Bitcoin (BTC) price has been dominated by a bearish sentiment lately. However, according to analysts, the BTC trend may be approaching a reversal. Several prominent analysts in the crypto community argue that BTC price action has evolved more unevenly over the years, with declining “cycles” indicating that Bitcoin has bottomed out.

Analysts argue that Bitcoin price has bottomed out

David Russell, a prominent cryptocurrency analyst and trader, conducts technical analysis to conclude that Bitcoin price has bottomed out. Russell argues that Bitcoin cycles are getting shorter, or “decreasing” as the maturity of the market increases. The descending cycles have therefore replaced the four-year halving cycles and based on this theory, the BTC price has bottomed out around $25,000.

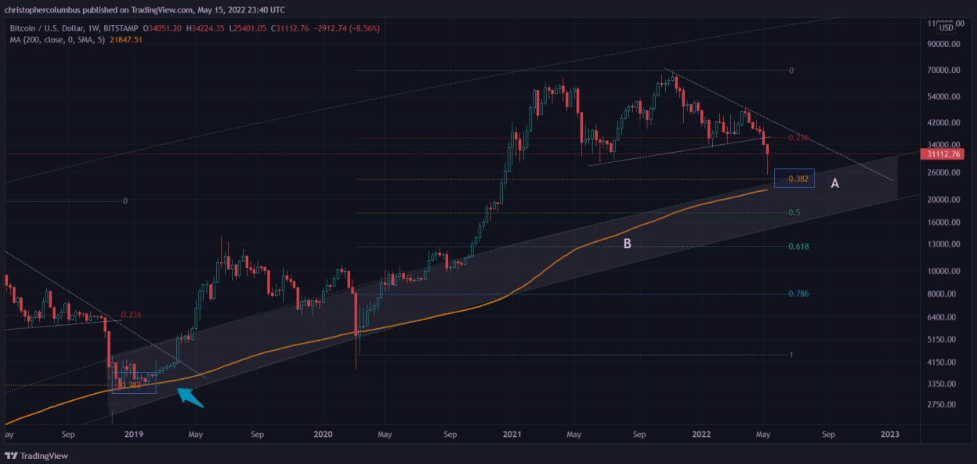

The analyst uses three technical indicators and patterns to explore how much further Bitcoin price can drop. Looking at the 200-week moving average, Russell notes that the BTC price is consistently trading above this level. The 200-week moving average

has acted as support since it appeared on the chart, and Russell believes this level will likely hold, given the consistent historical performance of BTC price. Therefore, the popular analyst says that the BTC price will drop to around $25,000 and it is unlikely to dive deeper.

BTC price chart, 200-week moving average in orange

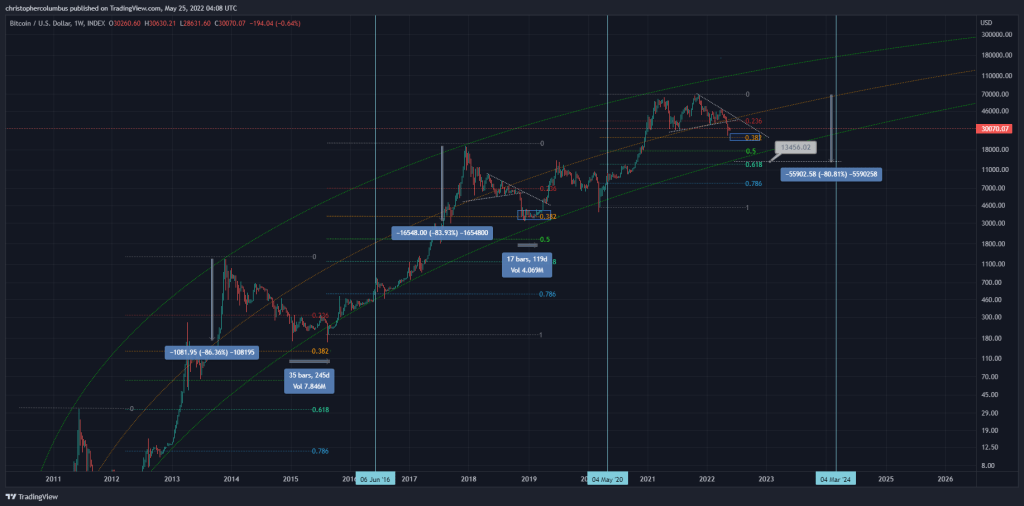

BTC price chart, 200-week moving average in orange Also based on the Logarithmic Growth Curve (LGC), Russell argues that an 80% price drop in Bitcoin price is unlikely . Logarithmic analysis is a statistical approach that takes into account historical price data and develops curves to reflect the potential path of future price growth.

