Crypto assets are following a calm course again this week, with a narrow trading range and low volatility. Low trading volumes add to the growing sense of apathy and boredom among investors. However, on the onchain side, there is some more positive data for the medium term, let’s take a look at what is happening.

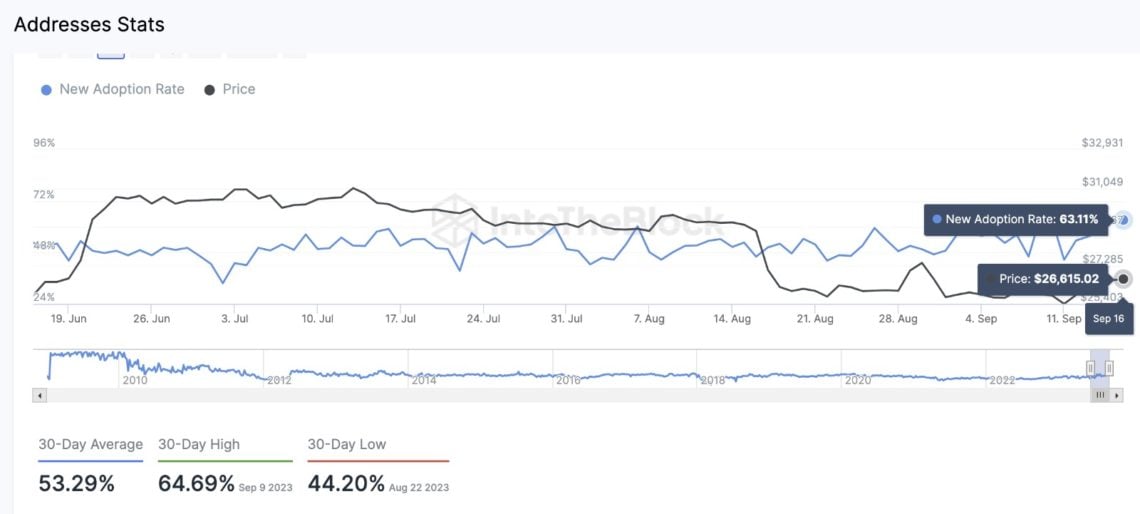

The percentage of new active addresses making their first transaction within a certain day is above the 30-day average at 63.11%, we can say that this is an indicator of increased investment adaptation.

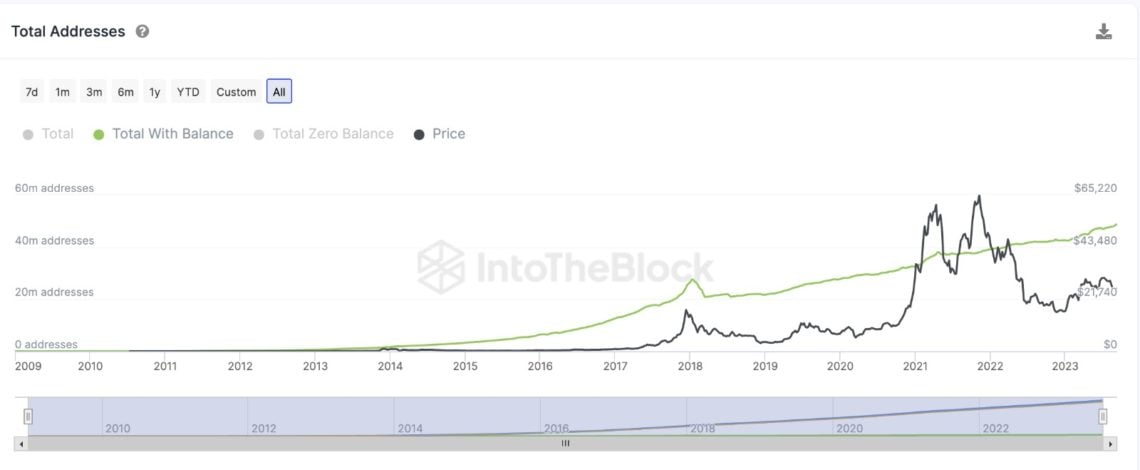

We see that the total addresses with balances are at an all-time high.

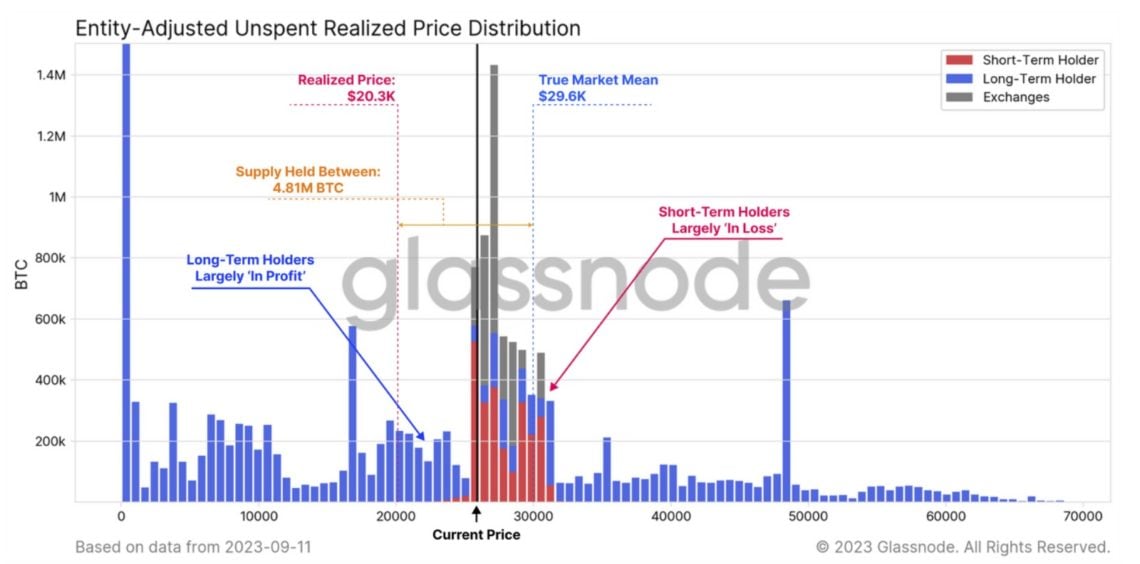

While transfer and exchange transactions in the market remain horizontal in a very low band, we see that long-term investors who hodl have a greater impact on the dynamics of the market. While short-term investors have a very low supply, the amount of Bitcoin held by long-term investors has reached ATH with 14.74M units.

4.81M Bitcoin appears to have been costed between the realized price of $20,300 and the market mean of $29,600. While most short-term investors have a loss of 83.7%, the loss of long-term investors remains at an all-time low of 26.7%.

In summary, while the total number of addresses and the number of new addresses are moving upwards rapidly, with very low volatility and lack of volume, it shows that long-term investors are not inclined to sell, short-term investors have become overly sensitive to the price, at a loss, and psychological levels have not been passed yet.

Our closest onchain lower support is at 350dma at $24,100, and our resistance is at 111dma at $28,200.

References:

https://www.intotheblock.com/

https://glassnode.com/