Decline in Robinhood’s Crypto Trading Volumes

Robinhood’s (HOOD) crypto trading volumes experienced a significant downturn in February, plummeting by 29% compared to January. This drop, primarily driven by a decrease in retail trader activity, sends a cautionary signal to other platforms, including Coinbase (COIN).

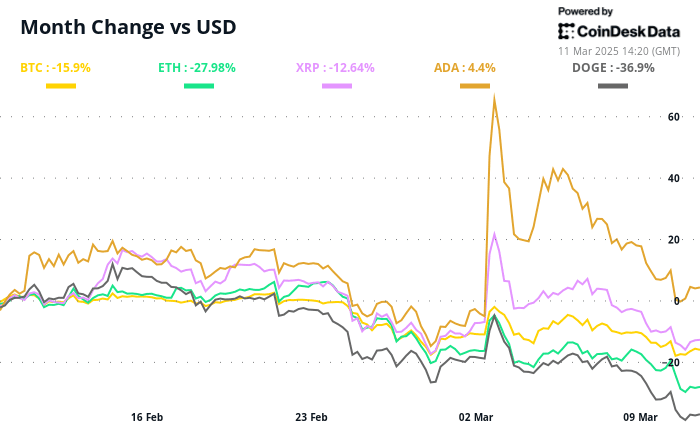

The month-over-month decline led to a total trading volume of $14.4 billion, which starkly contrasts with the more modest declines seen in equities and options trading, both of which fell by just 1%. Nevertheless, this figure remains more than double that of the same month last year, as reported in a recent press release from the company. The decrease in trading volume reflects the broader downturn in the cryptocurrency market, where Bitcoin (BTC) lost approximately 15% of its value throughout the month, and the broader CoinDesk 20 Index (CD20) suffered a decline of around 23%.

Moreover, activity surrounding memecoins has also shown signs of slowing down. For instance, Pump.fun, a leading token launchpad, witnessed a dramatic drop in daily token launches, falling from 62,000 to just 24,000, according to research conducted by 10x Research.

This downturn in cryptocurrency trading volumes indicates a waning interest among retail investors in the crypto space, which could have significant implications for exchanges like Coinbase (COIN), which target a similar demographic. Shares of Robinhood, a platform primarily focused on retail trading that also offers equities, have seen a drop of 4% this year. In comparison, Coinbase’s shares have fallen by 15%, mirroring the overall retreat in the cryptocurrency market.

Despite these challenges, Coinbase has been actively expanding its institutional services and enhancing its blockchain infrastructure, which may help mitigate some adverse effects of declining retail trading. Recently, the company announced the launch of 24/7 trading for Bitcoin and Ether futures, indicating a strategic shift to capture new market opportunities.