The signals that foreshadowed last year’s bull run are flashing again for Decentraland. Santiment analysts evaluated the new data in LINK and ETH.

Recognizing rally signals for Decentraland (MANA)

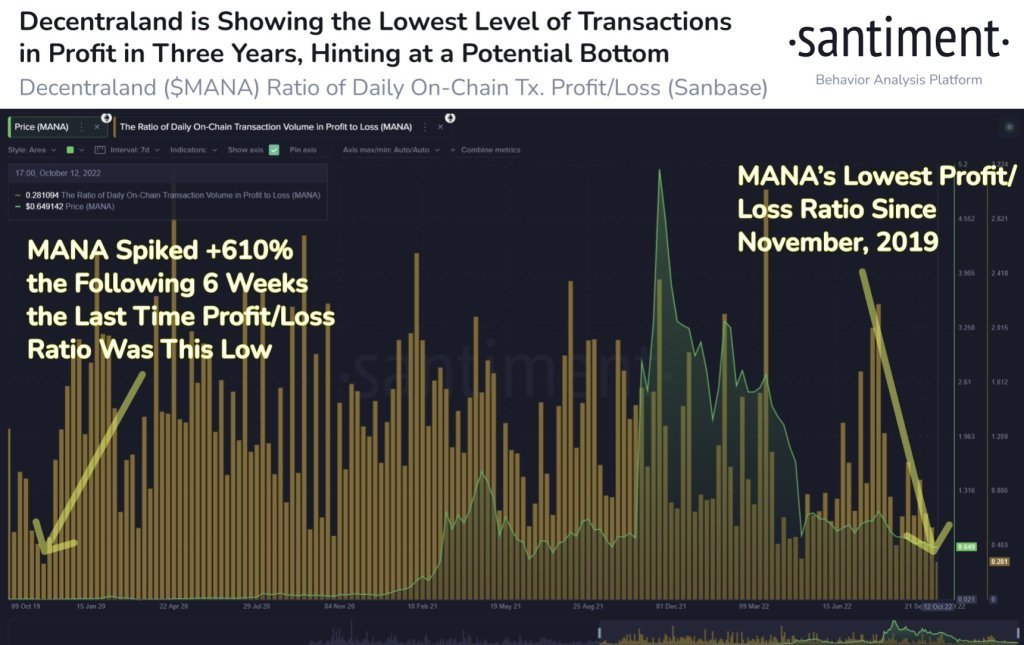

According to Santiment, the on-chain signals that heralded last year’s rallies are flashing again for Decentraland (MANA). The analytics firm reported that MANA’s profit/loss ratio was at its lowest level in three years. MANA price has rallied over 600% from this point before. Santiment says we are now at these levels again:

MANA’s transactions had the lowest profit/loss ratio in the last three years. Previously, its price increased by +610% in the following six weeks.

Decentraland (MANA) November 2021 ATH price is down more than 89% from $5.90 to trade at $0.6436. If history repeats itself, a 600% rally would represent $4.47 for MANA.

Santiment also monitors the largest oracle platform Chainlink (LINK)

The analytics firm says LINK’s recent price action has followed massive increases in social media engagement:

On Friday, Chainlink’s market cap dropped almost 5%. It experienced a spike in social dominance, indicating that investors are interested in LINK. The latest interest came as soon as the price increase started.

