Rumors that the crypto currency exchange will be sold or closed will be spread on the social media platform X. The allegations that the regulatory pressure will continue due to the incompatibility between global regulatory institutions were interpreted by some segments that Binance could go on sale or completely close. However, Yi He, one of the common founders of the Binance Exchange, denied these allegations in a certain language.

Binance founder made a statement about the stock market

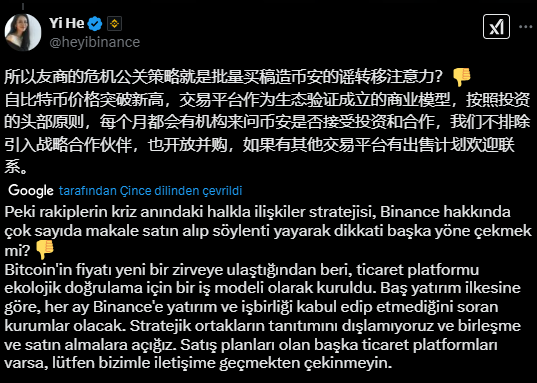

Yi He claimed that his rivals were trying to manipulate the agenda by spreading unfounded news about Binance. “Is the crisis communication strategy of competitors to spread rumors about Binance by purchasing many articles?” Using his expressions, he expressed his reaction with Thumbs Down (dislike) emojis on platform X. He also stated that Binance had regularly negotiated with various institutions on investment and cooperation. He emphasized that the company is open to establishing new strategic partnerships or buying other stock exchanges, but there is no sales plan in the current situation. “We do not ignore the acquisition of strategic partners and the opportunities for merger or purchase. If there are stock market platforms who are considering selling, they can contact us. ”

New Development in the SEC Case

Last week, the Binance and the US Securities and the Stock Exchange Commission (SEC) requested the court for at least 60 days of pause in relation to the ongoing case. This development was attributed to the work of the new crypto currency task force created under the leadership of the SEC commissioner Hester Peirce. Both sides acknowledged that the efforts of this task force could affect the solution of the case. At the end of the 60 -day period, the parties will provide an additional period by submitting a status report to the court. The temporary pause may help the parties to protect their resources and to ensure that an additional court process is not necessary if an early solution is found.

Criticism of listing from CZ

Changpeng Zhao (CZ), one of the founding partners of Binance, criticized the token listing process in the central exchanges (CEX). Zhao said that many crypto currencies have been added to the central stock exchanges after listing central non -central stock exchanges (Dex) and that this process leads to price manipulation. “As an observer, I think that Binance’s listing process is a bit wrong. First, the announcement is made, then the listing takes place within 4 hours. Token prices are rising in Dex and then people sell in CEXs, ”he said. CZ said that central stock exchanges should work more efficiently and shorten the listing time between Dex and CEX. This proposal is thought to create a more fair trading environment by reducing market manipulations.