Gold sold hard on Thursday morning after better-than-expected US jobs and growth data, after being stagnant for most of the week and meeting the Fed’s 25bp hike as usual. But while the precious metal climbed back above $1,960 on Friday, wiping out half of Thursday’s losses, analysts are fairly evenly divided on gold’s direction next week, while individual investors are a little more optimistic about their prospects. The latest Weekly Gold Survey shows that retail investors expect gold prices to rise during the week ending Aug. Market analysts, on the other hand, are more cautious as they expect a precise direction from economic indicators and technical trends. Here are the expected levels according to the weekly gold survey…

What happened to the gold price?

Colin Cieszynski, chief market strategist at SIA Wealth Management, thinks the yellow metal is in a bearish trend in the near-term despite the positive price action on Friday. Cieszynski said, “Gold is generally sideways and although it has bounced back today, overall it appears to be bearish within an established trading range. “I’m in a bearish trend on gold for the next week,” he said. On the other hand, Adrian Day Asset Management Chairman Adrian Day sees the Fed’s latest statements and the ongoing inflation as bullish for gold. Day said:

We’re nearing the end of the Fed’s rate hike cycle, but the inflation rate could reverse and pick up again in a few months as high oil prices hit the economy, affecting transportation and most products in stores. Ending the price hikes without reducing inflation will ignite gold.

What are the prospects for precious metal?

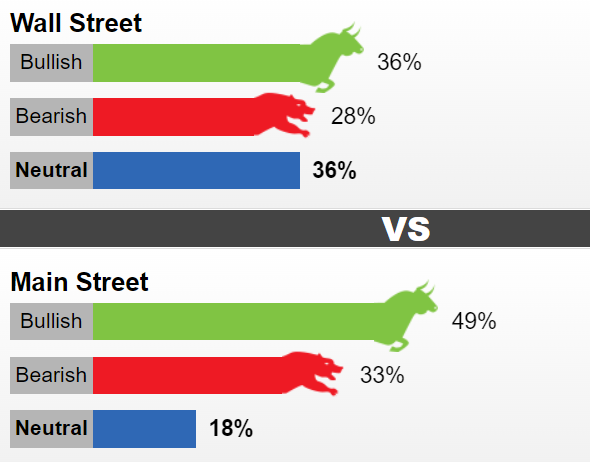

This week, 14 Wall Street analysts took part in the Kitco News Gold Survey. In the vote, which ended in a draw, both the bullish and neutral positions received five votes, or 36 percent. At the same time, four analysts, or 28 percent, were down on gold for next week. Meanwhile, 322 votes were cast in online polls. 158, or 49 percent, of respondents think that gold will rise next week. Another 106 people, or 33 percent, said that gold would fall, while 58, or 18 percent, said it would remain neutral in the near term.

The latest survey shows that retail investors expect gold prices to trade around $1,984 an ounce by the end of next week. The nonfarm payrolls report, due next Friday, represents next week’s key event risk for precious metals, and analysts will look to the key US jobs indicator for clues on the Fed’s next move.

How does US data affect the market?

According to James Stanley, senior market strategist at Forex.com, “We are currently looking at it unchanged with a downward trend. Durables and GDP both smashed expectations outside the US, a day after Powell said they were tied to data. Leading indicators have been pretty strong as inflation has dropped, so data dependency could lead to another spike in September and possibly after that, which markets are not expecting at the moment.”

Stanley said it was clear the Fed was not done, as the Core PCE was still above 4 percent. “For next week, I need to see the bears step up in their attempts to break out on the upside to continue to provide hints that this theme might come true,” he added.

Technical analysis points to a decline in gold prices

Most technical analysis points to a downward trend in gold prices next week. Gary Wagner of The Gold Forecast said that the technical picture for gold has deteriorated significantly this week. Wagner said the following:

After gold rose as high as $1,980.70, then quickly sold out, major damage was done on the technical chart. $1,980 is exactly where the 38.2 percent Fibonacci retracement is pinned. Although it opened above the 100-day moving average, it also broke below the shorter-term 50-day moving average, closing at a low not seen in the last 13 trading days.

Wagner said the combination of the FED’s hawkish statements and gold’s “breaking of key and critical technical levels” means it sees more downside risks for the precious metal in the coming days. Gold prices continue to turn towards neutral territory at the weekend. Spot gold was last traded around $1,961.60 an ounce. However cryptocoin.comAs we also reported, the precious metal is down 0.39 percent on a weekly basis.