Market Overview

Major cryptocurrencies such as XRP, Solana (SOL), and Cardano (ADA) have experienced a significant downturn, each witnessing approximately a 6% decline over the past 24 hours. This dip is largely attributed to prevailing macroeconomic pressures. Recent market narratives highlight increasing uncertainty surrounding U.S. economic policies, including potential tariffs and a hawkish stance from the Federal Reserve, which has adjusted expectations for fewer rate cuts in 2025. These factors create a challenging environment for major cryptocurrencies, leading to further downward movements.

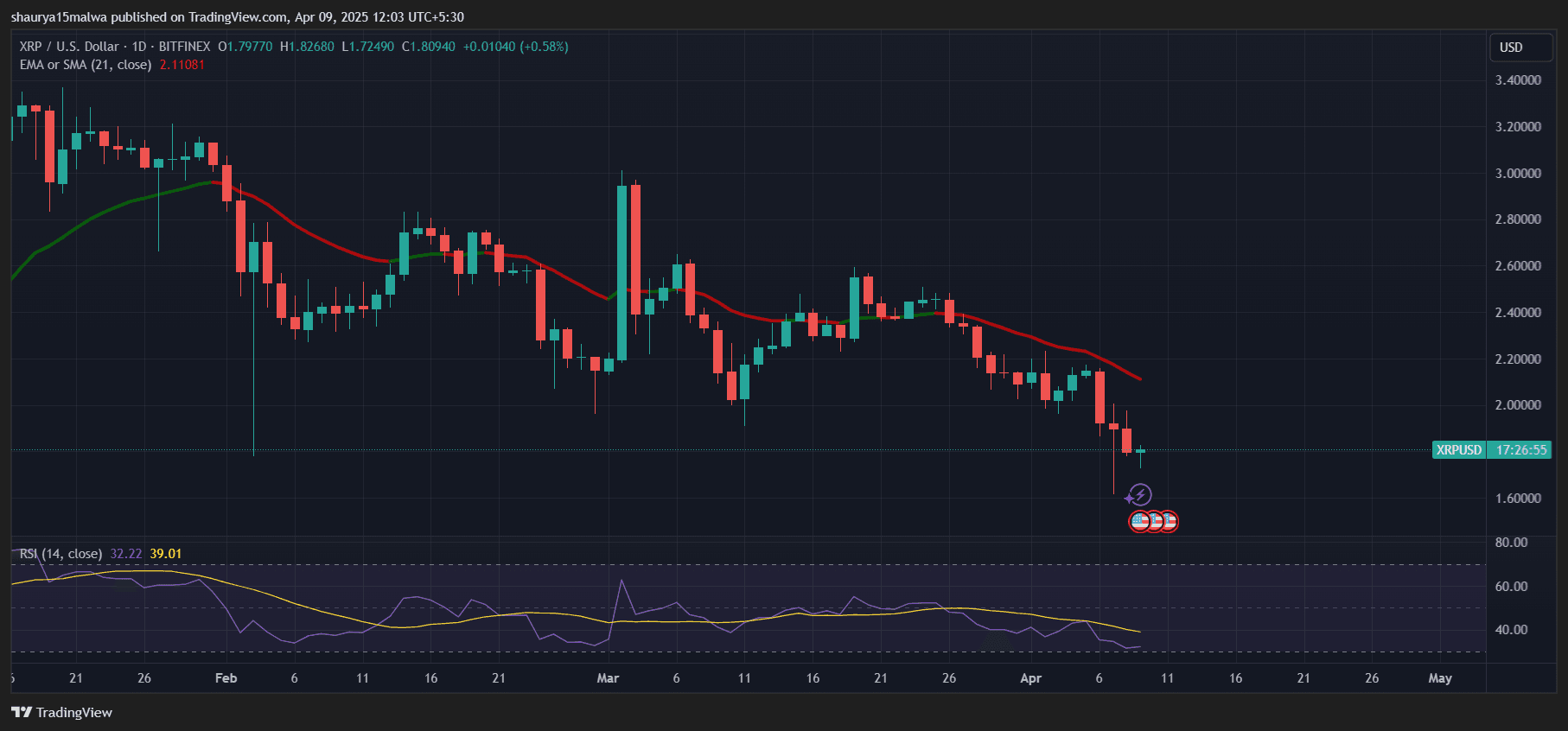

XRP Price Analysis

XRP, closely associated with the payments firm Ripple Labs, has fallen below critical support levels, with the next significant threshold situated around the $1.60 mark. High levels of leverage in XRP trading positions, as indicated by Coinglass data, signal the potential for additional downward pressure before any recovery can take place.

- A potential double bottom pattern has emerged near the $1.80 mark; however, the overall market structure remains bearish despite minor recovery attempts from the $1.60 to $1.70 range.

- Technical indicators reveal deeply oversold conditions, with the Relative Strength Index (RSI) at 22.41. Meanwhile, both the MACD and Chaikin Money Flow (-0.17) suggest strong bearish momentum as funds continue to flow out of the asset.

- The 50% Fibonacci retracement level at $1.91 serves as a crucial pivot point for a potential trend reversal in the near future.

