A crypto strategist predicts a potential rally that could send Bitcoin (BTC) to its long-term resistance. Another analyst is updating his long-term forecasts for BTC.

Analyst predicts an upcoming BTC rally

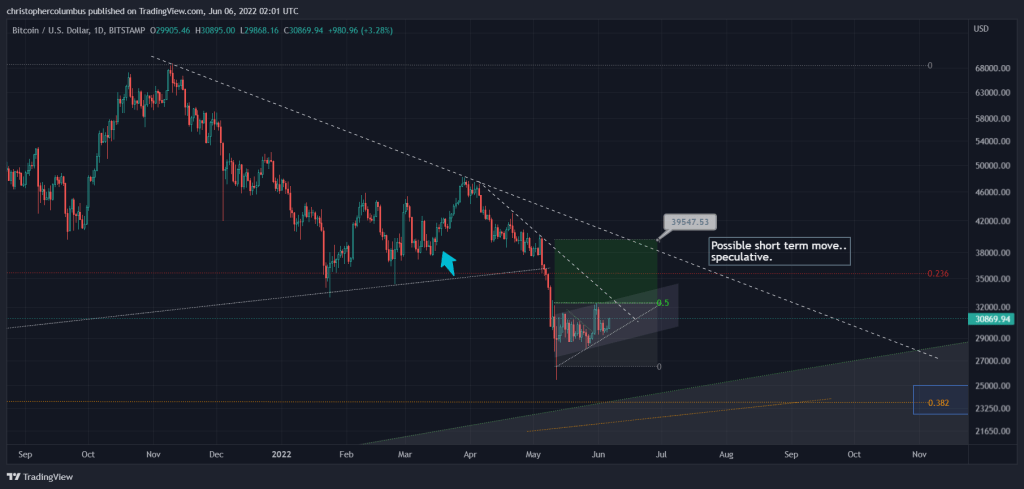

A crypto strategist correctly predicted Bitcoin’s May 2021 meltdown. You can refer to this article of Kriptokoin.com for the analyst’s accurate predictions. This crypto strategist is now predicting a potential rally that will send BTC to its long-term cross resistance. Analyst alias Dave the Wave says that Bitcoin is trading in an ascending channel. The analyst states that he is poised for a short-term rally to his target, potentially. The analyst uses the phrase:

Bitcoin shorter-term outlook.

Source: Dave the Wave/Twitter

Source: Dave the Wave/Twitter Crypto strategist notes that the $39,547 target is “speculative” and only valid as long as the channel holds. Dave the Wave remains cautious. He says traders who believe that Bitcoin will revisit its 2017 cycle high of $20,000 should start thinking about risk management. For this, he asks them to consider that BTC has dropped from its all-time high. The analyst says:

Last year, no one thought that the Bitcoin price would drop to the previous ATH level. And yet now the trumpet sounds a lot. Is it possible? Sure, but people need to balance renewed risk upside with risk downside. ‘They were once hyper-bulls’ which have been bearish or neutral at best since the last capitulation am now surprised that I’m more bullish.

BTC bear market has a bottom?

The crypto strategist also considers the possibility that the bottom of the bear market already exists. The analyst explains:

Likewise, the low may have already been seen. The shortest-term volatility is always the hardest to predict, almost randomly. It is the longer-term indicators compared to the monthly chart that provide the most reliability in technical analysis.

