Polygon-based stablecoin Real USD (USDR) saw its value drop to around $0.51 in a matter of hours. The use of the DAI in his treasury in redemption played a major role in this.

Another stablecoin has been de-pegged: It lost 50% of its value

cryptokoin.com As you can see from , the crypto market is no stranger to stablecoin de-peg. Especially after the dramatic collapse of Terra USD (UST), the stablecoin of the Terra ecosystem. Because, together with these events, the crypto market entered a long-lasting crisis. Now a de-peg incident has occurred. However, experts do not expect any serious repercussions since it is a small-scale stablecoin.

Real USD (USDR) is a stablecoin project backed by real estate assets. According to on-chain data from Tangible DAO, the entity behind USDR, the treasury currently holds zero DAI. Additionally, the only liquid asset is an insurance fund of approximately $6.2 million for the circulating supply of USDR45 million. According to calculations, this is worth 45 million dollars. The background of Real USD (USDR) is largely based on real estate assets. Following these developments, the value of the stablecoin dropped, causing its price to lose 50%.

USDR also includes real estate as collateral!

The price of the stablecoin issued by TangibleDAO and listed as USDR began to spiral on Wednesday. Before this, the altcoin project had a market cap of approximately $45 million. According to TangibleDAO’s website, there is real estate behind the scenes to support the asset. TangibleDAO, meanwhile, was intended to be a “new type of money” that yields 8-15% per year.

Stablecoins are pegged to traditional assets such as fiat currency. Therefore, it is considered a form or cryptocurrency with greater reliability. However, it is possible for investors to lose value when they lose confidence in the underlying assets.

USDR price dropped by 50%. Source: CoinGecko.

USDR price dropped by 50%. Source: CoinGecko.When we exclude TNGBL, the guarantee is insufficient

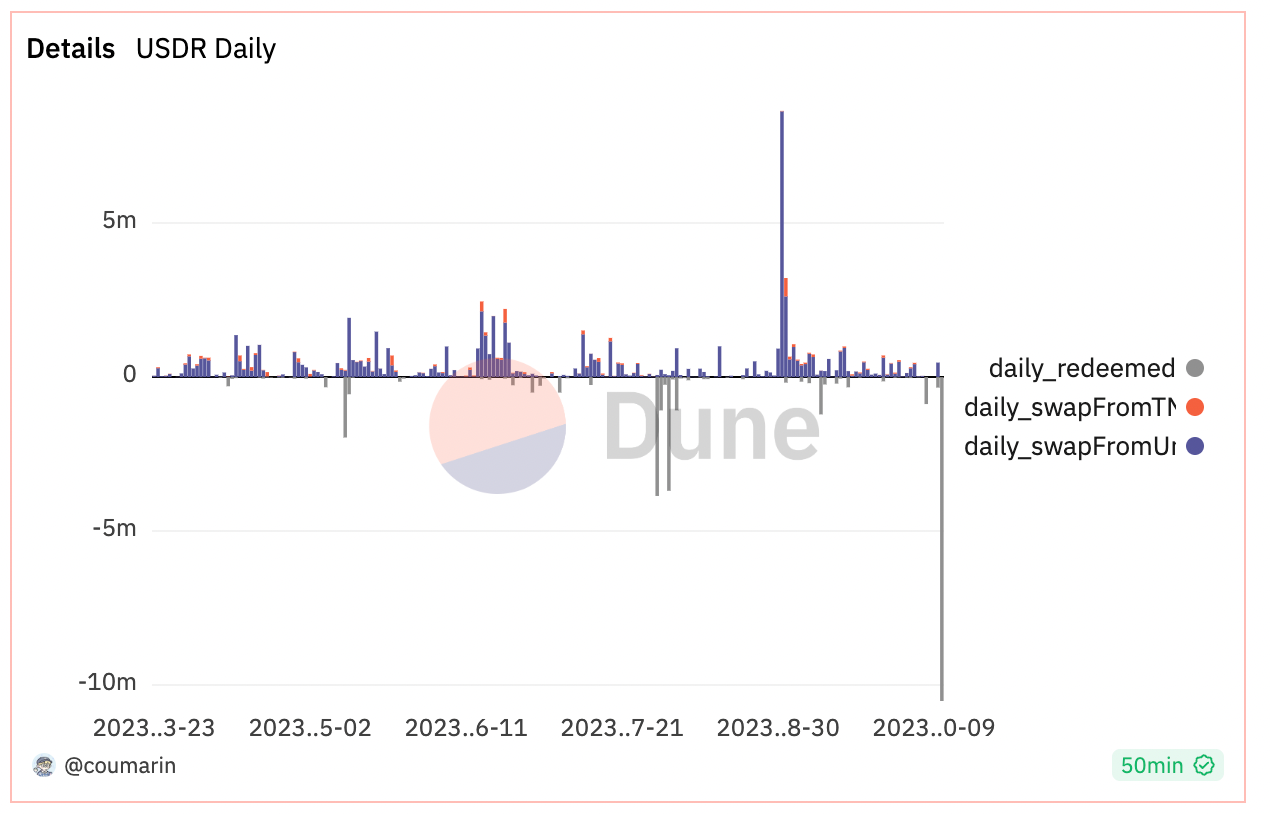

According to the Dune analytical dashboard, USDR lost its hold due to the intensity of redemptions. Stablecoin’s collateral consists largely of illiquid assets such as real estate. In addition, liquid assets such as DAI are also included in the collateral. Apparently, the $11.8 million DAI that was collateral for the stablecoin was completely eroded during redemptions. This left behind largely illiquid assets as collateral.

There was a huge increase in redemptions. Source: Dune Analytics dashboard.

There was a huge increase in redemptions. Source: Dune Analytics dashboard.According to the dashboard, if you exclude the project’s native TNGBL token, the stablecoin is currently undercollateralized. If you include this token, it is possible to reach a collateralization rate of 102%. The stablecoin’s own dashboard also claims that a portion of USDR is backed by USDR. He lists USDR 62,810 as collateral for himself.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!