Bitcoin (BTC) is currently trending sideways. However, the majority of the crypto industry remains confident that the asset is ready for a significant price increase in the future. Indeed, the halving event that will take place in 2024 is significant. It is seen as a possible catalyst that could increase the value of the leading cryptocurrency.

Bitcoin prediction that surprises from PlanB

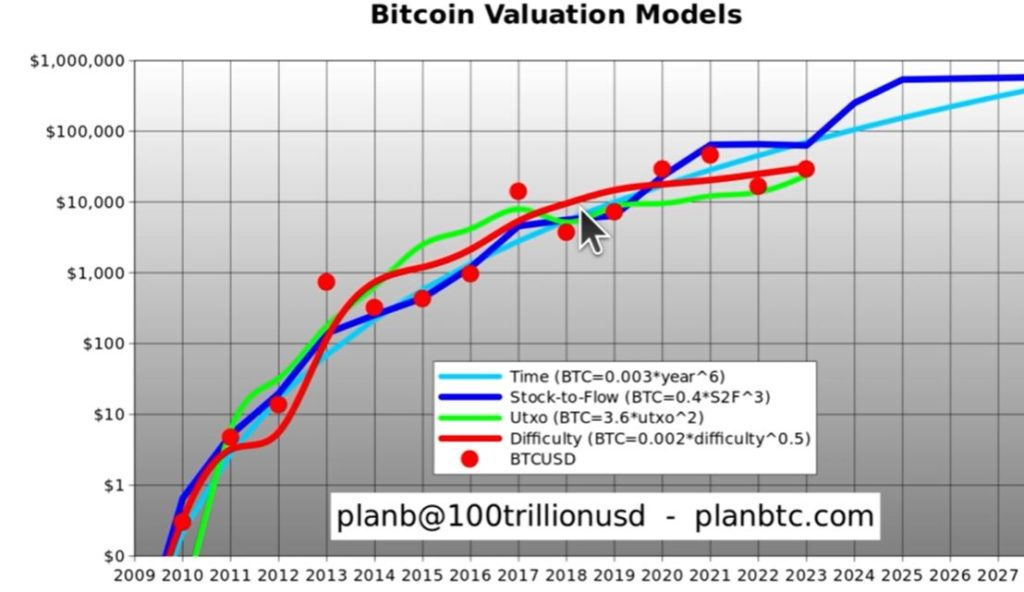

Crypto analyst PlanB made key statements in a YouTube video on July 28. He discussed various pricing models that could offer room for Bitcoin to grow towards the $1 million mark. The analyst emphasized that historically, Bitcoin has recorded price jumps after previous halving events. Accordingly, it is looking at the Stock Flow (S2F) model.

PlanB focused on the importance of the model and its relation to Bitcoin’s scarcity and price. He emphasized that the S2F model shows that there is a significant correlation between Bitcoin’s scarcity and its market value. The basic premise of the model is that scarcity plays a crucial role in determining the price of Bitcoin. It also lies in the idea that he measures this shortage using the Stock-to-flow ratio.

According to PlanB, the model shows that the price of Bitcoin tends to rise in response to the increasing scarcity caused by halving events. In addition, this claim is supported by historical data from previous halvings. PlanB makes the following statement at this point:

“You see the 2012 halving. The price jumps right after. Prices jumped right after the 2016 halving. The same happened in 2020. The next halving route will be in 2024. That’s why we’re seeing the pattern rise already.”

BTC valuation in 2024

Specifically, according to the model, Bitcoin should trade in the $60,000 region. Accordingly, this situation will cause emotional reactions among investors. In the short term, the model predicts that Bitcoin’s main support base towards $1 million could be the $100,000 level, which it thinks can be reached by 2024.

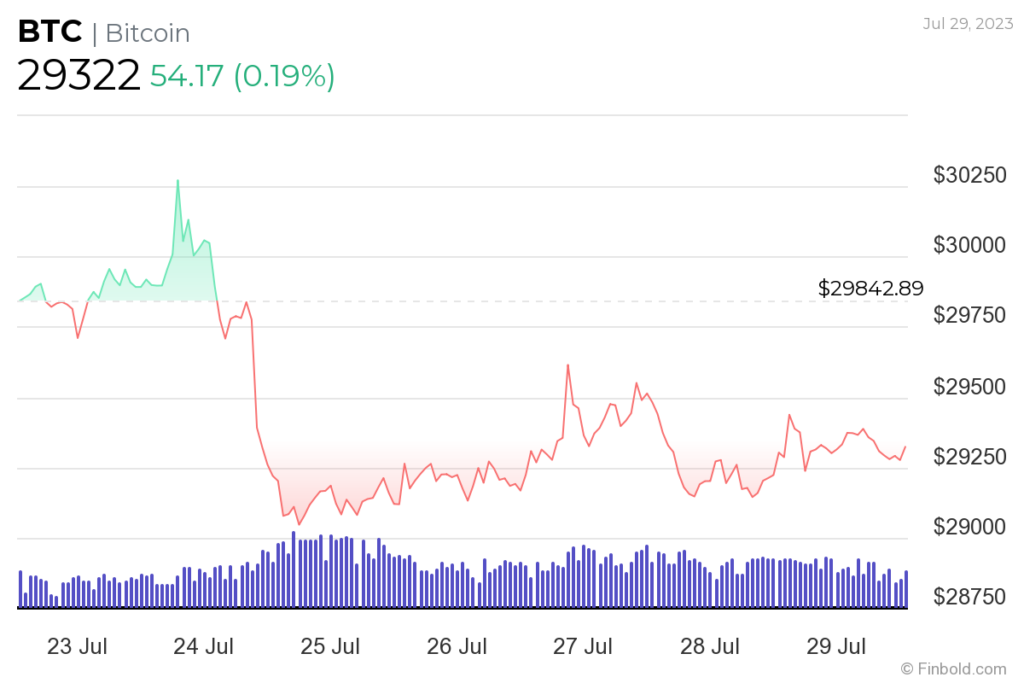

At the time of this writing, Bitcoin is trading at $29,322. On the other hand, there is an increase of less than 0.2% in the last 24 hours. However, the price is still below 30 thousand dollars. According to information from TradingView, technical analysis of BTC is mostly bearish. According to a summary of the one-day indicators, Bitcoin is showing a ‘sell’ sentiment at 11, while the moving averages are pointing to a ‘sell’ at 9. Oscillators recommend ‘neutral’ at 8.

cryptocoin.comWhen we look at it as a whole, indeed, Bitcoin has come under pressure, especially after failing to rise above the $30,000 region, which is considered crucial for its all-time high.