John Deaton stated that he found the SEC’s logic regarding XRP secondary sales to be flawed.

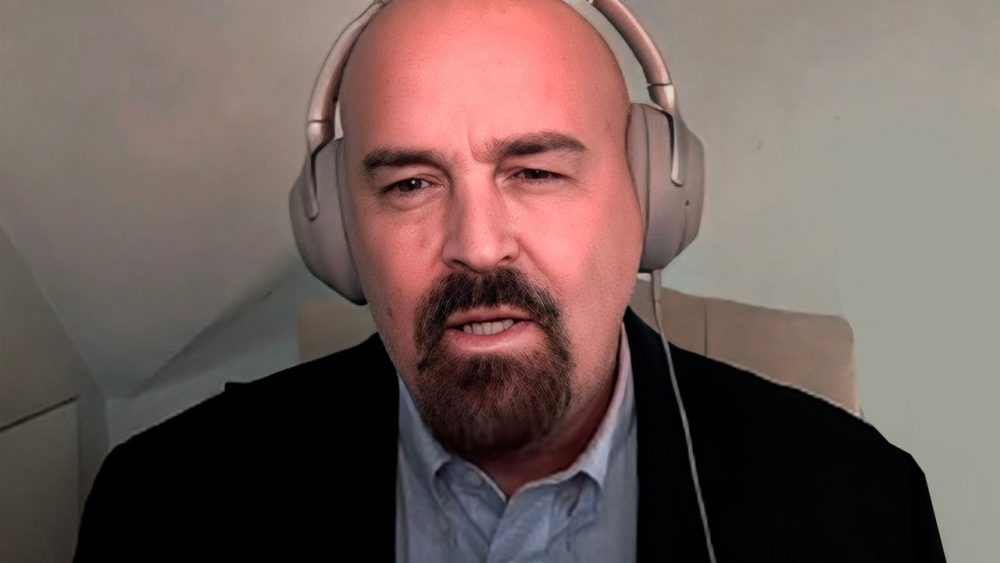

Ripple’s lawyer, John Deaton, wrote that the SEC was wrong about its secondary sales. The lawyer made his statements on Twitter.

Ripple’s Lawyer Says SEC Is Wrong About XRP Secondary Sales

Ripple’s attorney, John Deaton, asked the SEC to submit a single instance that would prove it was an investment contract even though there was no privacy or contact between a buyer and a seller or a backer. However, Deaton noted that the SEC was unable to substantiate its claim.

Excellent 🧵although I’m certainly one of the lawyers discussing unnecessary issues. I don’t mind the comment b/c I agree w/it. Unfortunately, when the SEC takes the position that “The XRP traded, even in the secondary market…represents the investment contract” one is forced to. https://t.co/I26hcuUc15 pic.twitter.com/xUJczT6a2c

— John E Deaton (@JohnEDeaton1) June 19, 2023

Deaton argues that, given all laws, the SEC has no evidence to support the theory that secondary market sales are also securities. It also states that the SEC disagrees with those who claim it has the right to pursue new theories that are not supported by law. According to Deaton, he argued that if the SEC was putting forward new and unsupported theories, then the Fair Notice Defense should be applied.

John Deaton believes that the judge in the Ripple-SEC case will likely address the issue of secondary market sales. Deaton explains as follows: First, the SEC’s summary resolution compels the judge to accept the draft almost as it is. Second, he thinks that the judge will choose not to remain silent, including the many friendly briefings presented in the Ripple dispute; this can provide further information on secondary market sales.