Part of the rapid surge in prices for alternative cryptocurrencies (altcoins) in the past few months may be traced back to South Korean traders, known for their high risk-taking behaviors that often spark speculative frenzies in tokens.

Spot volumes on local exchange Upbit have nearly doubled since September, analysts at on-chain data firm CryptoQuant shared in a Friday note to CoinDesk. Upbit, which constitutes over 85% of the Korean trading volume, experienced an 82% growth in October compared to September, with trading volume rising from $32.8 billion to $59.8 billion.

This possibly created a flywheel effect as rising volumes attracted market makers and traders, who, in turn, invested profits to continue buying in a rising market.

Notable booms include Loom Network’s LOOM, whose price surged approximately ten times over two months, and HIFI, whose prices spiked by 6,600% in September alone.

“For coins that are only listed on Korean exchanges, if there is a significant increase in trading volume, listing futures on them has been popular on overseas exchanges,” CryptoQuant’s analyst Bradley Park told CoinDesk in a message. “From an on-chain perspective, market makers are the buying power.”

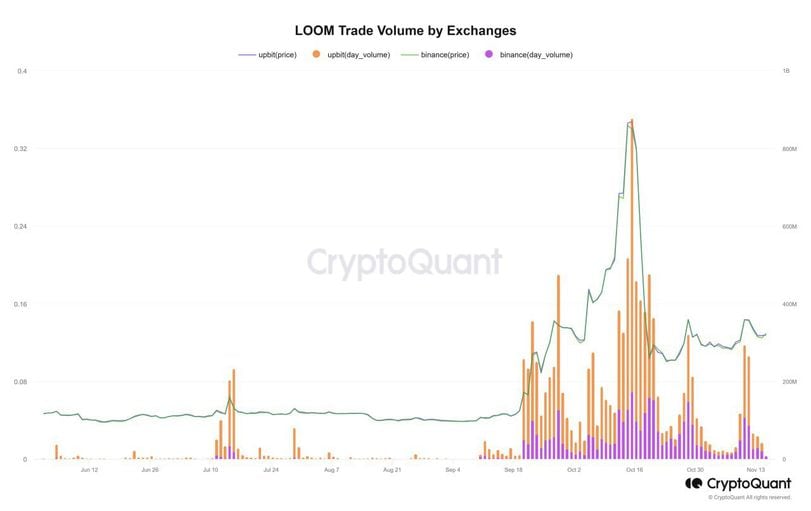

Loom trading volume by exchanges. (CryptoQuant) (CryptoQuant)

The chart shows Upbit led the volume growth in LOOM markets as prices surge 238% in September and another 100% in early October before reversing gains in the later half of the month.

The major part of the rally in decentralized lending and borrowing platform HIFI happened before Binance launched perpetual futures tied to HIFI in mid-September. Post the launch, the token’s price turned lower.

While altcoin activity has spiked on South Korean exchanges, bitcoin has maintained its dominant position worldwide.

Bitcoin’s market dominance – a ratio of bitcoin’s capitalization compared to the rest of the market – rose to 53% from 49% in this period, suggesting the premier cryptocurrency remained the most favored bet among traders.

Overall market capitalization has risen to $1.4 trillion as of Friday from just over $1 trillion at the start of September, data shows.