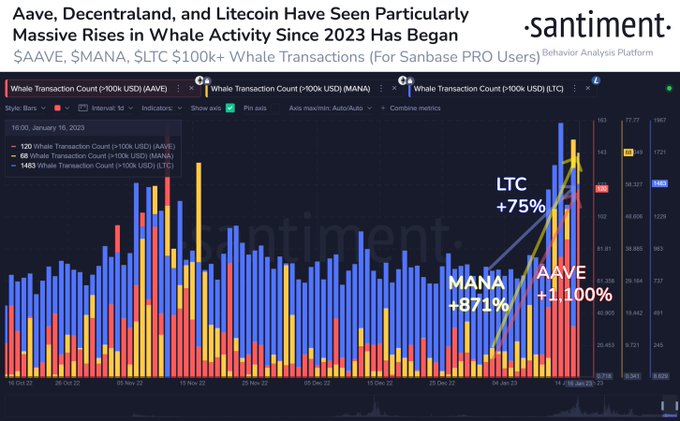

Crypto analytics firm Santiment has detected an anomaly in the whale activity of three Ethereum-based altcoin projects. In the new year when the market changes direction, whales are starting to fill their wallets again.

On-chain data shows whales congregating around these 3 altcoins

In their current analysis, Santiment says that since the beginning of 2023, three altcoins have become a favorite of whales. Starting with Aave (AAVE), Santiment analysts reported that the number of transactions above $100,000 has increased by more than 1,100% since the beginning of the year. Litecoin (LTC) is in second place. The 16th largest cryptocurrency by market capitalization has seen a 75% increase in transactions over $100,000 since the start of the year, according to the crypto analytics firm.

Santiment also reports that metaverse project Decentraland (MANA) has seen a more than 871% increase in large transactions in less than three weeks. According to analysts, “A few altcoins are still in individual runs for now, as the market-wide rally has stagnated. AAVE (+1.100%), MANA (+871%) and LTC (+75%) have increased massively since the new year with transactions exceeding $100,000.”

At the time of writing, Aave has gained 60% in price since the start of the year. Similarly, Litecoin grew 25% in the same period. Decentraland is currently priced at around $0.70, up 130% year-over-year.

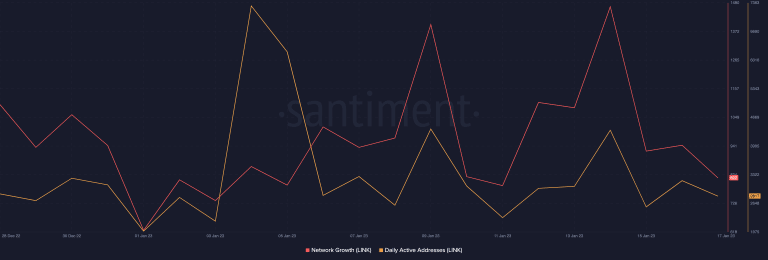

Chainlink (LINK) multiplies whale count

Santiment then cites Chainlink (LINK), noting that the number of whales holding LINK has increased by more than 26% in the past eight months:

Chainlink is a little ahead of the altcoin package today. There are 463 addresses with at least 100,000 LINK, which has increased by +26% since May 2022. It’s encouraging to see a coin build up during corrections.

According to Santiment, the number of whale addresses holding at least 100,000 LINK tokens has increased by over 26% since May 2022. Typically, this massive accumulation of whales has had a significant impact on the market, as the actions of these large holders can influence the price of a coin to rally.

Meanwhile, an analysis of on-chain performance has raised some concerns, although the LINK price has risen 23% since the start of the year, reflecting the overall growth in the market. According to data from Santiment, new demand for LINK has increased by 51% since the beginning of the year. However, the number of unique addresses transacting daily has dropped by 56% since Jan. cryptocoin.comMeanwhile, Shiba was witnessing laden whale sales.

The drop in daily active addresses, as well as the increase in new addresses for a coin, may indicate that more investors are not actively using it or taking part in transactions on the network when purchasing cryptocurrencies. In the overall picture, Chainlink continues to maintain its position among the top 25 cryptocurrencies, indicating investor interest.