Increasing breast coin fraud and Rug Pull events in the Solana ecosystem damage investor confidence. While the recent scandals accelerated the capital outputs, a harsh decline in user activity was experienced. Experts think that it can have a positive result for Solana in the long run.

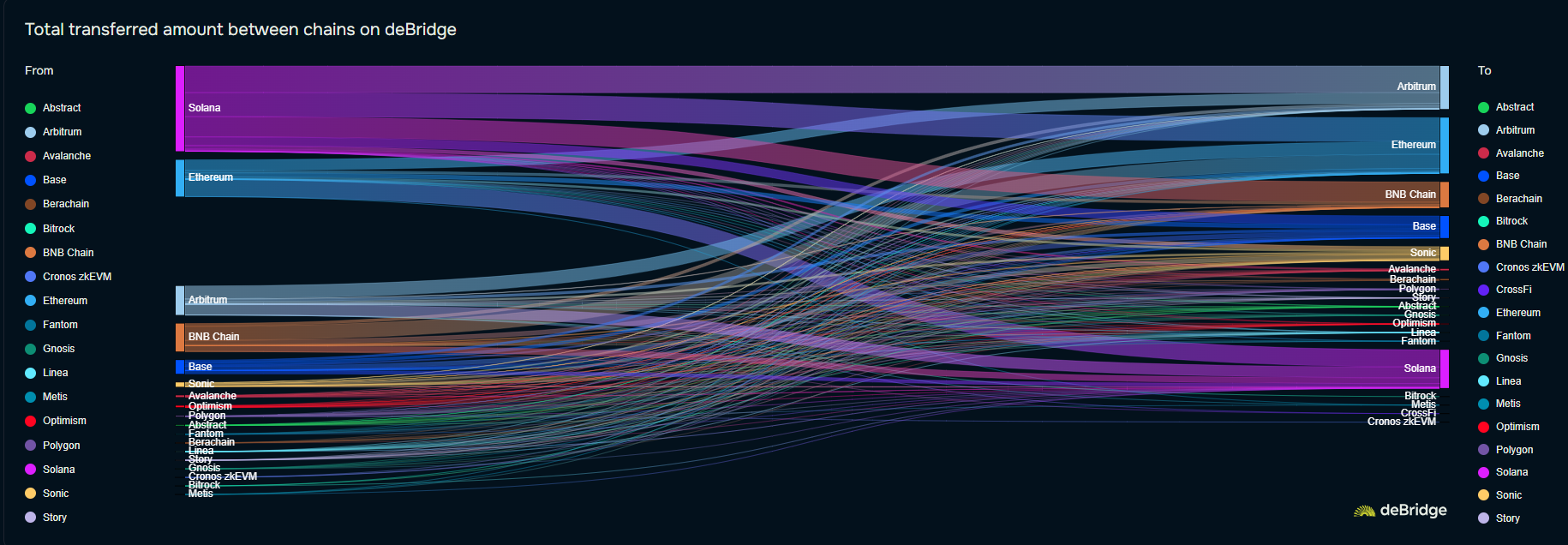

Breast Coin scandals shift capital to these networks from Solana

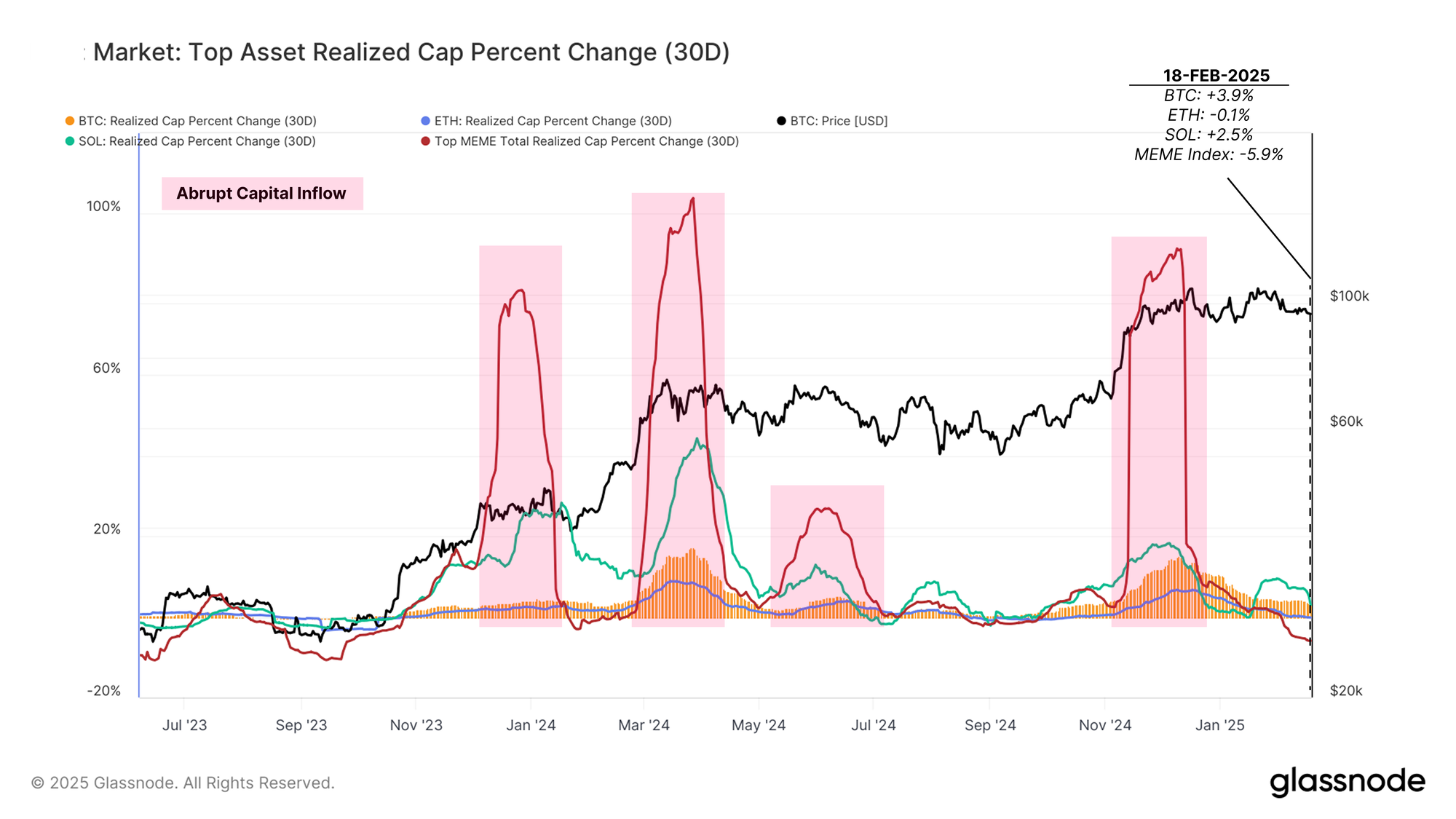

Frauds in the Solana network caused investors to turn to Ethereum and Arbitrum. According to Glassnode data, the monthly capital flow that entered the solana and breast index returned to negative by 5.9 %.

Glassnode analyst Cryptovizart said that the biggest reason for this decrease is the decrease in interest in the breast coin industry. According to the analyst, the capital entry, which reached the summit in December 2024, has now decreased to 2.5 %per month, and the decline tendency is moving faster than Bitcoin.

Solana user activity decreased by 40 %

In the last month, 29 %of the fading fell, Ethereum fell by 15 %and Bitcoin by 7 %. However, the largest decline in Solana was observed with a major decrease in the number of active users.

