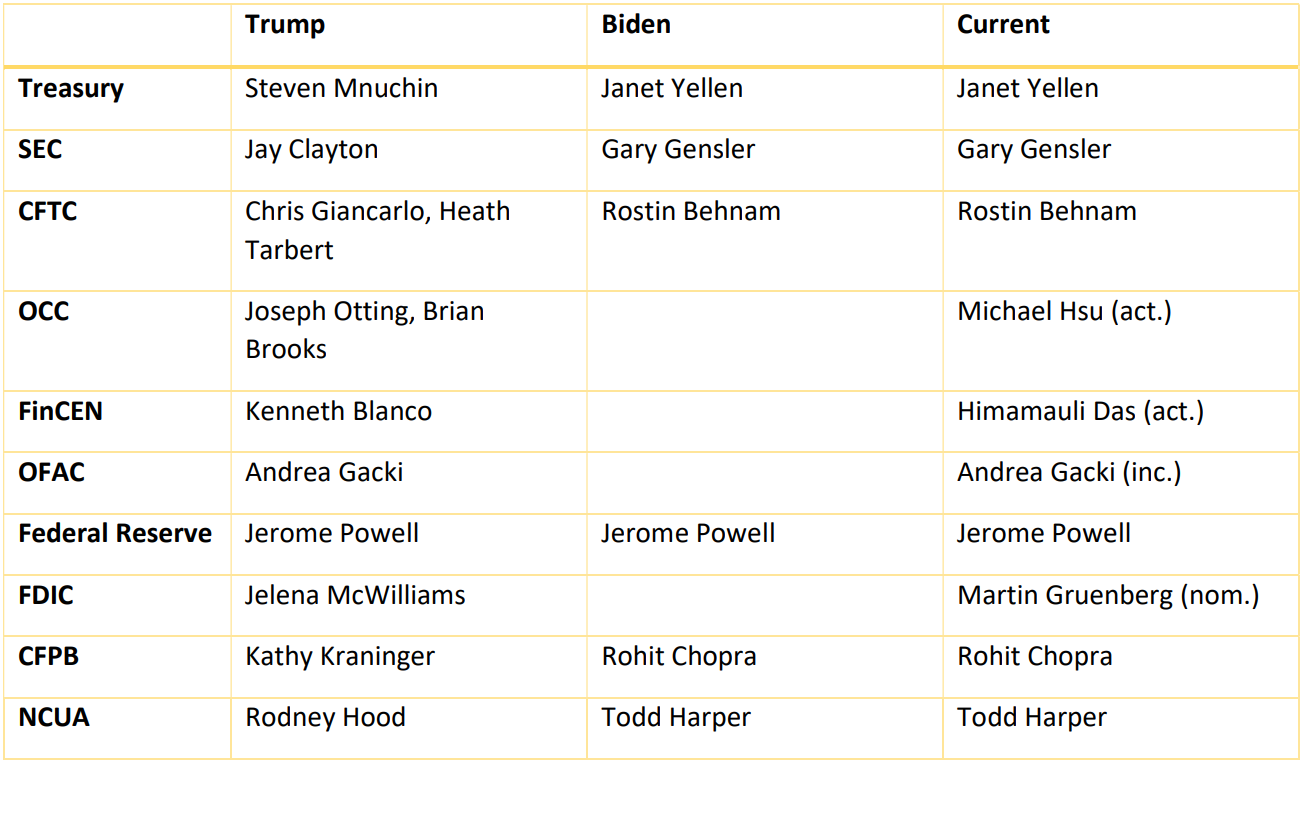

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

N/A

Outside CoinDesk:

-

(The Washington Post) Ticketmaster’s collapse when Taylor Swift fans tried to buy tickets is leading to Congressional hearings and antitrust investigations. BUT, the Post reports that Ms. Swift herself may have had some role in this.

-

(USDOJ) The U.S. Department of Justice seized several domain names tied to “pig butchering” crypto confidence schemes.

-

(Semafor) We haven’t talked about Twitter in a minute. Elon Musk said Bankman-Fried set of his “b******* meter” and now Semafor reports that despite this Musk invited Bankman-Fried to roll over his $100 million stake into the now-private company, which Bankman-Fried apparently did!

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!