The US Federal Reserve will announce a 50 basis point rate hike this evening. That much is certain and priced in the markets. However, the FOMC text and Powell’s press conference will resonate at least as much as the rate hike. False statements from the Fed may start a selling wave in all risky assets, including Turkish markets. In addition to rate hikes, the Fed will begin to narrow its balance sheet in May. It is very possible that this process will reduce the dollar supply and push the US interest rates and the Dollar Index up.

In Turkey, there are rumors that the dollar/TL rate is artificially below 15.00 due to intense CBRT FX sales. The rise in US interest rates and the Dollar Index may complicate the CBRT’s job.

Hours before the historic Fed decision, we have compiled the comments on this subject in the press:

Sputnik: Fed’s interest rate decision is expected in the markets: Dollar index at 20-year high

The US Federal Reserve is expected to increase interest rates. Before the interest rate meeting, the dollar index reached its highest level in 20 years, and gold prices fell sharply.

All eyes are on the Fed’s interest rate decision, which will be announced today. Before the decision, the US dollar is trading at 20-year highs.

While the Fed’s tight monetary policy causes hot money to turn to the dollar or interest rates, it can especially affect developing countries.

The dollar appreciated in the world before the bank’s interest rate decision. The dollar index reached around 104 points, reaching its highest level in nearly 20 years. Ounce gold, on the other hand, declined sharply. The ounce of gold, which fell to around $ 1850, saw its lowest level in 2 and a half months.

Markets are closed in Turkey due to the public holiday. While the dollar was approaching 15 liras against the Turkish lira in transactions in international markets, gram gold fell to around 880 liras.

Source link

Republic: In case the Fed raises interest rates, it will be adversely affected in Turkey, where inflation pressure continues and interest rates are kept low

Time The US Dollar is trading at 20-year highs ahead of the decision, which is expected to be announced at 9 PM.

The question whose answer is awaited is whether the Fed will step on the brakes and limit the rate hike to 50 basis points, or will it choose an aggressive rate hike by 75 basis points to control inflation, which has experienced the fastest increase in 40 years.

Economists warn that aggressive tightening could lead to a recession.

Due to the risk of an energy crisis that may arise in Europe with the continuation of the Ukraine war in the markets, it is expected that the dollar will continue to appreciate while the demand for the US dollar increases.

Some emerging markets are closed before the Fed rate meeting. The trading volume is low, but stocks are falling in open markets.

With the Fed’s entry into the cycle of interest rate hikes, the expectation of depreciation in emerging market assets such as Turkey increased.

Source link

Deutsche Welle: The rate increase is expected to be effective in Turkey, where inflation pressure continues and interest rates are tried to be kept low

South Korea, Stock markets depreciated in Taiwan and South Africa. The MSCI Emerging Markets Index fell for the fourth time in April due to the Ukraine war, the Covid-19 restrictions in China and the effects of the Fed’s monetary tightening.

ING Bank’s investor note included the assessment that “Especially emerging markets are going through a very tough period because there has been a portfolio investment outflow of 50 billion dollars from the bond and stock markets since the end of February”.

ING Bank’s assessment continued as “The Brazilian real and South African rand will be hit hardest as they are the most vulnerable currencies, but there will be a tough period in emerging market currencies in the next six to 12 months.”

While the central banks of many developing countries enter into a monetary tightening cycle to combat inflation, the Turkish Lira (TL) outlook in Turkey, where interest rates are tried to be kept low due to political pressure on the Central Bank of the Republic of Turkey (CBRT). Reviews are also negative. TL is also expected to be affected by portfolio investment outflows from emerging markets with the Fed rate hike.

Source link

THICK: Strong dollar, low interest pressures on TL

With the Fed’s start of interest rate hikes, the US Dollar is against other currencies quickly strengthened.

While the central banks of many developing countries are engaged in a monetary tightening cycle to combat inflation, the situation in Turkey is somewhat different.

While the political authority is blocking interest rate increases in Turkey, this situation is the most important factor in the distorted outlook in TL.

In addition to all these, it is expected that there will be new exits from emerging markets with the Fed rate hike and further pressure on TL.

Source link

After the Fed, G7 Central Banks will also narrow their balance sheets

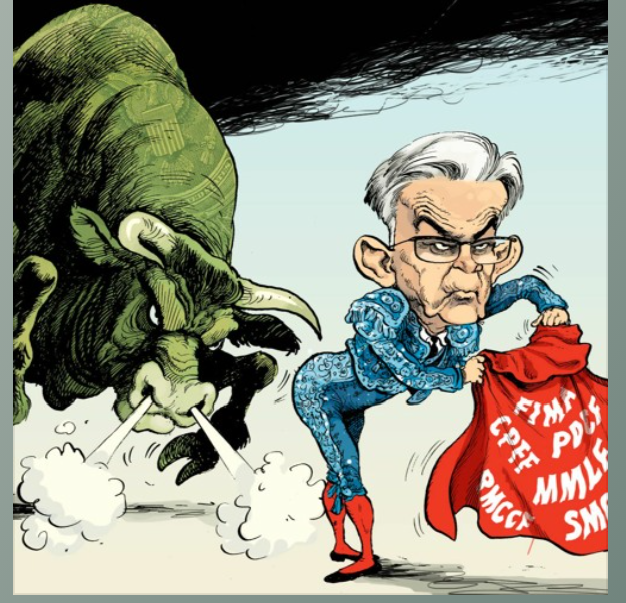

Dr. Tuğberk Çitilci: Are you ready for the Fed storm?

Emerging Market FX succumbs to China