Even though the cryptocurrency market has had a terrible and depressing year, the same conditions remain. That’s why market players are worried about the future of the market and crypto projects. On the other hand, there are some positive signals on the horizon for projects that continue to build in challenging conditions. Crypto analytics platform Santiment says the three altcoin projects are showing healthy signs towards 2023.

Santiment: There are good signs for these 3 altcoins!

cryptocoin.com As you follow, we have left behind a year of major collapses such as Terra and FTX. However, harsh winter conditions still continue. The new year has not yet brought excitement to the market. However, crypto analytics platform Santiment says it has received positive signals from three altcoin projects.

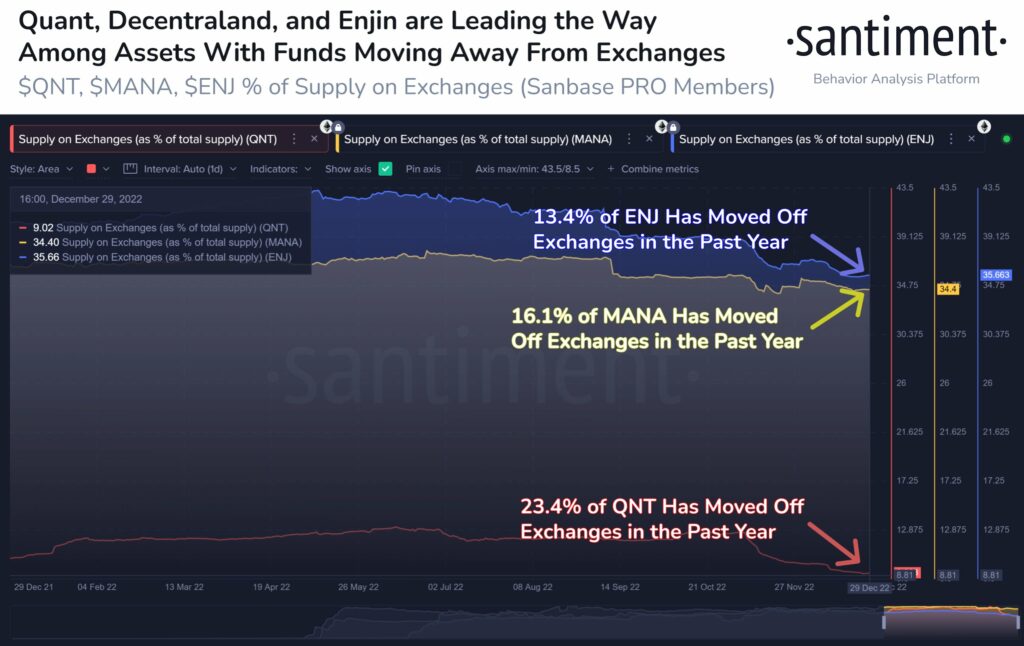

The first altcoin Santiment has seen positive signs is the interoperability blockchain Quant (QNT). It is followed by the popular metaverse coin Decentraland (MANA). And Santiment is finally getting positive signals from Ethereum-based GameFi coin Enjin Coin (ENJ). Accordingly, the analytics firm notes that these projects likely have a bright future ahead of them. Santiment notes that the supply on cryptocurrency exchanges for these projects has decreased sharply. He emphasizes that this bodes well for the price action this year. In this context, the analytics firm makes the following statement:

QNT, MANA, and ENJ are among the assets with the largest market caps to see a significant amount of cryptocurrencies leave exchanges in 2022. Like the rest of cryptocurrencies, their own prices are falling sharply for now. However, these are good signs for a better 2023.

Source: Santiment / Twitter

Source: Santiment / TwitterAt press time, QNT was trading at $105.70, down 0.19% on a daily basis. In the same time frame, MANA is changing hands at $0.2996, gaining 0.61%. Finally, ENJ is trading at $0.2433, up 0.65%.

Whales aggressively sold BTC in 2022, but…

Santiment then looks at the leading cryptocurrency Bitcoin (BTC). The analytics firm says it experienced a ‘bounce’ at the end of the year as whales and sharks aggressively sell BTC throughout 2022. The data shows that whales dumped $10.75 billion worth of Bitcoin over 12 months. Accordingly, Santiment makes the following assessment:

Two weeks before Bitcoin hit an all-time high on November 10, 2021, shark and whale addresses holding between 10 and 10,000 BTC collectively sold $10.75 billion. This decline, coupled with the drying up of circulation, has caused BTC to bounce back at the end of 2022.

Source: Santiment / Twitter

Source: Santiment / TwitterAt press time, Bitcoin was trading at $16,606, up 0.18% over the past 24 hours.