Increasing volatility is putting pressure on gold prices as the market remains in an uptrend. However, Wall Street analysts say that a possible drop next week is a must buy.

Sentiment in the gold market does not point to record highs yet

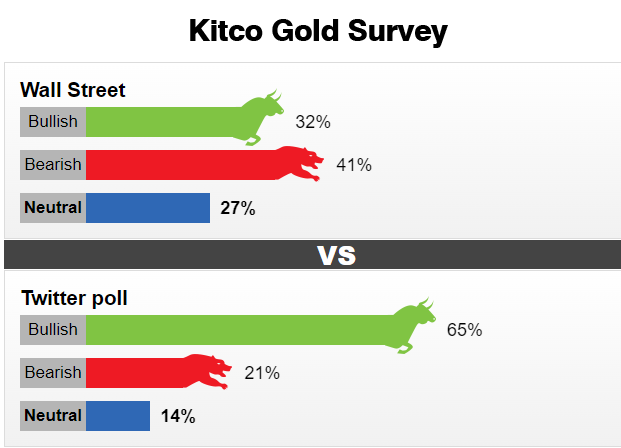

The latest Kitco weekly gold survey shows that bearish sentiment is outweighing Wall Street analysts. At the same time, individual investors continue to rise significantly. Therefore, the precious metal is expected to regain its luster after Friday’s sharp decline.

The uncertainty in the market comes as the gold price ended the week holding the critical support above $2,000 per ounce but fell solidly from the test of ATH levels above $2,080 per ounce. Analysts said the market continues to react to highly volatile interest rate expectations.

cryptocoin.com As you follow, the Fed shifted its monetary policy to a more neutral stance after raising interest rates by 25-bps on Wednesday. At the same time, markets began pricing in the possibility of a rate cut from July.

As we enter the weekend, solid jobs data overshadowed those expectations as the economy created 253,000 jobs in April and wages rose 5%. It caused gold prices to drop more than 2% to $2,007 an ounce.

Analysts say rising wages continue to point to sustained high inflation. They point out that this will force the Fed to maintain its hawkish monetary policy stance.

‘Downfall will be solid entry for long-term gold investors’

James Stanley, senior market strategist at Forex.com, said, “I think gold can sustain a break above $2,000 and eventually it will produce. But I’m still not convinced that we are in a position where this can happen right now. The factor that ultimately drove gold above $2,000 sustainably is the Fed’s return to not just a pause, but possible cuts and even QE. “I think the probability of that is low when the Core CPI is above 5% and the unemployment rate is 3.4%,” he said.

Thorsten Polleit, Degussa’s chief economist, said he sees gold potentially struggling in the short term as well, as the Fed is unlikely to cut interest rates before the summer. However, he added that volatility creates solid entry points for long-term gold investors:

On days like these, I don’t worry too much. I see this volatility as noise. But now is the time to buy as the long-term trend is higher.

A bearish mood prevails in the gold survey

This week, 22 Wall Street analysts took part in the Kitco weekly gold survey. Among respondents, seven analysts, or 32%, were bullish on gold in the short term. At the same time, nine analysts, or 41%, were expecting a decline for the next week. Finally, six analysts, or 27%, saw prices move sideways.

Meanwhile, 774 votes took place in the online polls. Of those, 500, or 65%, were expecting gold to rise next week. Other said it would be 163 or 21% lower. On the other hand, 111 voters, or 14%, remained neutral in the near term.

Individual investors also expect to see a solid recovery in gold. This class of investors expects prices to end the week around $2,060. The bullish outlook comes with June gold futures closing the week at around $2,023 an ounce, up 1% from last Friday.

Some analysts noted that Friday’s sell-off and the ability to hold support at $2,000 an ounce could attract investors next week.

Analysts say dip should be bought

“I think you should buy these dips,” said Phillip Streible, chief market strategist at Blue Line Futures. Gold remains an important store of value… As fears of the banking crisis continue to mount, the upward trend in the labor market will diminish.”

Richard Baker, creator of the Eureka Gold Miner’s Report, said that gold is on the rise as the US government approaches default as the debt limit debate drags on. He added that this uncertainty will continue to support gold as it did in 2011.

“We’ve seen this Convention dance before,” Baker said. The 2011 US debt crisis pushed gold prices to a new record. Congress should increase or suspend the debt limit to avoid market catastrophe. But both sides of the argument are intransigent. If composure prevails and a default is averted, gold prices could quickly return to the ground. Meanwhile, last week’s forecast is that gold could reach or possibly exceed $2,450 in the coming weeks.”

‘$2,000 is not the strongest support’

Most analysts point out that gold’s failed breakout at $2,080 an ounce could lead to some consolidation in the short term. Darin Newsom, senior market analyst at Barchart.com, said he saw the price action of gold forming an above-the-box formation. He added that the support level he is watching is at $1,990.50 per ounce:

If June gold breaks the support, it could approach $1,927.50 as a downside target. That’s a very long distance. We’ll see if that happens.