It’s a bit of a truism in journalism that any headline that ends in a question that can be answered with “yes” or “no” will usually be answered with “no.” A few weeks ago, however, I asked “Is Sam Bankman-Fried Going to Jail?” and in a rejection of that truism, the answer was “yes.”

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Back behind bars

The narrative

Sam Bankman-Fried went to jail last week after a federal judge revoked his bond.

Why it matters

We now know the judge really is somewhat fed up with Bankman-Fried’s actions, reading out a 20-minute order walking through why he believed the FTX founder’s bond should be revoked before actually doing it. This sets the stage for the next phase of his pretrial work: preparing for trial from behind bars.

Breaking it down

Sam Bankman-Fried looked down for several long seconds last Friday in the moments after federal Judge Lewis Kaplan announced he was revoking the FTX founder’s bail. A few feet behind him, his mother Barbara Fried looked emotional while his father Joseph Bankman stared straight ahead.

Bankman-Fried has indeed gone to jail barely two months ahead of his trial on seven different charges, including securities fraud, wire fraud, commodities fraud and money laundering.

In revoking the bond, Judge Kaplan walked through a 20-minute summary of the facts as he saw them, including both Bankman-Fried’s reach-out to FTX.US general counsel Ryne Miller – who is expected to be a witness at trial – and the more recent diary episode.

“Defendant has proposed a benign reading of [the Signal message]. It’s one I didn’t share then and it’s one I don’t share now,” Kaplan said. Later, addressing the Times report, he said “it’s now undisputed the defendant spoke to a Times reporter and entertained the reporter on the virtual eve of the article’s publication.”

The virtual private network incident came up as well, with the judge saying that while alone it wasn’t necessarily a violation of his bond terms, it spoke to a dangerous mindset.

“[Bankman-Fried is willing] to risk crossing the line in an effort to get right up to [the line], wherever it is,” he said.

Bankman-Fried’s lawyers have appealed the decision, though the judge drew some audience laughs after remarking that appeals courts generally side with him. In the meantime, the attorneys asked that he approve Bankman-Fried to receive his prescription medication (the judge signed off on this) and both parties have started sorting out what pieces of discovery they do and don’t want to see at the trial.

The deadline for motions in limine – referring to pretrial motions seeking to limit evidence presented during the trial itself – was Monday, the same day the DOJ filed a superseding indictment providing further detail about the campaign finance allegations and defining the scope of what we may see during the trial itself.

Indictment first: All of the allegations themselves are familiar, and this is a modification of the first indictment, meaning the charges themselves aren’t new either.

The DOJ alleges that Bankman-Fried directed the use of customer funds to buy Bahamas real estate, make personal investments and donate to political campaigns.

“Bankman-Fried personally borrowed more than $1 billion from Alameda and oversaw similar borrowing by other FTX executives, which was then principally used to make investments in the name of Bankman-Fried and his associates, rather than in the name of Alameda. This conduct served to conceal the close connection to Alameda, as well as the criminal source of some of the funds,” the superseding indictment said.

But it’s the motions in limine that hold the really spicy stuff.

According to the DOJ, “three of the defendant’s co-conspirators, who have each pleaded guilty under cooperation agreements with the Government, will testify at trial” – referring to Gary Wang, the former FTX chief technology officer, Nishad Singh, the former FTX head of engineering and Caroline Ellison, the former Alameda Research CEO. We already knew this but I think this may be the first official confirmation.

While FTX President Ryan Salame, having pleaded the fifth, will not testify,, the DOJ does appear to have quite a few “private messages” from him quite literally spelling out how he was the person to route donations to Republican lawmakers and candidates while Bankman-Fried directed donations to Democrat lawmakers and candidates.

“In a private message to a trusted family member in November 2021, Salame explained that the defendant ‘want[ed] to donate to both democtratic [sic] and republican candidates in the US,’ but the defendant would not do so ‘cause the worlds frankly lost its mind if you dontate [sic] to a democrat no republicans will speak to you and if you donate to a republican then no democrats will speak to you,’” the filing said.

The DOJ also wants to play FTX ads and business records. While prosecutors hope Bankman-Fried will authenticate certain records, if he does not, they want to call these records’ custodians to the stand to speak to said records specifically.

The DOJ aims to block Bankman-Fried from arguing that FTX customers and investors didn’t conduct adequate due diligence on FTX and Alameda, as well as any evidence or claims that other crypto companies might be committing fraud and otherwise doing the same stuff FTX did, the filing said.

Prosecutors also want to block Bankman-Fried from arguing that he planned to make FTX customers whole.

In addition, the DOJ had a section saying the court shouldn’t allow Bankman-Fried to argue there was insufficient regulatory oversight.

“The defendant has made a number of public statements that suggest he may attempt to shift blame for the collapse of FTX onto regulatory agencies. While the defendant’s statements about his view of regulators have not always been consistent, he has stated that regulators ‘make everything worse’ and ‘don’t protect consumers at all,’” the filing said. “Arguments attempting to shift the blame for FTX’s collapse onto regulators are improper and should be excluded because a supposed absence of sufficient regulatory protections would not excuse the defendant’s fraud.”

According to the filing, the DOJ is also concerned that Bankman-Fried might try and claim that he committed “good acts” in his defense, and argues that he shouldn’t be allowed to try that.

There’s also a section saying the defense team shouldn’t be allowed to question any of the witnesses about their recreational drug use.

For its part, the defense team filed a much shorter set of motions in limine, starting with an argument that the DOJ shouldn’t be allowed to introduce any evidence that was produced for the defense team as discovery after July 1, 2023.

“As the defense has raised with the Court on numerous occasions, the Government has repeatedly failed to meet the discovery deadlines it represented to the Court and to this day continues to produce voluminous documents to the defense,” the filing said. “ This includes a production just three days ago of nearly three-quarters of a million pages of Slack messages from Gary Wang’s laptop that the Government originally promised to produce by the end of March.”

The defense team did agree with the DOJ in its second motion, in which both parties say bankruptcy issues are out of the scope of this particular trial.

Moreover, the defense wants to block the DOJ from referencing any of Bankman-Fried’s public statements about FTX.US, rather than FTX.com.

The ball is now in the judge’s court, both for scheduling another arraignment on the latest superseding indictment and in responding to the motions.

Stories you may have missed

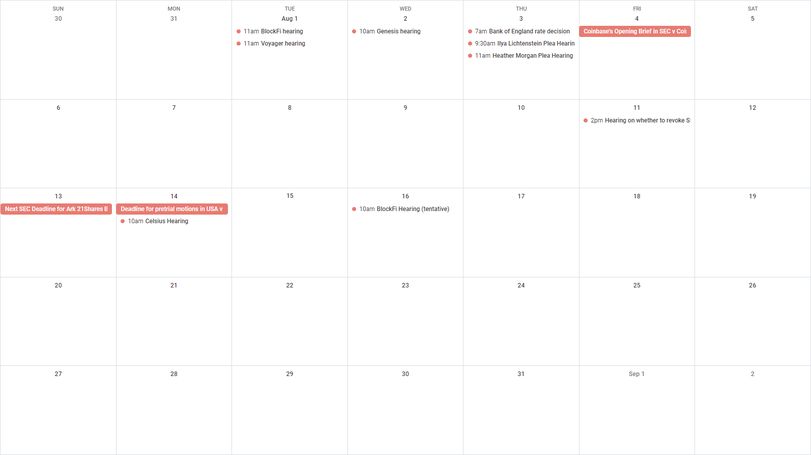

This week

Monday

Wednesday

Elsewhere:

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!