Will the massive crypto rallies of Uniswap and Optimism continue? Santiment analyzes the largest Ethereum altcoin projects. Also, Santiment reports that in June Cardano whales bought a staggering amount of ADA.

UNI addresses saw a massive backlog increase in just two weeks

Its analytics platform Santiment is looking at two cryptoassets that posted triple-digit percentage gains in a relatively short period of time. Santiment is starting with the decentralized finance (DeFi) platform UniSwap (UNI). He says the crypto asset has gained over 150% in value over a period of about two months:

Uniswap has worn out quite a bit in the last seven weeks. In a few cases, it diverged from the rest of the altcoin package. UNI has jumped +153% since June 18.

According to Santiment, Uniswap’s daily address activity has increased. It also continues to accumulate large holders of the crypto asset. In this context, he makes the following statement:

It’s also great to see that shark and whale addresses have accumulated fairly high percentages of Uniswap’s overall supply since May. In particular, 100k to 1 million UNI addresses saw a huge backlog increase just two weeks ago. And continued price increases soon followed.

Short and long term predictions for altcoin

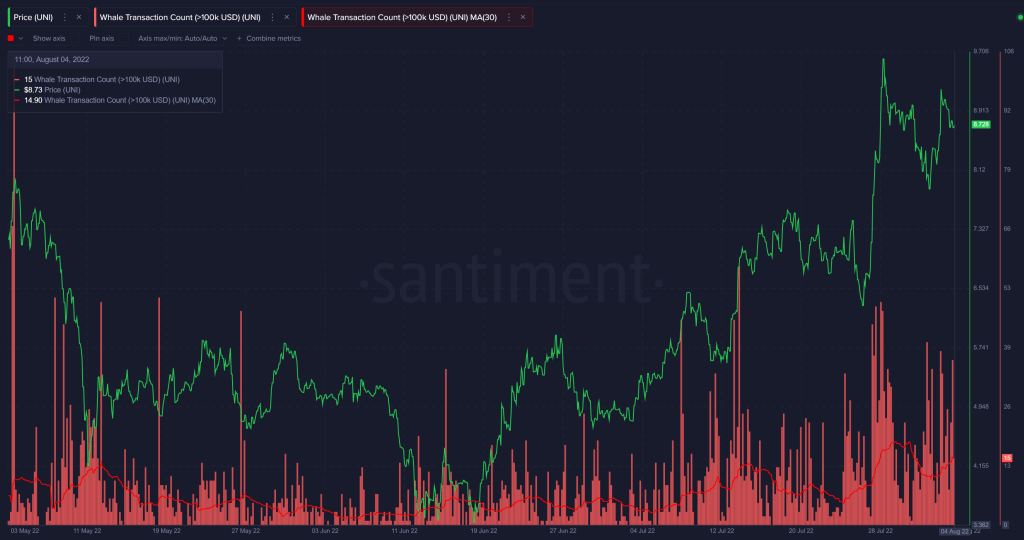

Speaking of whales, the volume of large transactions is also rising to May levels, according to Santiment. The massive pile of whale transactions that started forming just before the massive price surge to $9.69 a week ago is clearly visible.