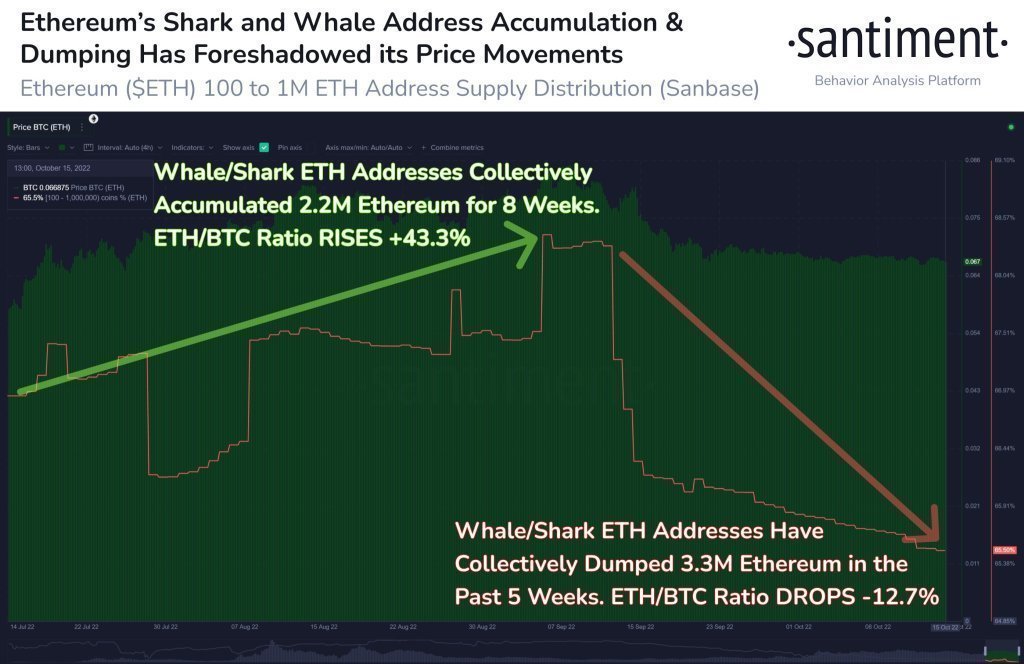

Santiment says whales have been driving down Ethereum (ETH) price for the past five weeks

According to the data, Ethereum addresses holding between 100 and 1 million ETH were responsible for both last month’s correction and August’s rally. Santiment analysts point out that during the last drop, whales preferred to sell:

In the past five weeks alone, Ethereum’s whale addresses (those holding 100 to 1 million ETH) have sold 3.3 million ETH. In terms of Ethereum, this is equivalent to about $4.2 billion. Ethereum’s price has branched out due to market shareholder Bitcoin.

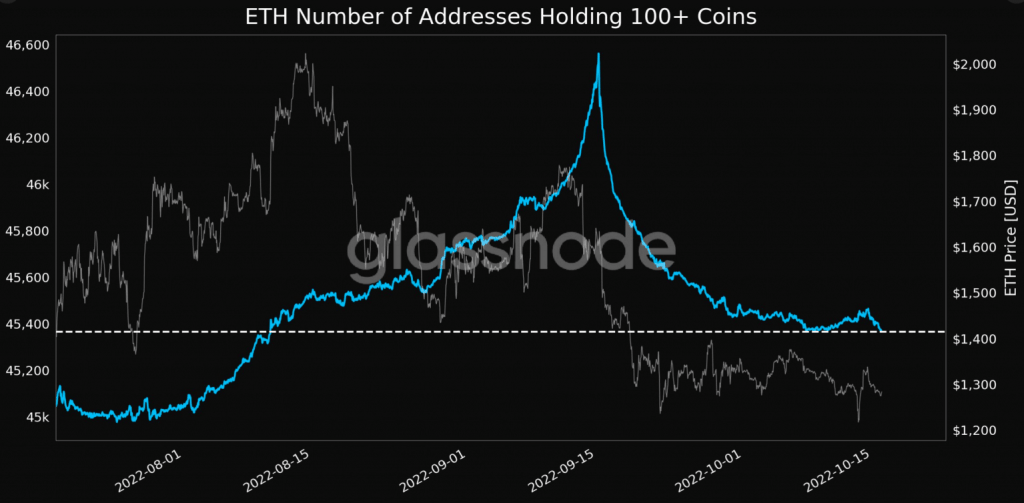

Based on Santiment’s data, when we consider the start of September 2022, the ETH:BTC ratio has hit 2022 highs. Data from TradingView showed that the ETH:BTC ratio reached 0.084 for the first time since December 2021. This meant that the rate rose from roughly 0.053 in mid-July to about 58%. This lead against Bitcoin can be attributed to the excitement around the merge, the Proof-of-Stake upgrade. But ETH has been relatively quiet in terms of price. On the other hand, addresses holding more than 10 ETH hit a one-month low of 45,366, according to Glassnode.

Additionally, looking at the technical front, ETH has witnessed an unprecedented increase in censorship as more than 50% blocks were created in the past day. These blocks came under the jurisdiction of the US Treasury Department’s Office of Foreign Assets Control (OFAC), following compliance recommendations.

cryptocoin.com As you follow, ETH price is currently trading above $1,300. It was green at 3.35% and 1.41% on daily and weekly timeframes, respectively.