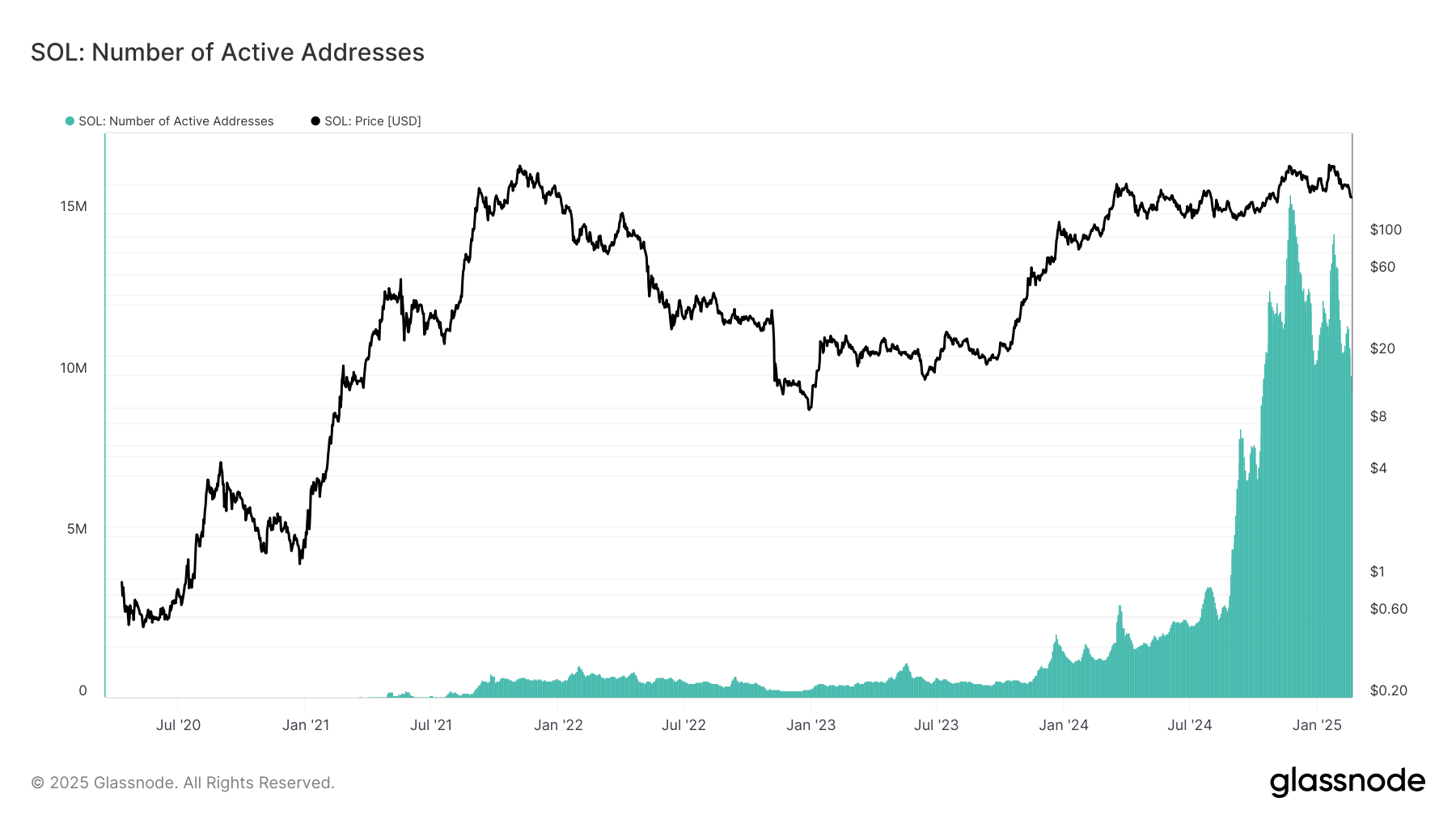

- November 2024: 15.6 million active users

- February 2025: 9.5 million active users

This 40 %decrease shows that Solana has returned to the pre -bull market levels.

Libra Breast Coin scandal and $ 4 billion loss

One of the biggest frauds in Solana was Libra Token, supported by Argentine President Javier Milei. After the project team pulled the liquidity of 107 million dollars, the token price fell 94 %within hours. This event led to a total loss of $ 4 billion investors. Kriptokoin.comWe have included details in this article.

Could it be positive for Solana in the long run?

Recently, 7.7 million dollars from Solana to Arbitrum, 6.9 million dollars was transferred to Ethereum. These capital outputs can clean speculative and non -confidence projects in the ecosystem.

Blockchain researcher Aylo commented on this situation in his sharing of 18 February:

This turmoil will turn into something very good in the long run. Standards should rise, malicious actors should be cleaned.

According to experts, if Layer 1 token prices are supported only by gambling -like transactions, the long -term growth of the sector will be limited. This process in which Solana is experiencing can form a more solid foundation for the ecosystem.

To be aware of last -minute developments Twitter ‘ in, Facebookin And Instagram follow and follow Telegram And Youtube Join our channel!