AXS, the native token of the blockchain-based play-to-earn game Axie Infinity, has come out of oblivion this week with a double-digit price rally.

Leverage traders appear skeptical if AXS’ turnaround from 17-month lows would be long-lasting.

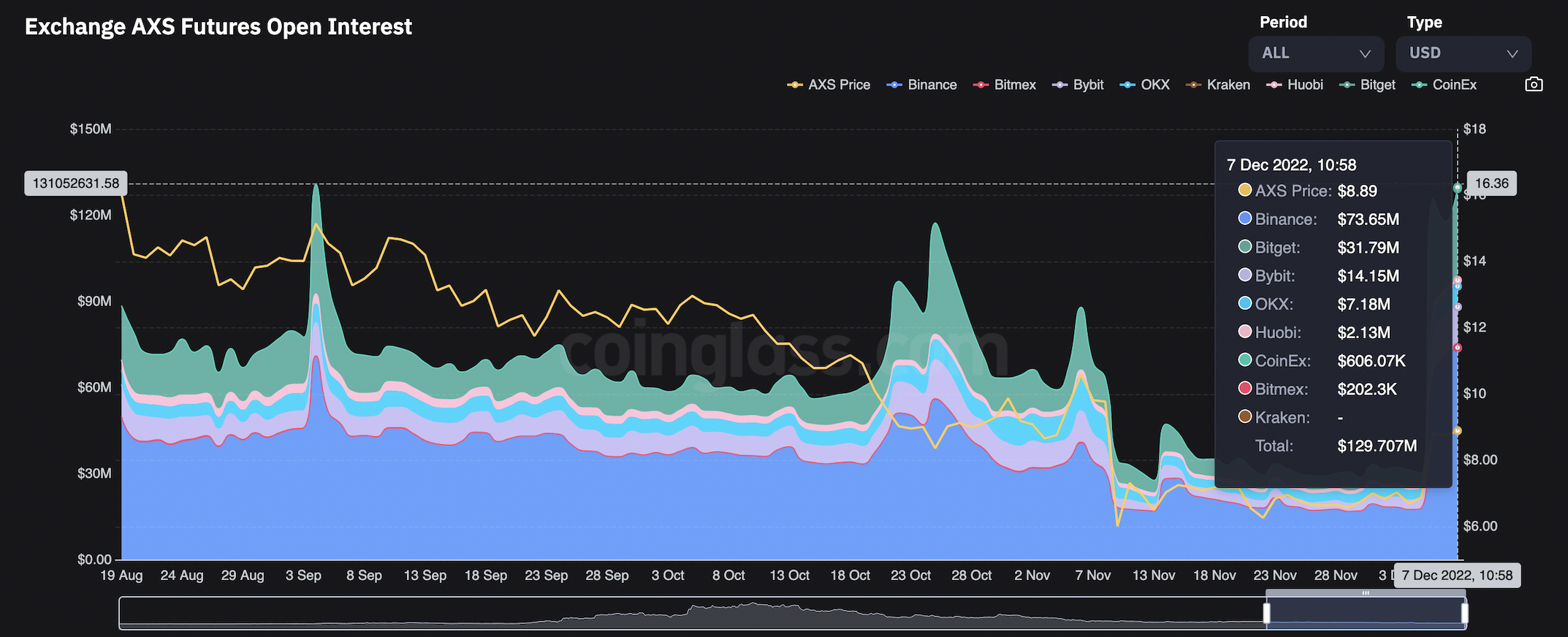

That’s because while open interest or the dollar value locked in the number of active standard futures and perpetual futures contracts tied to AXS has increased to a three-month high of $129.70 million, funding rates remain negative, according to data source Coinglass.

Funding rates are the cost of holding bullish long and bearish short positions in the perpetual futures market. The negative rate indicates shorts are paying longs to keep their positions open, and the leverage is skewed on the bearish.

The combination of rising open interest and negative funding rates suggests an influx of new money on the bearish side, a sign of traders shorting the rally.

“With a favorable environment for alternative cryptocurrencies far away, a rise in open interest implies a higher probability of increased shorts,” Griffin Ardern, volatility trader from crypto asset management firm Blofin said.

“The continued nearly zero or negative funding fees indicate that traders have not yet shifted from their bearish sentiment,” Ardern added.

Open interest in AXS futures and perpetual futures has jumped to the highest since early September. (Coinglass) (Coinglass)

AXS jumped to a three-week high of $10.40 on Monday after Axie Infinity announced plans for progressive decentralization of the game.

The decentralized strategy would focus on building an end-state where community members with meaningful contributions would play a pivotal role in decision-making progress, Axie Infinity said in the publication titled “Axie Contributor Initiative Kickoff.”

“The AXS bounce is a typical event-driven move,” Ardern noted, referring to Axie’s announcement of the community decentralization plan.

At press time, the token changed hands at $8.4, representing a nearly 22% weekly gain.

The persistent bearish sentiment in the futures market can be attributed to the lingering FTX contagion fears and macroeconomic uncertainty that has weighed heavily over crypto prices this year.

That said, a continued rise in AXS might compel traders to reassess their commitment to the bearish trade, paving the way for a short squeeze – an extended rally fueled by the unwinding of shorts, the likes of which we have recently seen in U.S. stocks.

“Considering the current low liquidity in alternative cryptocurrencies, a short squeeze cannot be ruled out,” Ardern quipped.