Leading analysts of the cryptocurrency market have announced critical levels for Polkadot, ADA, ETH and XRP! Here are the details…

Polkadot could fall to its lowest levels of the year!

Polkadot (DOT) price broke below an ascending support line and a horizontal support zone and it could continue to slide as low as $4.2, the yearly low. After hitting a yearly low of $4.22 in December 2022, DOT price recovered and moved above the 20-week moving average (MA), which is often used to identify long-term trends.

This momentum helped the altcoin price retest the resistance area at $7.8 before it was rejected during the week of March 20-27. While the price held above the 20-week MA as support for the next 8 weeks, it broke this MA last week and closed below it. This is an important bearish signal that the bears have taken over the market.

However, according to experts, DOT price has stayed below the 20-week MA over the past week and will likely form a bearish candlestick. If so, it could drop to a year low of $4.2, down more than 20 percent from the current level. The RSI indicator supports this possibility as it was rejected at the 50 level and trending down.

The daily chart shows Polkadot price dipping below the ascending support line formed from the yearly low. Since this line covers the entire uptrend, its break indicates the end of the uptrend. Additionally, the price also broke below the key horizontal support area of $5.8, confirming this area and the ascending support line as resistance yesterday as indicated by the red arrow on the chart. Therefore, it seems likely that Polkadot price will continue to decline to $5.2 in the coming days.

Whales take action for XRP!

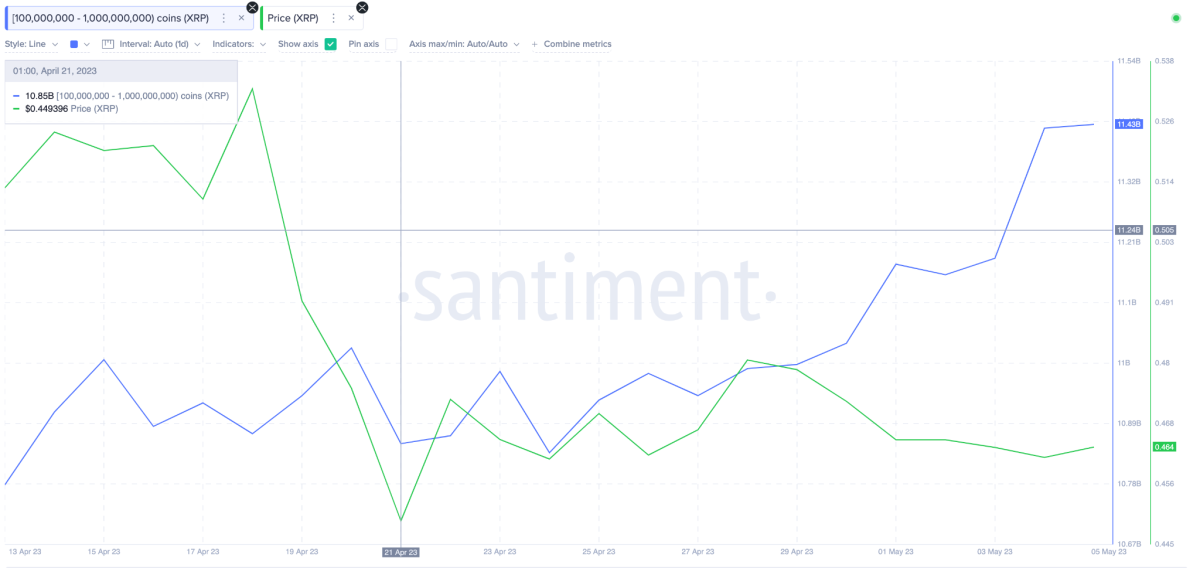

According to Santiment, XRP whales entered May in a hoarding frenzy. According to the chart, on-chain data shows how crypto whale investors holding 100 million to one billion XRP coins have been buying since the close of April. In 14 trading days from April 21 to May 5, the whales added 610 million XRP coins to their wallets.

