Bitcoin is having a stellar 2023, gaining 75% so far. That type of price performance invariably piques investor interests. For those who still limit themselves or are limited to investment in public equity and debt securities, there is at least one way to get exposure to the movement in bitcoin’s price: Public mining stocks.

These companies – Core Scientific (CORZ), Riot Blockchain (RIOT), Bitfarms (BITF), Iris Energy (IREN), and CleanSpark (CLSK) – have traded up 947%, 442%, 300%, 458% and 212%, respectively. That said, at the beginning of the crypto bear market last year, almost all of these stocks were hit harder than bitcoin.

This story is part of CoinDesk’s 2023 Mining Week, sponsored by Foundry.

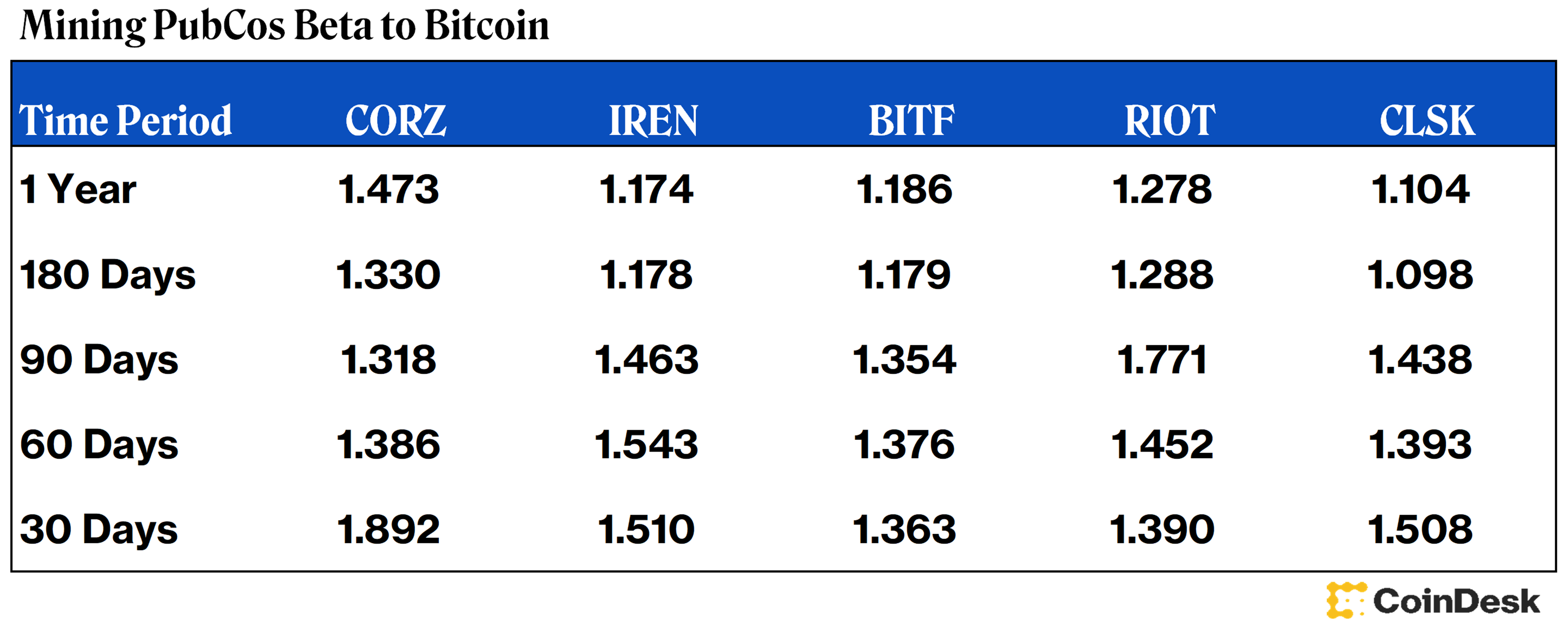

This has led to the notion that mining stocks act as a high beta bitcoin trade. Beta is a measure of a stock’s volatility in relation to the overall market. A beta greater than 1.0 suggests that the stock is more volatile than the broader market, and a beta less than 1.0 indicates a stock with lower volatility.

If we consider the “overall market” to be bitcoin, all the aforementioned mining stocks have seen greater than 1.0 beta (on various lookback time periods) to bitcoin, suggesting they do in fact offer that high beta bitcoin trade (i.e. additional upside or downside on trading bitcoin alone).

PubCo Mining Stocks Beta