BTC LGC

BTC LGC On-chain data shows light at the end of the tunnel for Bitcoin

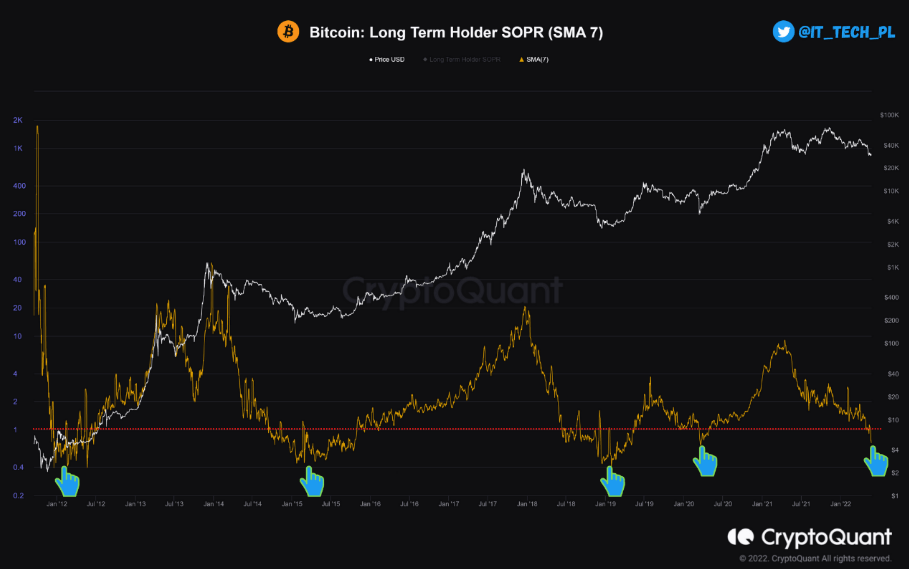

Bitcoin Long Term Holder s, or SOPR, is an indicator that reflects the degree of profit and loss realized for all on-chain cryptocurrencies. It covers a range of BTC with a lifetime of more than 155 days. Therefore, it is considered a long-term indicator that represents the total profit or loss realized by long-term holders. If the value is greater than or equal to one, it means that holders can sell Bitcoin at a neutral level or profit. If it falls below one, it indicates a loss.

The current value is 0.72 which means that some BTC Long Term Holders may sell at a loss. Investors who hold Bitcoin for three to twelve months are known to sell their Bitcoin at a loss. The analyst states that as the value of the indicator drops below one, it indicates a potential BTC bottom formation.

BTC Long Term Holders SOPR (SMA 7)

