Interlay, a decentralized stablecoin network, has launched InterBTC (iBTC) – a wrapped bitcoin token. Wrapped tokens are synthetic (or tokenized) versions of crypto assets not native to the blockchains they exist on. Polkadot, a network that allows different blockchains to communicate with one another, with one iBTC redeemable directly on the Bitcoin blockchain for one BTC (1:1 redemption ratio). The wrapped token allows bitcoin to be used for decentralized finance (DeFi) applications on Polkadot via a bridge (a system connecting one blockchain to another).

Wrapped bitcoin

While several brands of wrapped bitcoin exist, the most popular one is an ERC-20 version aptly named wrapped bitcoin (wBTC). BitGo, Kyber and Ren created wBTC in 2019 and it now dominates the wrapped bitcoin market. According to Dune, a crypto data analytics site, wBTC accounts for almost 85% of all wrapped bitcoin on Ethereum.

Read more: What Are Wrapped Tokens?

The wBTC ecosystem has two key players – merchants and custodians. Users exchange regular bitcoin for wBTC with merchants like Kyber, Rhino.Fi (formerly DeversiFi) and Ren. Merchants have relationships with custodians who receive and hold that regular bitcoin and mint one wBTC for each bitcoin deposited with them. The minted wBTC token is sent to the user who can redeem the underlying bitcoin at any time. Redemption involves returning the wBTC token to the merchant, who then requests the bitcoin collateral from the custodian. Finally, the custodian burns the wBTC token and releases the bitcoin to the merchant and user.

What’s different about iBTC?

The traditional wBTC ecosystem has one glaring weakness – centralization. In order to obtain wBTC, users must give bitcoin custody to trusted third parties. Given the recent developments in the DeFi community, a more decentralized and trustless solution would be significantly better.

Interlay claims iBTC is that better solution. Apparently, iBTC is built on a trustless model that borrows its security from the token’s target blockchains (in this case, Bitcoin and Polkadot). The model uses decentralized vaults that hold collateral, instead of relying on third-party merchants and custodians.

How iBTC works

Interlay followed in MakerDAO’s footsteps by incorporating overcollateralized and decentralized vaults. The vaults are run by members of the Interlay community who must deposit multi-asset collateral (e.g. bitcoin, USDC, DOT) as insurance (in case the vault fails). According to Interlay, the overcollateralization gives iBTC a stablecoin-like quality (wrapped tokens and stablecoins have similar mechanics).

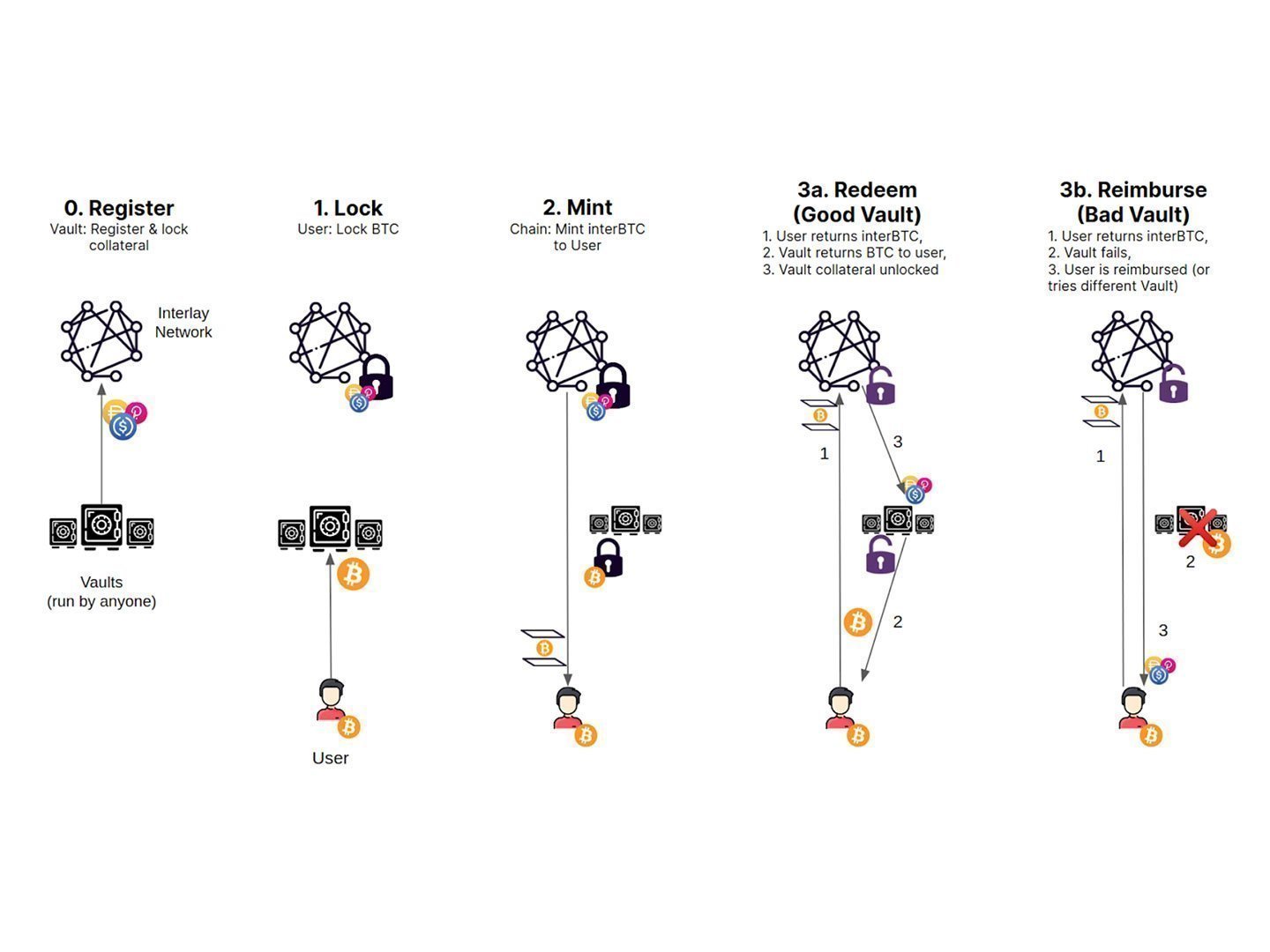

A visual representation of how users interact with the Interlay network and its decentralized vaults to exchange bitcoin for iBTC (Interlay.io)

Users deposit bitcoin into the vaults in exchange for iBTC. At this point, the bitcoin is locked in the vault while vault collateral is locked by the Interlay network. Users then return iBTC to the vault, thereby unlocking and releasing their bitcoin, which triggers the Interlay network to release vault collateral. If a vault fails to return bitcoin to a user, the network liquidates vault collateral and reimburses the user.

Read more: How Does MakerDAO Work? Understanding the ‘Central Bank of Crypto’

Acala, a stablecoin and trading platform, as well as Moonbeam, an Ethereum-compatible smart contract platform, are two Polkadot applications where iBTC can be used. Interlay plans to extend iBTC compatibility to Ethereum, Cosmos, Solana, Avalanche and other DeFi networks.