- Price action demonstrates a series of lower highs originating from the $2 support zone. A bullish divergence has formed on lower timeframes, indicating stabilization, but this level will now act as a resistance after having previously been a key support level.

- Momentum indicators have transitioned from bearish to neutral in recent sessions. The RSI indicates oversold conditions, hinting at the possibility of a reversal if bullish momentum develops. The MACD, however, shows a bearish crossover, reinforcing a downward bias unless a clear reversal signal appears.

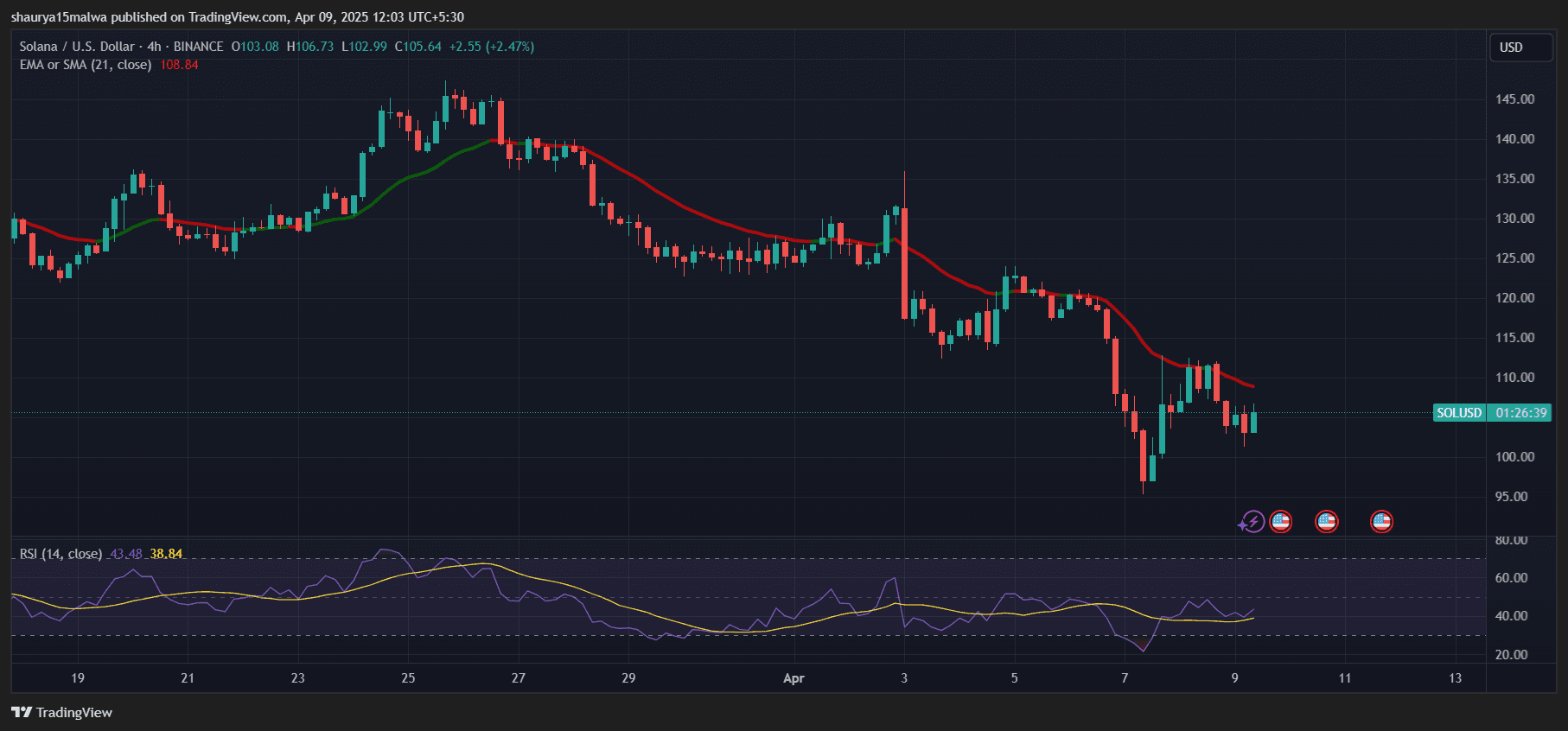

SOL Price Analysis

SOL has experienced a decline of over 8% within the past week and is currently situated in a critical support zone between $100 and $110. The ongoing slump suggests it may revisit these levels or potentially drop even lower, with thin liquidity below $100 raising the risk of a sharper fall towards the $50 mark.

- Between April 5-7, SOL faced a dramatic 22% drop from $122.75 to $95.72, followed by a partial recovery that established a new trading range between $103 and $112.

- Significant Solana whales have unstaked and sold off large portions of their holdings, including a single transaction valued at approximately $30 million, coinciding with a $200 million token unlock event.

- To target $120, SOL must reclaim the $112 level; failure to do so could result in a drop to $96. The RSI consistently remaining below 40 indicates robust bearish momentum and oversold conditions.

