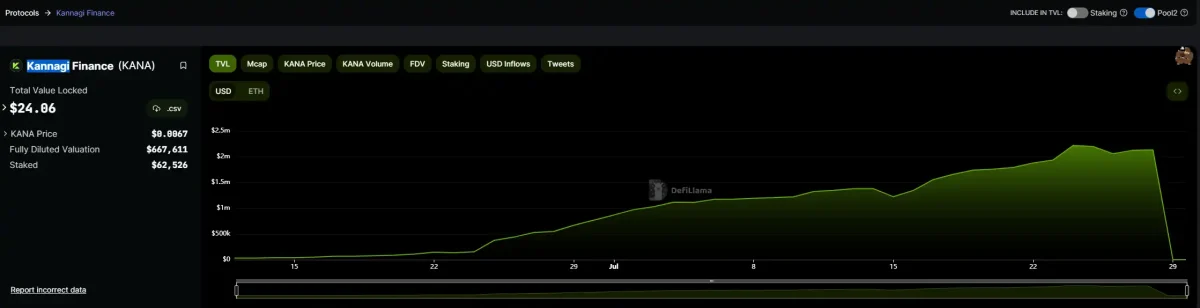

In a shocking event, altcoin project Kannagi Finance in ZkSync Era has suffered a rug pull that has caused huge losses to investors. According to DeFiLlama data and community feedback, the incident occurred on July 29 and the Total Value Locked (TVL) remained only $24, compared to $2.13 million recorded the day before. Another issue that raises suspicions is that the official Twitter account of the project has been closed. Here are the details…

Rug pull experienced in altcoin project

Marketed as a protocol that implements multi-strategy return optimization on the zkSync mainnet, Kannagi Finance aimed to provide users with maximum returns through low fees and skimming. The platform offered a variety of services, including case composition, lending, and yield generation. Unlike typical yield farming protocols, Kannagi Finance stood out by promising its users a combination of transaction fee rewards in the form of KANA tokens and the use of a multi-strategy optimization vault system.

However, as of now, the situation has taken a serious turn for the project and its investors. The token value of Kannagi Finance’s local currency KANA has been in a steady decline since hitting an all-time high of $0.02 on March 5 earlier this year. According to data from CoinGecko, KANA is currently trading at an insufficient value of $0.006. This staggering decline has left investors in distress and uncertainty about the future of the project.

Kannagi Finance’s cryptocurrency dropped to zero

The project’s recent performance in the market paints a grim picture. With the current trading price of $0.000066 and a 24-hour trading volume of just $21,716.27, Kannagi Finance has experienced a 99.04 percent drop in value in just 24 hours. These numbers caused the project to drop to 3,945 on CoinMarketCap and its live market cap is currently unavailable.

Also, specific details about the carpet pulling incident have yet to be disclosed, leaving the community in the dark about why and the parties involved. Pulling a carpet in the DeFi space often refers to a deliberate action by developers or insiders to drain liquidity and funds from a project, often resulting in significant losses for investors left with worthless tokens.

Investors suffered significant losses

Investors who had high hopes for Kannagi Finance and its innovative approach to return optimization are currently grappling with significant financial losses and feeling betrayed. With the project’s official Twitter account shut down, communication channels were cut, making it difficult for affected users to seek answers or support. As this story unfolds, the wider DeFi community remains cautious and vigilant, emphasizing the need for thorough due diligence before investing in any DeFi project. The decentralized nature of these projects can be both a blessing and a curse.

Because lack of central control means less regulatory oversight, but it also puts the responsibility of doing extensive research on individual investors. Kannagi Finance’s carpet pull serves as a stark reminder of the risks inherent in the DeFi space, where potential gains can be tempting, but a lack of security and regulation can also lead to devastating losses. As always, potential investors need to be vigilant, verify information and be mindful of the risks posed by the rapidly evolving decentralized financial world.