Jim Bianco, a professional cryptocurrency analyst, has revealed that there is a hype issue for Bitcoin. The early BTC investor is putting some issues on the table for the leading crypto.

Big problem for Bitcoin: Inflation

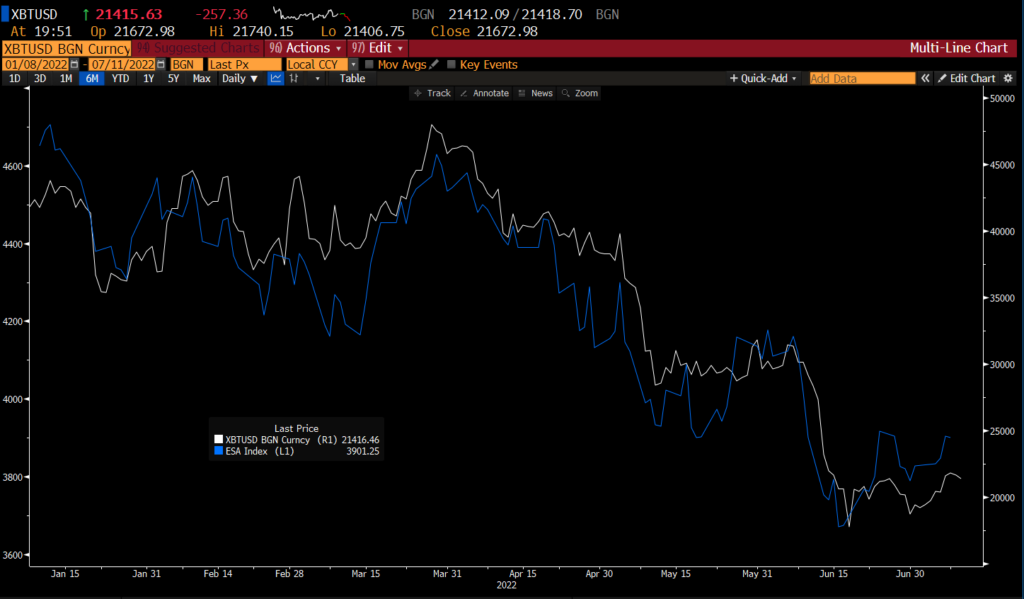

Jim Bianco, a well-known analyst, recently stated on Twitter that there is a problem that Bitcoin does not function as an inflation hedge. According to Bianco, over the past six months, Bitcoin has traded incrementally with S&P 500 futures.

As cryptocurrencies and stocks continue to be traded coordinated, there will be a significant correlation. According to Bianco, Bitcoin is essentially the same as a “leveraged crash.” “I argued that it shouldn’t be this way, and it continues to be that way,” the analyst says.

Bianco hopes the Fed is secretly printing more money, even as it criticizes its easy money policy. Because risk assets often benefit from low interest rates and various types of quantitative easing. The analyst claims that this is a major issue for Bitcoin’s long-term goals.

The latest quarter for Bitcoin has been the worst performer in over a decade

The Nasdaq Composite, which is heavily tech-focused and often highly correlated with cryptocurrencies, had its worst quarter since 2008. The failure of Bitcoin to provide a safe haven during the market volatility in 2022 supports the idea that the largest cryptocurrency is truly a risk-free investment.

Bank of America, one of the leading banks in the US, stated in May that Bitcoin is not a practical portfolio diversifier due to its tendency to behave similarly to stocks. Therefore, the largest cryptocurrency cannot be used as a hedge against inflation. So what causes this instability of Bitcoin?

This is why BTC failed

Billionaire investor Paul Tudor Jones is optimistic about Bitcoin as an inflation hedge. However, Dallas Mavericks owner and investor Mark Cuban dismissed the idea as a “marketing slogan.” Another argument is that Bitcoin will have an intrinsic store of value over time as gold is accepted. Supporters believe that Bitcoin will be seen as an asset that will not lose value over time. Anjali Jariwala, certified financial planner and founder of Fit Advisors, has something to say about it. “The size of the volatility matters, it is very difficult for me to see Bitcoin as a store of value,” the analyst says.

Jariwala has negative prospects for crypto in general. The analyst says that Bitcoin and cryptocurrencies are a new type of asset that does not yet function as gold. Because “it cannot be easily exchanged for a good or service”. Despite its scarcity, he says the price of cryptos like Bitcoin is still largely based on consumer sentiment. cryptocoin.comAs we have covered in our analysis, Plan B made a rather optimistic forecast in this regard.