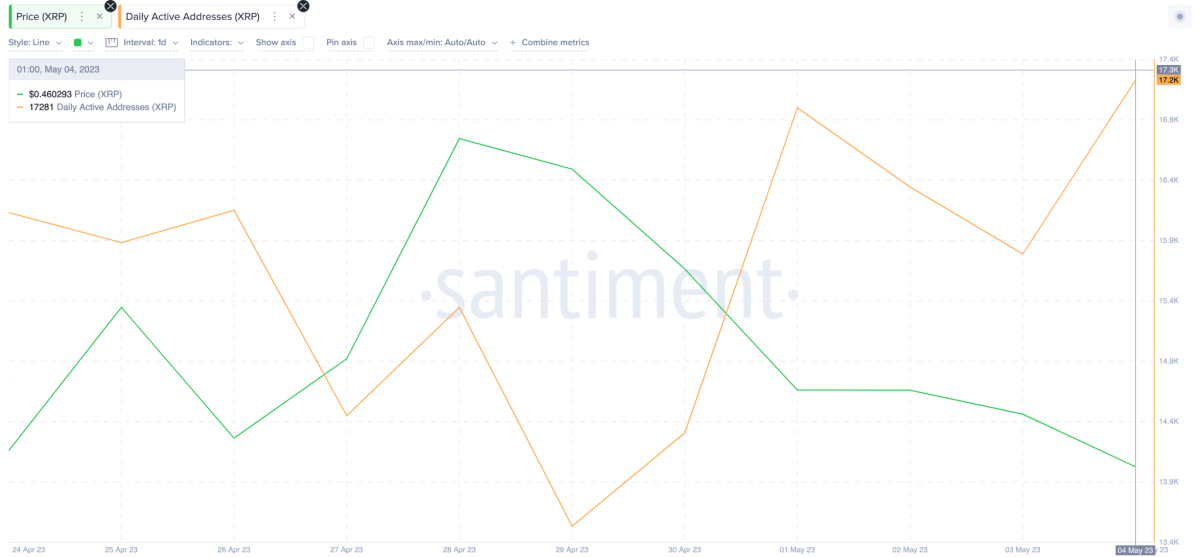

610 million XRP is valued at $287 million, and whales have been investing for several weeks with these massive investments that price levels will be on the rise. Also, there was a positive increase between Prices and the number of Daily Active Addresses (DAAs) on the XRP network. In particular, between April 29 and May 5, the price decreased by 4 percent, while the number of daily active addresses increased by 27 percent.

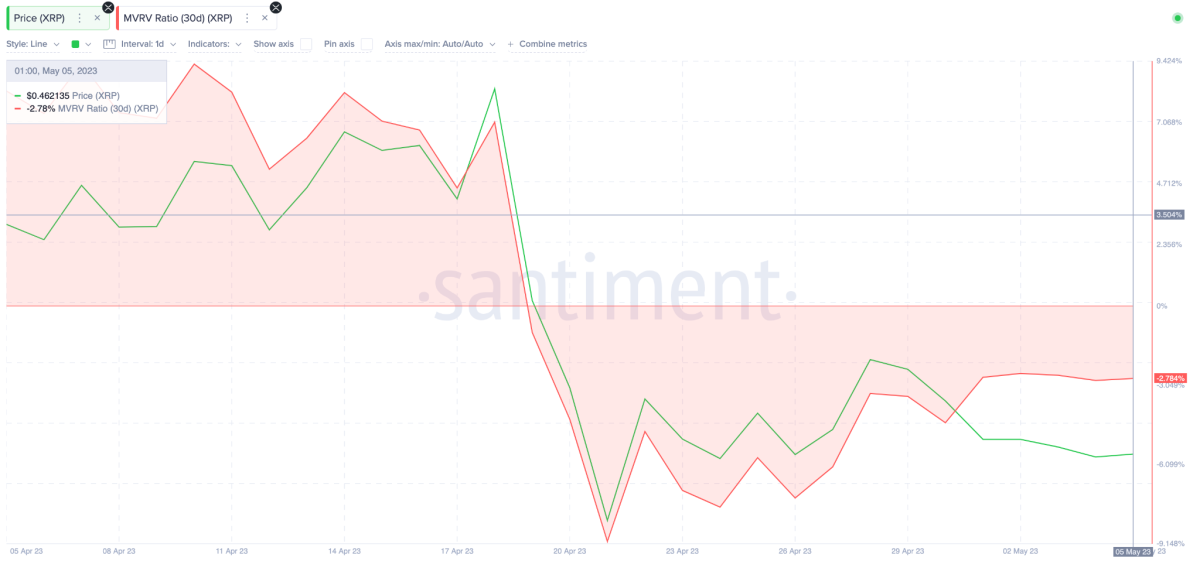

Over the past week, the bulls vigorously defended the $0.45 support level. According to Santiment’s Market Value to Realized Value (MVRV) data, bulls can now force a bullish XRP price prediction to hit $0.50. Historical data shows that they are unlikely to sell until the price is up another 10 percent to reach $0.50. If XRP can break past the $0.50 resistance, it could enter a prolonged rally towards the $0.60 region before the bears start to regain control.

