Ethereum used the explosive effect of the expected merge update since 2015 for a “bear market rally”. The merge scheduled for September 15 helped ETH price break the $2,000 resistance. As the selling pressure continues, a prominent crypto analyst says he is looking at another altcoin project instead of Ethereum.

The analyst shared the altcoin that he expects to outperform Ethereum (ETH)

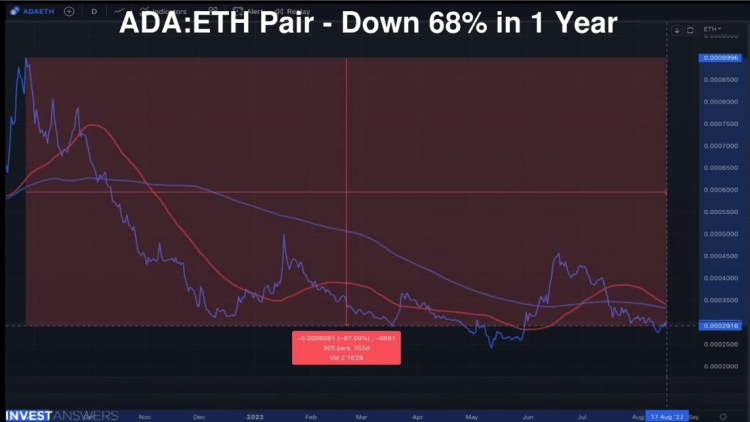

The 2 biggest altcoin competitors of the cryptocurrency market are subject to the predictions of a popular crypto expert. InvestAnswers’ anonymous server compares leading smart contract platform Ethereum to PoS Blockchain giant Cardano (ADA). Browsing the ADA/ETH chart, the analyst says Cardano is poised to outperform:

Right now, everything is bleeding against Ethereum, but the ADA/ETH pair is down 68% in a year. Sometimes it’s important to zoom out and see exactly what’s going on. It seems to be forming a pretty solid base very close to the 0.00025 level. For Cardano, this should be some kind of bottom.

The analyst argues that the planned Cardano Vasil hard fork, which was recently delayed from its June launch date, will be crucial. The anonymous server of InvestAnswers has this to say in part of the post on this subject:

The ADA/ETH transaction here is a good time to basically convert your ETH to Cardano if the option goes for a run if the hard fork is successful for Cardano and adoption comes back.

Cardano is currently trading at $0.5277, down 2%. Ethereum is trading slightly higher at $1,863.75.

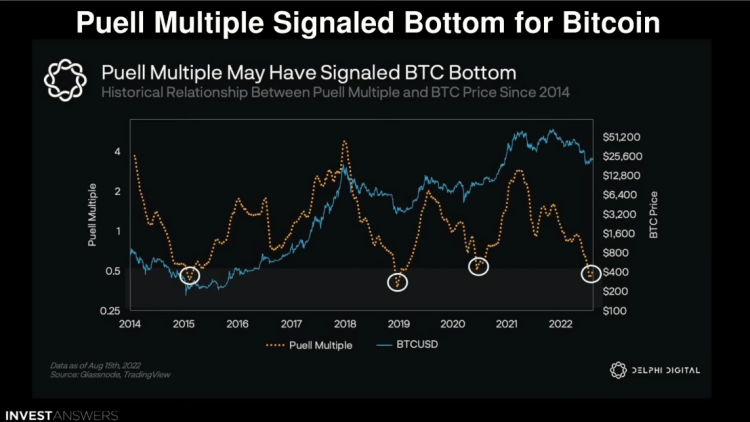

Analyst then uses Puell Multiple for Bitcoin

The analyst then used the Puell Multiple indicator to determine if Bitcoin (BTC) had reached the bottom of the bear market. The metric is calculated by dividing the daily issuance value of BTC by its 365-day moving average. The analyst shares a chart showing the previous three Bitcoin bottoms in 2015, 2019 and 2020.

The analyst interprets the data from the Puell Multiple as follows:

Represented in blue, the Puell Multiple and Bitcoin price pointed to all the major bottoms we’ve experienced before. This statistic once again examines the supply side of the Bitcoin economy, namely the revenue generated by Bitcoin miners. As you can see, this has historically been a fairly accurate sub-indicator.

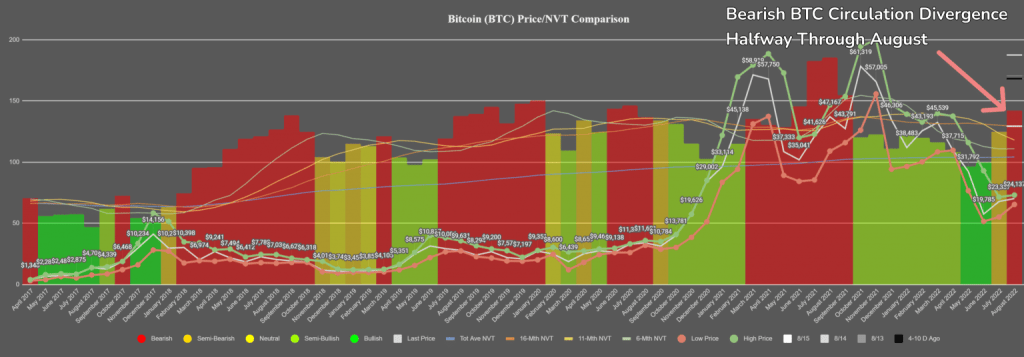

Interesting data is accompanied by declining BTC supply

cryptocoin.com As you follow, Bitcoin is currently trading at $23,303.54. Meanwhile, the most interesting move seen in BTC has been the recent drop in circulating supply. According to Santiment data, the leading crypto followed a healthy circulation rate from October 2021 to June 2022.