- The MACD displays bearish crossovers, aligning with a prevailing downward trend. Additionally, the price is trading below key moving averages ($130.5 and $184.2), reinforcing a bearish sentiment.

- Technical analysis suggests more downside risk unless SOL can reclaim the $112 level.

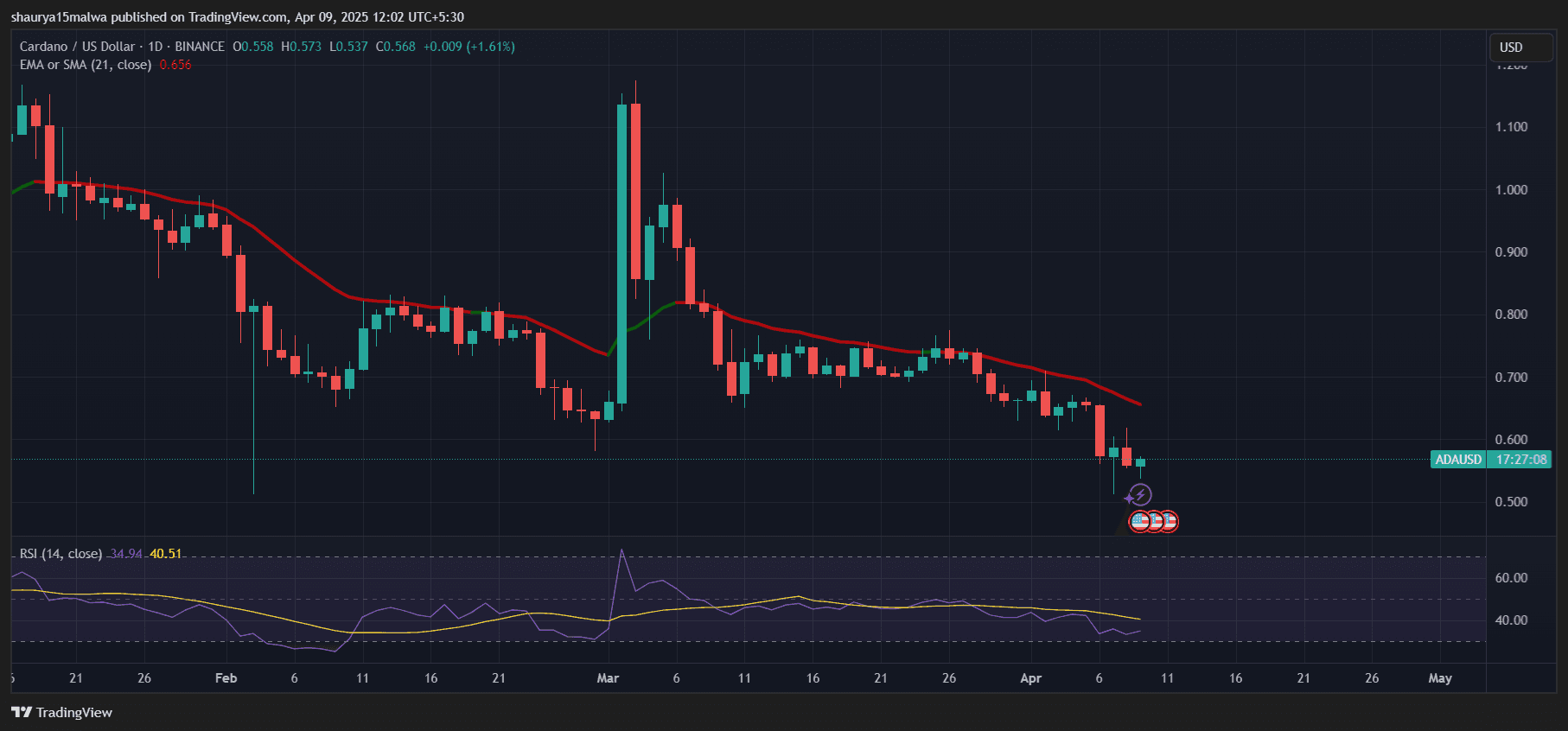

ADA Price Analysis

ADA has similarly faced a decline of about 6% in the last 24 hours and has plummeted over 23% in the past two weeks.

- The daily RSI stands at 32, indicating that ADA is approaching oversold territory (typically defined as below 30), yet there remains potential for further downside before a possible reversal. This suggests that bearish momentum is still strong, although exhaustion may be near.

- ADA is trading below its 21-day moving averages, confirming a bearish trend on the daily timeframe.

- Interestingly, ADA is currently positioned within a falling wedge pattern on the daily chart, which is often recognized as a bullish reversal pattern. A dip to the 60 to 61 cents range is anticipated before a potential sharp upward reversal, possibly forming a bear trap.

Market Outlook

For XRP, the $1.62 level is a crucial support to monitor; a break below this point could push the price down to $1 or lower, while a bounce may indicate a short-term relief rally. The fate of SOL hinges on its ability to hold the $100 support; failure to do so could lead to accelerated losses, although oversold conditions might trigger a rebound if macroeconomic pressures ease. Additionally, ADA bulls need to maintain their current range to prevent a decline toward the 55 cents mark.