The bulls hold the upper hand over the bears as Bitcoin faces sideways price resistance. Meanwhile, traders expect a ‘big move’ and ‘Moonvember’ for Bitcoin. Meanwhile, Bitcoin’s ‘double bottom’ NVT signal is getting bulls excited.

According to analysts, Bitcoin will make a big move on Moonvember

Considering the NVT Signal, a big move is coming for BTC, according to analyst alias Mustache. The analyst says that we will see a big green candle very soon, considering that the BTC price has increased by ~450% on average over the last 3 years.

Bitcoin NVT signal analysis / Source: Mustache

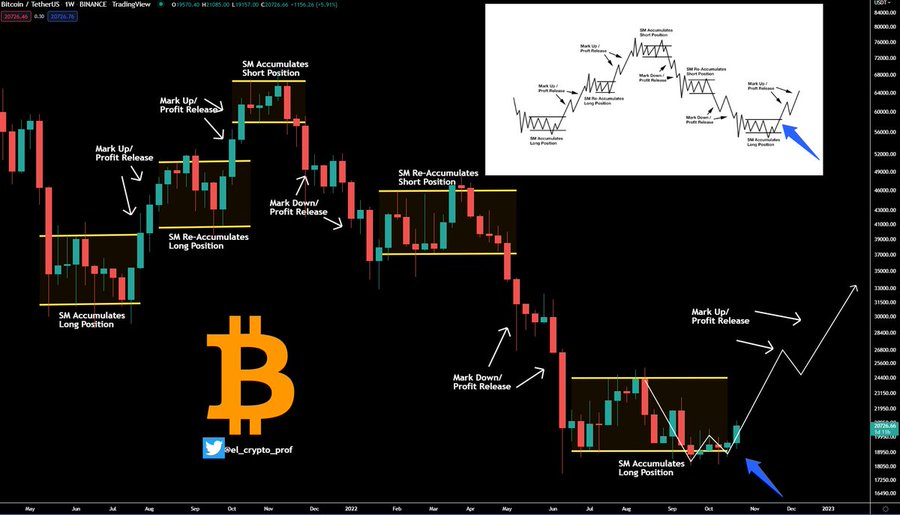

Earlier, Mustache published his Wyckoff Method analysis with a chart of Bitcoin heading towards $30,000 in 2023. “Because he has rarely seen such an accurate model in almost 1.5 years,” the analyst said.

Wyckoff Method Bitcoin analysis / Source: Mustache

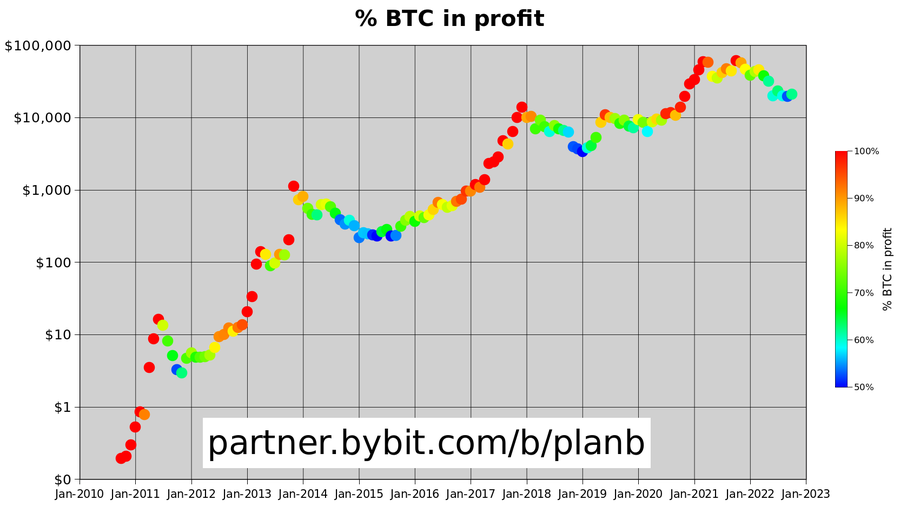

At the same time, analyst PlanB shared a chart showing BTC percentage on profit chart on October 30. According to the analyst, he noted that he expects Bitcoin to make a big move in the ‘Moonvember’ (November).