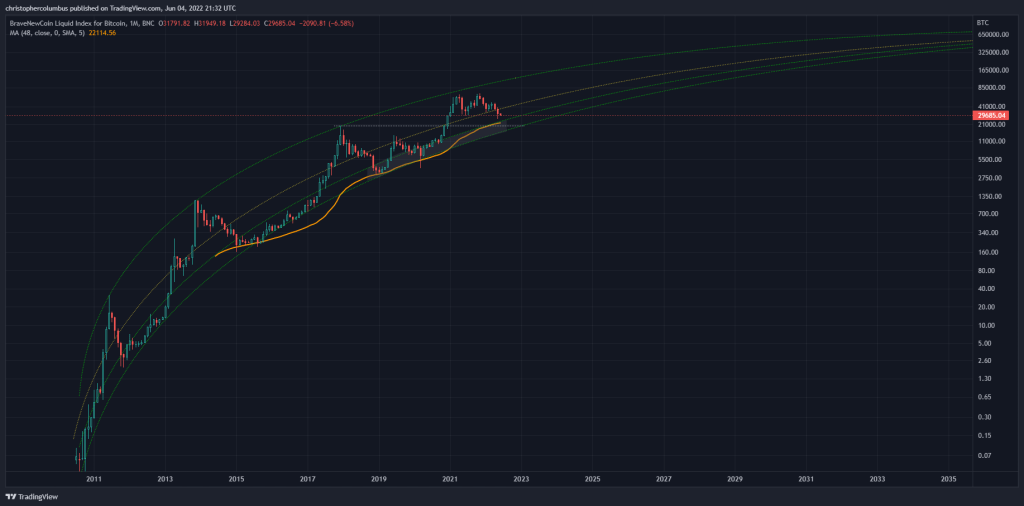

The analyst is looking at the long-term time frame. It shows how Bitcoin has always bottomed out after touching the four-year moving average on the monthly chart.

Four-year moving average support.

Source: Dave the Wave/Twitter

Source: Dave the Wave/Twitter At press time, Bitcoin was trading at $30,365. However, it is hovering above $22,000, the four-year moving average on the monthly chart.

Long-term Bitcoin forecast with new trading models

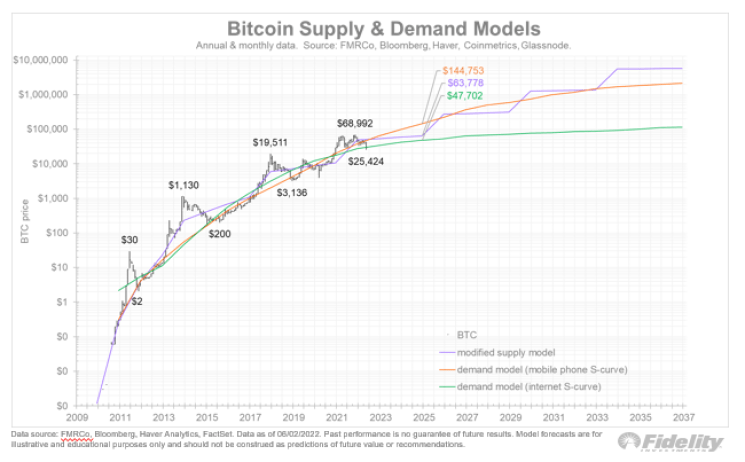

Fidelity’s global macro director, Jurrien Timmer, updates his long-term forecasts for Bitcoin (BTC). Leading crypto asset Bitcoin is struggling close to $30,000. The analyst cites PlanB’s once-popular stock-to-flow model (S2F). PlanB’s model attempts to predict the price of Bitcoin based on supply shocks from BTC halvings.

Timmer offers an S2F-inspired supply model, as well as two other models that track internet and mobile adoption rates. The analyst’s modified supply pattern shows that Bitcoin could be near $63,778 by 2025, about a year after its next halving. The analyst says:

The close-up below shows that the original S2F is more accurate than its predictions for this halving cycle. It is also a more modest supply model.

Source: Jurrien Timmer/Twitter

Source: Jurrien Timmer/Twitter Bitcoin could explode based on this model

Timmer is worth Bitcoin, based on mobile adoption He says he might explode. The analyst predicts that BTC could trade at $144,753 by 2025. But if Bitcoin follows the internet adoption rate, Timmer’s model suggests that BTC will peak. Additionally, he estimates that it could trade at $47,702 in three years. The analyst explains:

I assume the mobile phone curve is a more appropriate analog. In this case, the curve shows a strongly growing network for Bitcoin in the coming years. But the more asymptotic internet curve makes it more likely that Bitcoin’s growth curve is more mature than my models assume.

Analyst is optimistic about Bitcoin as an avid store of value in a world of ongoing financial pressure. But he reminds us that the exercise assumptions above should always be reconsidered, especially when price action deviates from expectations.