BTC Long Term Holders SOPR (SMA 7) Institutional demand for BTC

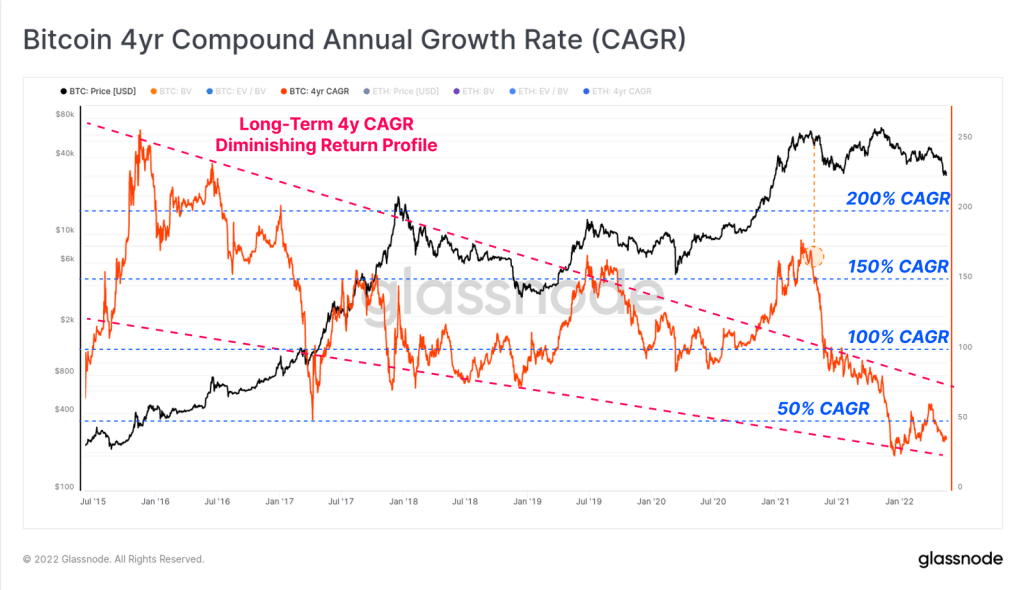

Glassnode analysts also found BTC price It also evaluates the trend and on-chain measurements. Analysts have been recording a decline in Bitcoin price performance over the past 12 months as the asset’s long-term Compound Annual Growth Rate (CAGR) has taken a hit. The chart below shows the 4-Year Compound Annual Growth Rate (CAGR) for BTC in rounded numbers.

Bitcoin four-year Compound Annual Growth Rate (CAGR)

Bitcoin four-year Compound Annual Growth Rate (CAGR) Chart shows a decline in institutional demand for Bitcoin, and consensus is that returns profiles for BTC can be expected to decrease overall with increasing market valuation. shows that.

Guggenheim CEO believes BTC will drop to $8,000

As we have covered in cryptokoin.com news, Guggenheim’s Chief Investment Officer Scott Minerd is bearish on Bitcoin and predicts a bearish target of $8,000 for BTC. However, Scott Minerd expects the bottom to come soon when the Fed implements restrictive policies. Scott Minerd predicts a potential bottom formation in Bitcoin and describes the bottom as $8,000. This means a 70% drop in Bitcoin price from current levels. Comments by Minerd:

When it consistently drops below $30,000, $8,000 is the ultimate bottom. So I think we have a lot more room on the downside, especially with the Fed tightening it.

If Scott Minerd’s BTC prediction comes true, the cryptocurrency market, which wiped out $500 billion in market capitalization last month, will face more pain.

Minerd’s previous Bitcoin price predictions have failed!

Scott Minerd told Bloomberg in December 2020 that the BTC price could rise to $400,000, according to Guggenheim’s fundamental study on the asset. At the time of this prediction, BTC was trading around $20,000.

"Our fundamental work shows that Bitcoin should be worth about $400,000," says Guggenheim's Scott Minerd https://t.co/9QyOWyYAVA pic.twitter.com/uojQqaKPia

— Bloomberg TV (@BloombergTV) December 16, 2020

Within a month of Minerd’s forecast, BTC price rose to $40,000 and the Guggenheim stood behind its goals for existence. Minerd even told Bloomberg that investors bought BTC on his recommendation. In February 2021, Minerd increased the Bitcoin price target to $600,000 based on the firm’s research and offered the following views:

Considering the BTC supply and the total value of gold relative to the world’s gold supply, if BTC were to go to such numbers, per Bitcoin We would be talking between $400,000 and $600,000.

"Cryptocurrency has come into the realm of respectability & will continue to become more and more important in the global economy." @ScottMinerd talks $GME / $SLV / $BTC and the logic of bubbles versus buying frenzy. pic.twitter.com/ZWoZqZNU2M

— Julia Chatterley (@jchatterleyCNN) February 2, 2021

Bitcoin price then dropped from $63,000 to $33,500 in July 2021 and Minerd pointed to $10,000 this time. Minerd’s prediction of a BTC bottom did not come true in previous examples, but this time it is accompanied by indicators pointing to a potential BTC bottom formation. Crypto analysts and traders on Twitter have criticized Guggenheim and its analysts for their highly inaccurate BTC price predictions.

Guggenheim investment CEO talking bull shit about Bitcoin? Your company hires people who doesn’t know anything? pic.twitter.com/xmgGS3imNx

— MM (@diamondhands_88) May 24, 2022