CryptoQuant analyst Dan Lim states that the biggest Bitcoin whales remain in ‘hodl’ mode. The analyst says this is because the token supply between one month and three months has fallen slightly until recently. In this context, the analyst notes:

While it’s not as strong a move as the start of a bull market yet, if investors respond with DCA or split purchases on a case-by-case basis, good results are likely to come in the end.

“BTC will move sideways as contention continues”

cryptocoin.com As you follow, Bitcoin (BTC) gave signals to pass the $21,000 level. However, it later corrected some more in the early trading hours of October 31st. However, BTC remained above critical levels. After the small drop, senior analyst Jim Wyckoff suggests there is a ‘general near-term technical advantage’ over the bears. Also, the analyst says that Bitcoin bulls are still in control.

In conclusion, based on the recent price action, Wyckoff notes that investors should expect Bitcoin to trade sideways as a drag between the bulls and bears continues. Based on this, the analyst makes the following statement:

There is a novice price uptrend on the daily bar chart. The bulls still have the overall short-term technical advantage to suggest that the path of least resistance for prices will be higher sideways in the near term.

Bitcoin candlestick chart

Bitcoin candlestick chartBTC technical analysis

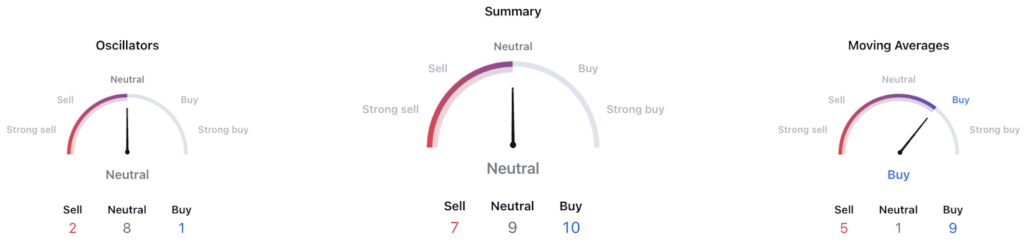

Crypto analyst Paul L has the following assessment regarding BTC’s technical outlook. Following the correction, Bitcoin specs appear shaky with the summary mainly aligned between neutral and buy. Remarkably, the ‘neutral’ is at the nine. ‘Buy’ is represented by 10. For moving averages, ‘buy’ ranks first out of nine. Also, oscillators are essentially ‘neutral’ at eight.

Bitcoin technical analysis / Source: TradingView

Bitcoin technical analysis / Source: TradingViewAlso, Bitcoin has consistently traded above $20,000 for the first time since the beginning of September. Despite this, it still faces the possibility of high volatility. It is worth noting that, against the background of the prevailing macroeconomic factors caused by inflation and increases in interest rates, Bitcoin is trading alongside stocks.

“Bitcoin repeats itself in 2022”

Some analysts said that in recent days, Bitcoin faced a “double top” with two spikes above $21,000. This means decline. The falling volume indicates that the bulls cannot turn the level to support and many are waiting for new macro lows to follow.

However, the alternative new analysis provides a more optimistic view. For analyst Stockmoney Lizards, the similarities between 2022 and 2018 are hard to ignore. “Bitcoin repeats itself,” he summarizes alongside a comparative BTC chart. This chart compares what happened after Bitcoin reached its ATH level of $20,000 in 2017 and $69,000 in 2021.

The chart shows that after a one-year bear market, BTC is approaching similar macro lows in both 2018 and 2022. So, the June trip to $17,600 and the lows in the first half of October, it’s actually possible a ‘double bottom’ similar to Q4 2018 and the first half of 2019. If that turns out to be true, the next logical step will be upwards. However, Bitcoin needs to avoid another event of capitulation.

BTC annotated charts / Source: Stockmoney Lizards / Twitter

BTC annotated charts / Source: Stockmoney Lizards / Twitter