Cryptocurrency exchange Binance recently published Understanding the rise of MemecoinsThe report called ‘investor profile’ focused on this field.

Claiming that Memecoins embody the basic principles of the cryptocurrency industry, the report stated, “There appears to be a clear priority given to financial profit and less focus on technological progress.”

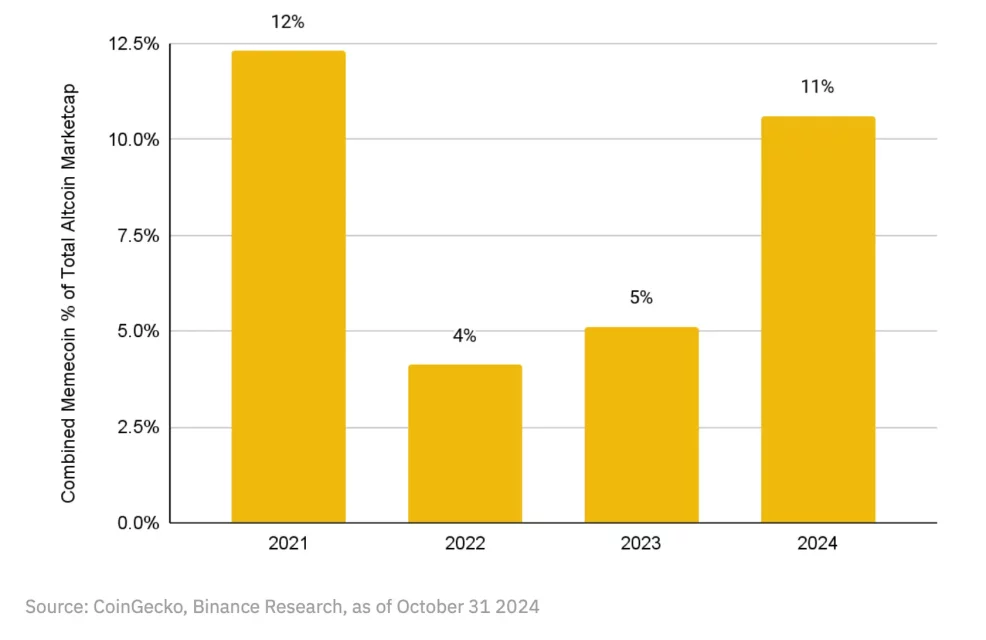

The market value of Memecoins is increasing day by day

The ratio between the total market value of Memecoins and altcoins has almost tripled since 2022. But this rate is still below the peak of 12 percent recorded in 2021.

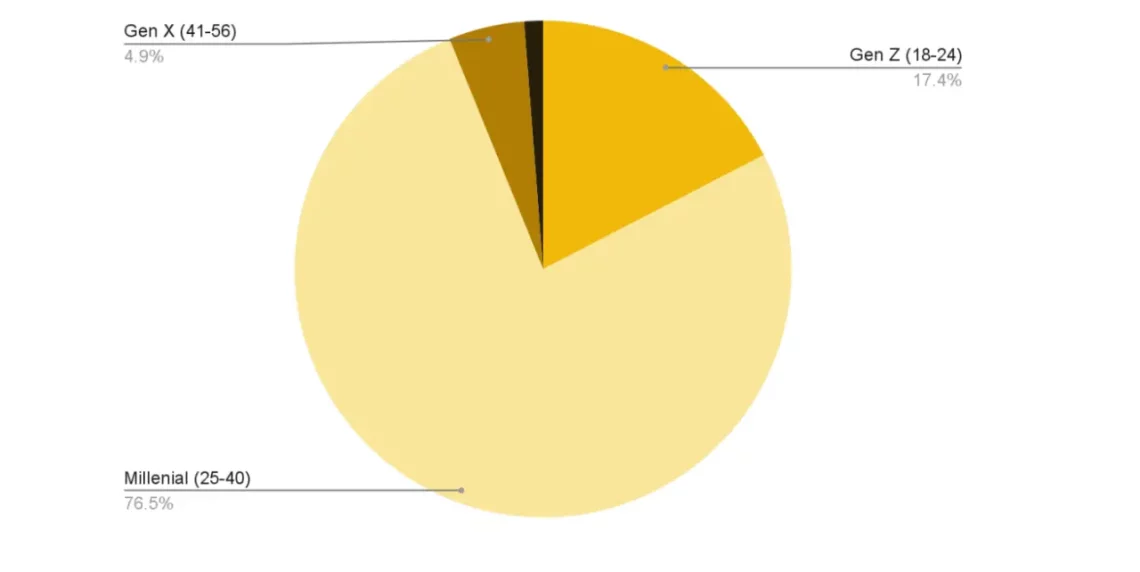

Poor performance from Generation Z in crypto investing

According to Binance’s report, 76.5 percent of cryptocurrency investors come from generation Y. While generation Z, representing the ages of 18 to 24, attracts attention with its relatively low share of 17.4 percent, generation X, between the ages of 41 and 56, is the lowest group investing in crypto with 4.9 percent.

