The mood in the gold market continues to rise as the momentum supports higher prices. However, analysts warn investors that the Fed should try to maintain its hawkish monetary policy stance even if it does not change interest rates. Therefore, he warns not to expect prices to rise above $2,000 an ounce next week. So, what are other investors saying? Here are the expectations of both Wall Street experts and individual investors for the next week…

Should $2,000 be expected for the gold price?

The latest weekly gold survey shows that retail investors are continuing their bullish on gold in the near term. But Wall Street analysts remain cautiously optimistic ahead of next week’s critical inflation data and the US central bank’s monetary policy decision. Colin Cieszynski, chief market strategist at SIA Wealth Management, took a purely technical perspective. In this case, he said, bullish on gold in the near term. Cieszynski pointed out that momentum indicators are starting to turn slightly bullish. He said that this allowed prices to rise a little more. However, he added that he does not expect gold prices to rise above $2,000 per ounce. The strategist used the following statements:

I think the Fed will signal a pause in interest rates and this could push gold prices up another $20 per ounce. But the pause does not mean the end of the tightening cycle. What it takes for gold to break above $2,000 is a clear signal that the Fed’s tightening cycle is over.

Phillip Streible, chief market strategist at Blue Line Futures, said he was neutral on precious metals in the near term ahead of the Fed. He also said he recommends purchasing weekly put options on gold and silver as insurance against hawkish comments from the US central bank. Streible added that while there is so much uncertainty in the market, investors should wait for a solid break in gold before jumping in. Also strategist; He said a break above $2,063 per ounce would signal a new uptrend for the precious metal.

What do the surveys point to for the precious metal?

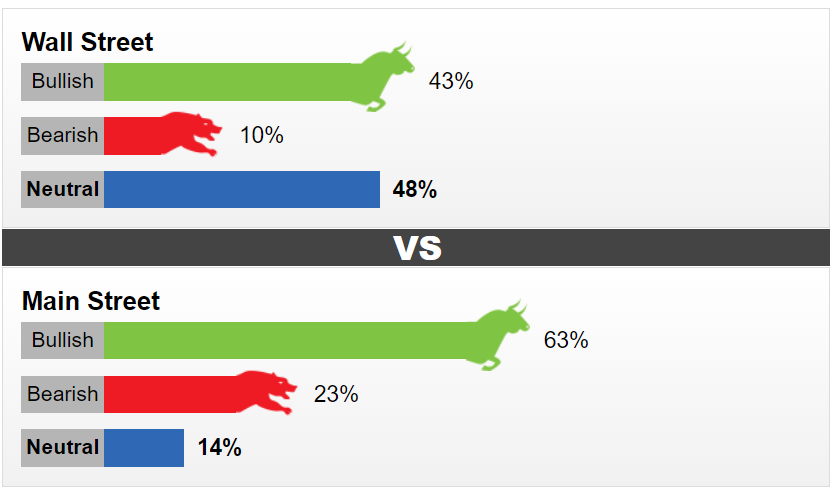

21 Wall Street analysts participated in the Kitco News Gold Survey this week. Nine analysts, or 43 percent, among respondents; He was bullish for gold in the near term. At the same time, two analysts, i.e. 10 percent, showed a bearish bias for the next week. On the other hand, ten analysts, or 48 percent; He thinks that prices will remain flat. Meanwhile, 692 votes were cast in online polls. 435 or 63 percent of respondents think that gold will rise next week. Another 159 people, 23 percent, say that prices will decrease. Finally, 98 people, or 14 percent, said they would remain neutral in the near term.

Although there is still a strong uptrend in the market, individual investors also do not expect prices to rise above $2,000 an ounce. Individual investors think that gold prices will close next week at around $1,992 per ounce. cryptocoin.com As we have also reported, last week, analysts and individual investors were showing an upward trend in gold prices. However, prices finished the week slightly higher at $1,976 an ounce, up 0.32 percent from last Friday.

The biggest near-term risk for gold remains the Fed’s monetary policy decision. Markets are currently waiting for the US Federal Reserve to keep interest rates unchanged. However, the hawk moves from the Bank of Canada and the Reserve Bank of Australia created suspicion in the market. Adrian Day, head of Asset Management, said that while markets won’t completely rule out a rate hike next week, the sell-off in gold may be short-lived. Day used the following statements:

The Fed’s rate hike is already largely in the price, so any fall due to a rate hike will be shallow and short-lived. When this increase and the US Treasury’s large bond issuance after the debt ceiling is lifted, gold will continue its upward movement. There are growing reasons to be positive, including China’s recent easing moves.

There are also bearish expectations for gold.

However, not all analysts think gold prices will rise next week. Christopher Vecchio, head of futures and forex at Tastylive.com, was one of those who thought bearish this week. Vecchio said that gold is on a downward trend as the Fed still hasn’t finished raising interest rates because it still hasn’t gotten inflation under control. Vecchio added that if the Federal Reserve thinks it has the banking crisis under control, it could use next week’s meeting to signal the need for more rate hikes. Before the banking crisis in March, markets began pricing in a final rate of around 6 percent, Vecchio said.

Vecchio said investors will need to pay close attention to the central bank’s updated economic projections, also known as dot charts. Vecchio said that while the Fed is unlikely to raise its interest rate forecast to 6 percent, it could indicate that they do not want to cut rates anytime this year. He also used the following expressions:

FED’s failure to cut interest rates this year will mean a rise for the US dollar, which will be negative for gold. I would look to sell on rallies up to $2,000 an ounce and increase that position once it drops below $1,950.