Data revealed by Cryptoquant CEO Ki Young Ju shows that an anti-crypto country currently has enough reserves for Bitcoin (BTC) and thus the market crash.

China emerged as a sneaky whale that could crash the market

The largest country in Asia was at the forefront of countries rejecting cryptocurrencies. Even now, it has reserves that can completely destroy the market in a few seconds. According to a report published on Nov. 13 by cryptocurrency researcher Paulo A. José, the Chinese government holds more Bitcoin (BTC) and Ethereum (ETH) than MicroStrategy or Elon Musk.

Ki Young Ju, founder and CEO of blockchain data analytics platform CyptoQuant, first shared this information on Nov. Ki Young Ju also published a chart listing the publicly traded companies with the largest Bitcoin reserves.

China got most of this cryptocurrency reserve from a fraud investigation in 2019. According to research:

Chinese authorities seized 194k BTC, 833k ETH and other cryptocurrencies from PlusToken scam in 2019. They transferred assets of 6 billion dollars to the national treasury.

China isn’t the only Bitcoin whale

In a separate comment, Young Ju stated that the Bulgarian government owns more than 200,000 Bitcoins. The Bulgarian government also took over these cryptocurrencies from a crypto criminal gang in 2017.

PLOT TWIST: Government of Bulgaria🇧🇬 *might* have 200k+ Bitcoins.

Bulgarian authorities disclosed that they found 200k $BTC from criminals but didn't specify that they successfully seized these #Bitcoin.https://t.co/JLxzvNel4t

— Ki Young Ju (@ki_young_ju) November 3, 2022

Is Bitcoin in Danger?

According to José, who brought up the countries’ crypto reserves, if China starts selling the 194,000 BTC it has seized, there is a chance the market will suffer severely. According to the researcher, China’s strength is enough to bring the price of Bitcoin down to $ 5,000 in seven seconds. However, China has been implementing nationwide cryptocurrency bans since 2021. However, the bans failed to prevent the country from adopting cryptocurrencies. China still remains in the top 10 for the use of cryptocurrencies.

Additionally, despite the bans, Chinese miners continue to grow, according to information from Birawr. Sources reveal that as of November 11, there are 65 Bitcoin node operators.

BTC price analysis

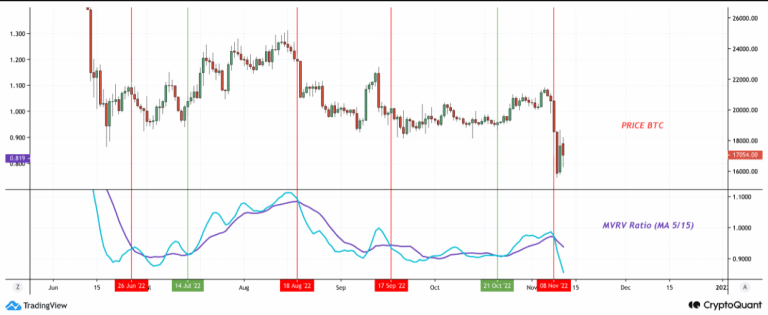

CryptoQuant analyst Achraf Elghemri shared that Bitcoin’s MVRV value is showing an interesting move that could lead to a trend reversal. In their analysis, he pointed out that the MVRV index showed an undervalued ratio. There has been very little speculative bounce in recent days due to the severity of the decline. This points to a possible market floor. Therefore, investors can expect a price increase.

On the on-chain side, interestingly, the number of addresses holding 0.01 or more Bitcoins has reached 11032.070 ATH, according to Glassnode. This was a positive development as it reflected the confidence of investors in Bitcoin amid the crisis. cryptocoin.comAs you follow, BTC price is currently spending time in the $16,500 region.