Source: Santiment

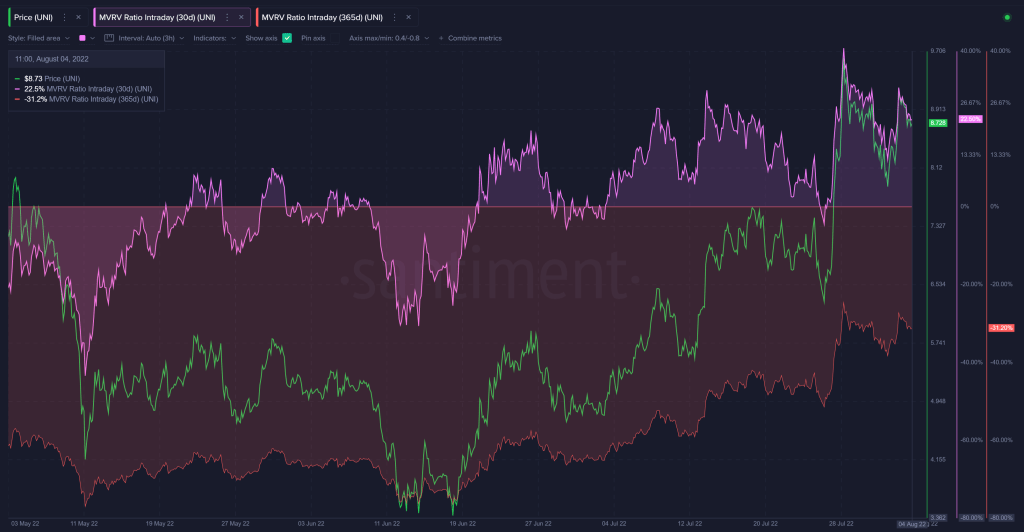

Source: SantimentThe crypto analytics firm states that those who bought Uniswap 30 days ago are in double-digit profits. Despite this, he says that those who bought the crypto asset a year ago are still at a loss. As a result, Santiment notes that Uniswap’s price may decline in the short term. But he says it’s still undervalued in the long run. In this context, he shares the following analysis:

We can see that the 30-day Market Cap to Realized Value (MVRV) is currently up to +22.5%. This is well above the backtested ‘Danger Zone’ of +15% or more. But even as medium-term trading returns start to overflow, the good news is that long-term Traders are still flooded. This means there could be an impending setback for UNI in the next week or two. But its long-term future is still overlooked.

Source: Santiment

Source: SantimentMVRV is the ratio of the current price to the average purchase price of a given asset. An increase in MVRV indicates an increase in potential profits.

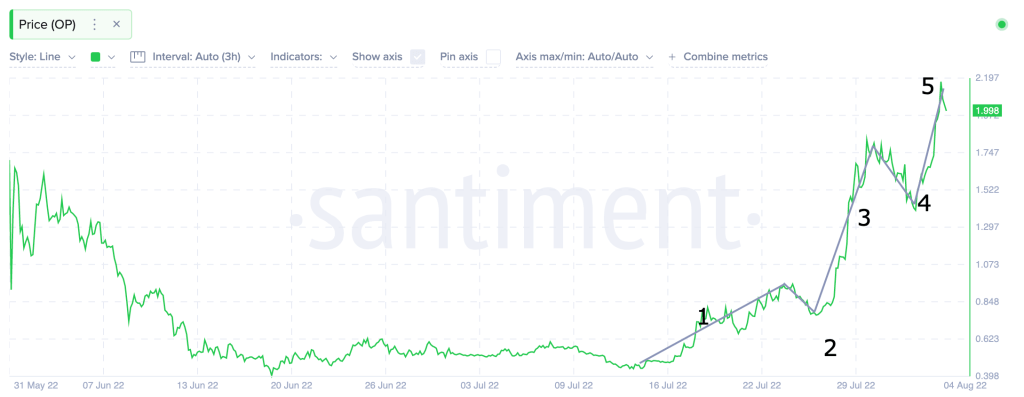

“It is possible for Optimism to undergo a correction”

Santiment then looks at Ethereum (ETH) scaling solution Optimism (OP). Optimism rose from a July low of $0.45 to $2 in August, according to the analytics firm. This means an increase of just over 300%. So the altcoin went through a classic ‘dump and pump’ movement. The analytics firm says that based on Optimism’s Elliot Wave theory, a retracement of over 30% could pass at just over $1,297 in the short term. Santiment comments:

Expect a correction soon at the bottom of the fourth wave. But no more than five waves tend to continue after that.

Source: Santiment

Elliott Wave theory states that the long-term price trend of an asset moves in a five-wave pattern, while corrections move in a three-wave pattern.

Altcoin whales buy ADA for $138 million

In a recent tweet, Santiment shared that in June Cardano whales and sharks bought a surprising amount of ADA. He also stated that if this trend continues in August, “it could get interesting”.

Whale and shark wallets received $138 million in Cardano’s native token ADA in mid-June, according to Santiment. This buying time comes just one week after the token’s price dropped at that time. The Santiment team points out that this amount does not seem surprising at the moment. But if these investors continue to buy ADA in August, things could get interesting.

🐳🦈 #Cardano shark & whale addresses have accumulated a combined ~$138M in $ADA in 8 days after the mid-June dump around the local price top. This is only a mild accumulation for now, but could get interesting if this trend continues throughout August. https://t.co/7ix8VPSkZG pic.twitter.com/uPfuLfbbkl

— Santiment (@santimentfeed) August 5, 2022

In early July, whales were accumulating ADA. Wallets holding 10,000 – 100,000 ADA at the time bought $79.1 million in ADA within a month. By the way cryptocoin.com As you follow, Cardano has achieved a 238% increase in on-chain transaction volume. Thus, Bitcoin surpassed Ethereum and Dogecoin.