On the other hand, bears could still reverse the situation if XRP price drops below $0.45. However, they will likely offer bullish support at this level as investors try to keep their losing positions below 5 percent. Otherwise, XRP could decline much more towards the next key support level of $0.40.

Cardano whales are accumulating massive amounts of ADA!

Ethereum rival Cardano recently released Hydra, its Layer-2 scaling solution. The rollout of the launch provided the bullish thesis among ADA holders. ADA whales added more than 100 million ADA coins to their portfolios last week.

ADA whale accumulation

ADA whale accumulationWhales are likely waiting for a rebound in ADA price. The last time between 100 million and 1 billion ADA was accumulated in ADA, there was an increase in the price of Cardano. Cardano Blockchain recently launched a Layer 2 scaling solution called Hydra. The Layer 2 protocol runs on the Cardano blockchain, and Hydra is designed to increase Cardano’s throughput and the overall efficiency of the blockchain.

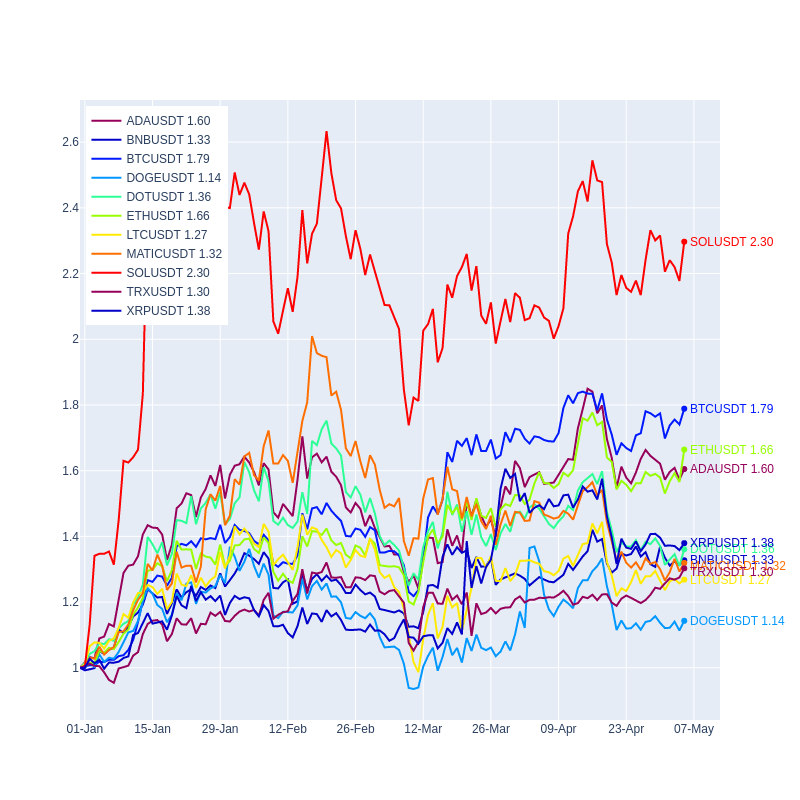

Hydra enables parallel processing of transactions and increases the overall capacity of Cardano’s blockchain. According to experts, this development could possibly act as a bullish catalyst for Cardano price. Cardano’s Year-to-Date (YTD) performance is the fourth best in the crypto ecosystem after Solana, Bitcoin, and Ethereum. Interestingly, however, the altcoin observed 65 million transactions in April 2023 as its network continued to grow.

Ethereum whales took action for the $ 2 thousand level!

Currently trading at $1,997, Ethereum price is a few inches away from breaking the $2,000 mark and potentially closing a daily candlestick above it and turning it into a support level, according to experts. Acting as resistance since May 2022, this barrier was breached only once last month before ETH dropped 13 percent.

