If Bitcoin stabilizes in the next two weeks, the protracted cryptocurrency bear market, also known as the crypto winter, could end as quickly as it started.

According to Edward Moya, the cryptocurrency market is ready for a comeback

This prediction came from Oanda’s senior market analyst, Edward Moya. According to Moya, “Wall Street is enjoying an aura of positive risk-taking, which is good news for cryptos.” The expert also says that the crypto market is starting to look “attractive as the economy looks a little better as Fed tightening expectations ease.”

Moya is referring to the surging stock market and the general calming of macroeconomic fears among investors. Often times, the rise in stocks also raises cryptocurrencies. Expert investors are starting to feel more optimistic about the economy, inflation and rising interest rates, which is a positive sign for risky assets, she says. Typically, the more confident investors feel about the stock market and the broader macroeconomic environment, the more risk they are willing to take.

Cryptocurrencies ahead of the Fed meeting

Bitcoin hit a one-month high on Wednesday, breaking above $24,000. cryptocoin.com As you follow, Ethereum has gained more than 50% in the last few days. The leading altcoin traded above $1,600 on Wednesday and then today.

For the past few months, many crypto experts have been waiting for one last big drop for the crypto market. Others are aiming for a bottom between $10,000 and $14,000 for Bitcoin. While that could still happen, Moya says if he buys more institutions in the coming weeks, this could allow Bitcoin to bottom out since “market positioning has become extreme.”

What’s next for the cryptocurrency market, how should investors react?

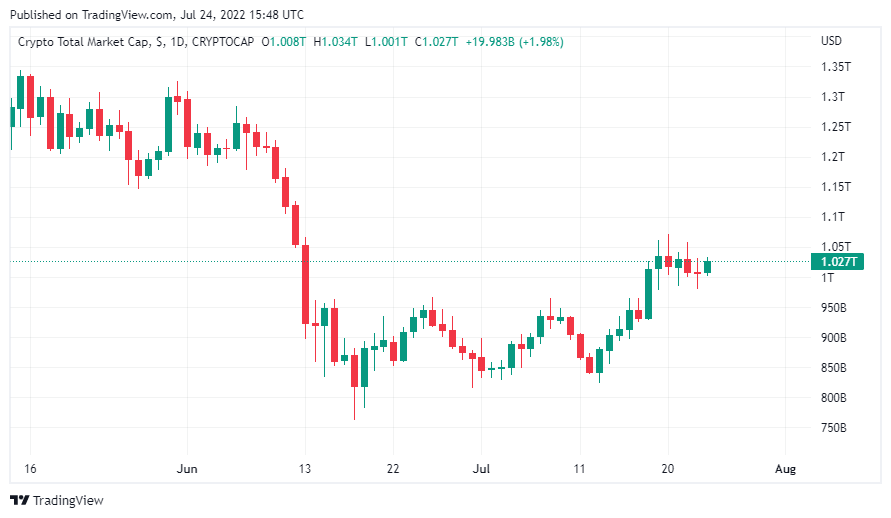

Until a month ago, cryptocurrencies were in the midst of one of the worst market crashes it has ever experienced. Bitcoin and Ethereum have fallen more than 70% since the peak of last year’s bull run. Many crypto companies, notably hedge fund Three Arrows Capital and Celsius, have declared bankruptcies. Meanwhile, its total market capitalization fell below $1 trillion. Thus, it was a significant drop from a few months ago when it was more than $3 trillion.

But Marcus Sotiriou, market analyst at crypto exchange GlobalBlock, says investors hope this crash is nearing its end. Crypto prices are skyrocketing as investors begin to feel more bullish, thanks in part to the recent rally in stock markets in the US, Europe, and Asia. Cryptocurrencies, especially Bitcoin, have been following the exchanges closely since the beginning of the year. Sotiriou comments on the current bear market:

As the market begins to react positively to negative news, this is a sign that it may be in a local bottom for now, as fear may have caused the news to be priced in.

“Rally for Ethereum will start at this level”

Despite the positive momentum over the past few days, the crypto market is still suffering. Both Bitcoin and Ethereum have dropped more than 50% this year. Bitcoin recorded its worst quarterly loss between April and June. Crypto expert and educator Wendy commented on what levels Ethereum will rally buyers at:

We are in a fully developed bear market, not in a bear cycle. We are currently trading at $1,500 for Ethereum and seeing some positive price action for me to be super doesn’t mean we are not clear. Bullish on Ethereum, I should see us break above $2,248.

So what does the latest cryptocurrency rally mean for investors?

It shouldn’t significantly change your crypto investments or how you invest in crypto if you’ve been into it for a long time. Given crypto’s history of volatility, this increase does not guarantee a long-term return. Crypto prices are as likely to fall back as they continue to climb.

The future of cryptocurrency certainly includes much more volatility. For this reason, experts recommend not dedicating more than 5% of your investment portfolio to crypto. It makes sense to invest only in what you are willing to lose.