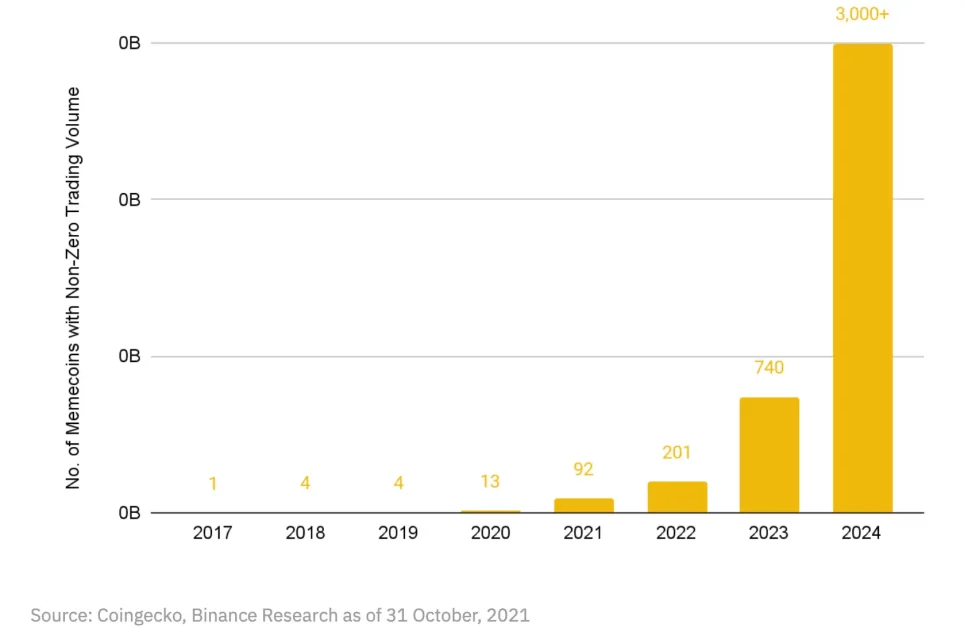

75 percent of memecoins on the market were produced in the last year

The report highlighted the astronomical increases recorded by new and popular memecoins in a short time. For example, WIF reached a market value of $1 billion in 104 days. SHIB reached this level in 279 days, while DOGE took eight years to reach a market cap of $1 billion. It was reminded in the Binance report that 75 percent of the memecoins traded in the market were produced in the last year.

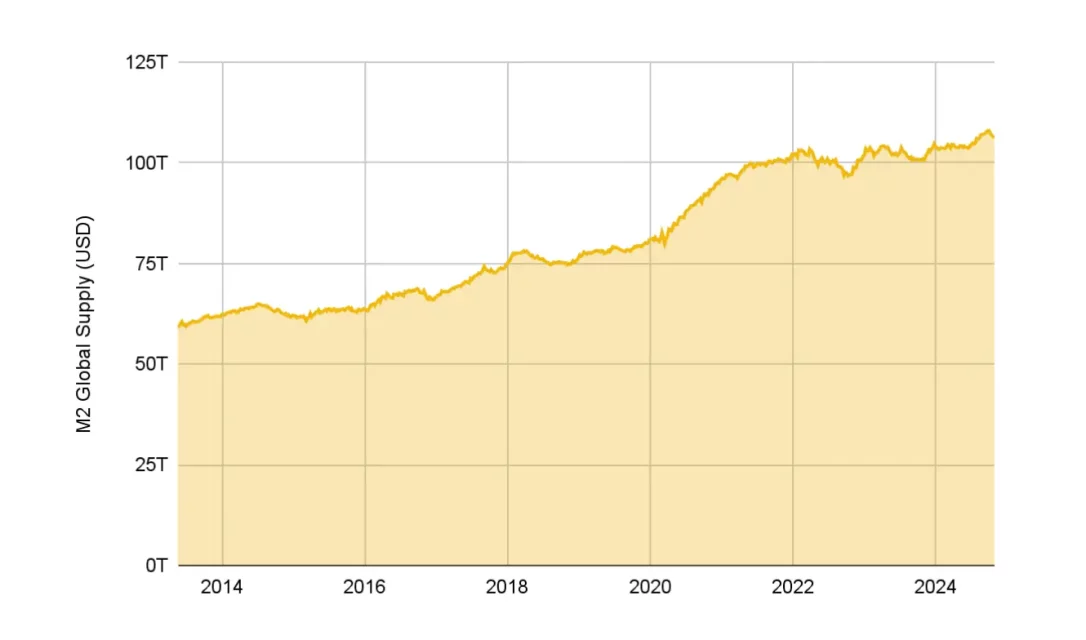

Inflationary environment leads to memecoins

In the Binance report, which examined the economic and socioeconomic factors behind the interest in Memecoins, it was emphasized that the global money supply would grow by more than 25 percent between 2020 and 2022, rising from 81 trillion dollars to 102 trillion dollars. While it was stated that the monetary expansion in question caused inflation to rise, attention was drawn to the US inflation rate, which is measured as 7 percent in 2021 and 6.5 percent in 2022. According to the report, individual investors turned to memecoins that promise higher returns due to the inflationary environment in question.

The report included the following statements: “Risky investments are becoming more attractive in the context of the accelerated expansion of the global money supply. While the majority of this capital is directed towards traditional assets such as the S&P 500 and real estate, some is also flowing into major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). “At the extreme end of the spectrum, memecoins stand out as high-risk, high-reward investment vehicles for excess capital.”

It’s hard to find memecoins that survive in the long run

However, memecoins, which have high earning potential in the short term, also pose a high risk. As a matter of fact, according to the Binance report, 97 percent of memecoins released between 2023-2024 were almost zero. Only a few memecoins, such as Dogecoin and Shiba Inu, have managed to survive in the long term. It is useful to be careful when investing in memecoins, which bring a lot of profit in a short time but carry high risks.