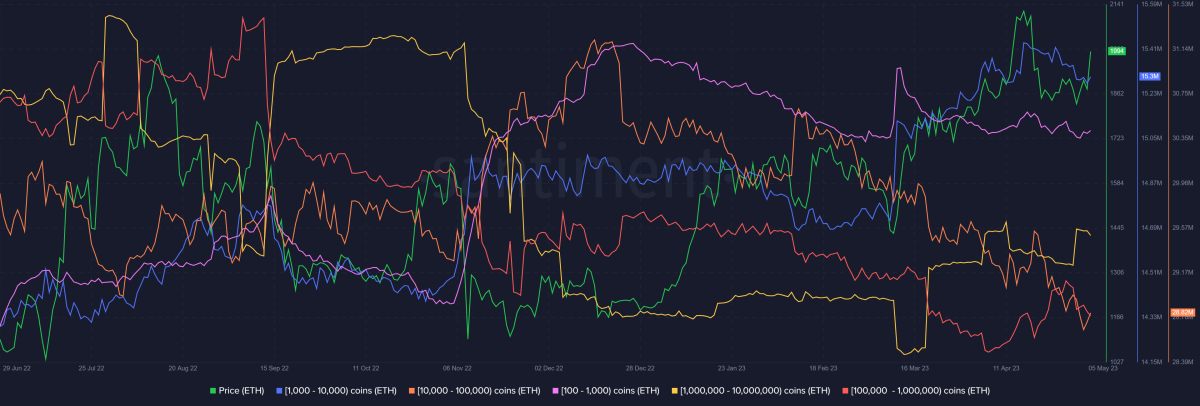

The 6.4 percent increase observed in the last 24 hours appears to be the effect of optimistic whales continuing their accumulation streak, albeit with some skepticism. Wallets holding 100,000 to 1 million ETH have accumulated over 1.4 million ETH during the month of April, reaching $2.8 billion as their supply has increased from 20.1 million to 21.5 million ETH. Similarly, as we quoted as Kriptokoin.com, addresses with 1 million to 10 million ETH added another 400,000 ETH to their holdings, increasing their balance to 11.61 million ETH.

This kind of rise is critical to recovery and may have been the driving factor for Ethereum price to approach $2,000. However, some sales were observed in the hands of 100,000 to 1 million ETH holders last week. Whales holding 10,000 to 100,000 ETH disposed of more than 800,000 ETH worth approximately $1.6 billion, while 1,000 to 10,000 ETH holders disposed of 100,000 ETH within a week, bringing their total holdings to 15.29 million ETH. Small investors’ skepticism that a recovery would not happen was met with broader market cues and the tenacity of Ethereum whales.

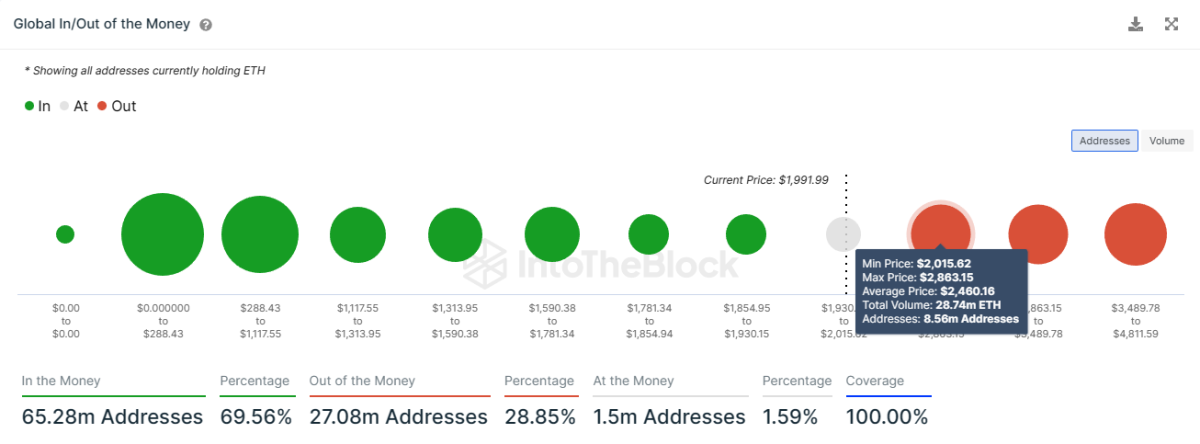

However, the true recovery journey is much longer and requires each ETH holder to rise. According to the Global In/Out of the Money indicator, which compares the current price of ETHs with the price at which they were purchased, approximately 8.56 million addresses are still facing losses. The sum of these addresses, holding 28.74 million ETH worth $57.4 billion, represents almost 24 percent of Ethereum’s circulating supply.

According to experts, for ETH to become profitable again, the altcoin needs to climb to at least an average price of $ 2,460. But for all 28.74 million altcoins to gain, the Ethereum price must post a 43 percent increase to label the $2,865 upper bound. Ethereum price was last at this level in May 2022, and a rally as big as needed may not come for a while.

However, given that it is the critical psychological support level, the turn of $2,000 to a support base would certainly trigger enough rally to mobilize investors.