Crypto analytics platform Santiment reported that traders panicked and started selling Ethereum and 2 altcoins. It did not go unnoticed that the cut-throat traders accepted significant losses. Meanwhile, Ethereum (ETH) is hovering above $1,600 following its unimpressive ETF launch. Crypto analyst Valdrin Tahiri shares his predictions for ETH’s next course.

Santiment: Traders sold these 3 altcoins at a loss!

cryptocoin. c om As you can see from , the market is acting like a roller-coaster ride. This causes confusion among investors and traders. Naturally, this confusion causes them to act in panic. Crypto analytics platform Santiment reported that amid this confusion, traders sold ETH, SHIB, and SUSHI at a loss. In this context, Santiment made the following statement:

Ethereum, Shiba Inu and SushiSwap traders showed mild signs of panic yesterday. Their network recorded some of the highest trader take-loss levels all year. These are typically signs of a short-term recovery opportunity.

📉 #Ethereum, #ShibaInu, and #Sushiswap traders showed some mild signs of panic yesterday, and their networks showed some of the highest levels of trader loss taking (vs. profit) all year long. These are typically signs of a short-term rebound opportunity. https://t.co/lz6NsiH62o pic.twitter.com/HWzWvM5RHz

— Santiment (@santimentfeed) October 6, 2023

The crypto analytics platform also stated that this development points to a short-term recovery opportunity. As a matter of fact, today all 3 altcoins started to rise after the panic decline. In a way, this proves Santiment right.

Ethereum ETFs haven’t gained much traction!

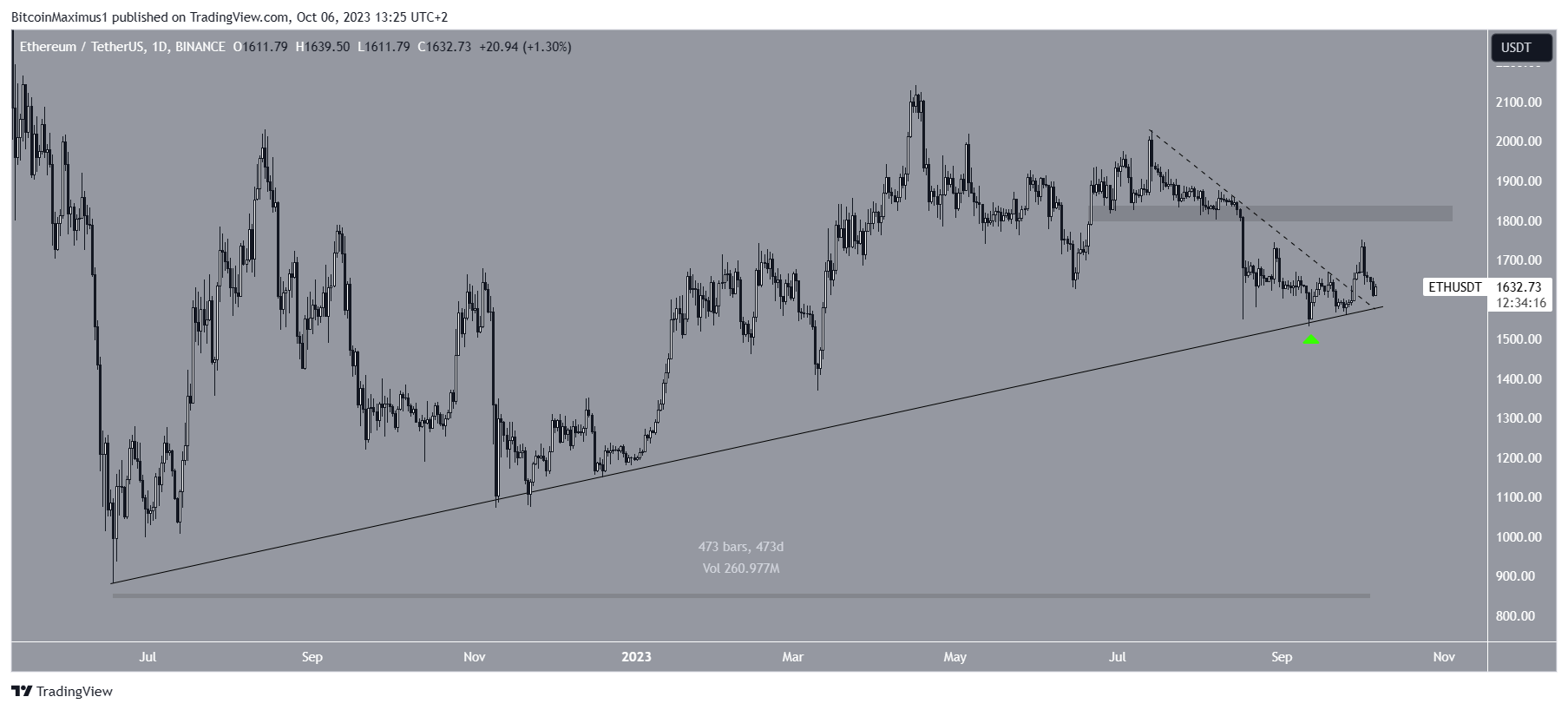

The daily time frame chart shows that the ETH price has increased since September 11. At that time, it bounced at the long-term ascending support trend line (green icon), which has been in place for 473 days. After making a higher low, ETH price broke out of the shorter-term descending resistance trend line on September 28. This breakout reached a high of $1,751 on October 1. However, the price has dropped since then. The rest of the crypto market saw a similar decline. After the price breaks a major trend line, it sometimes returns to confirm as support before resuming its previous move, as has been the case so far for Ethereum.

ETH Daily Chart. Source: TradingView

ETH Daily Chart. Source: TradingViewThe news for the Ethereum network is mixed. On October 2, nine Ethereum futures Exchange Traded Funds (ETFs) launched in the United States. However, these funds did not impress market speculators, collecting volumes of less than $2 million. Additionally, Grayscale has filed with the Securities and Exchange Commission (SEC) to convert its Ethereum trust into an Ethereum ETF.

ETH price prediction: What’s next for the price?

When we take a closer look at ETH price action, we see that there was a significant bullish divergence (green line) on the RSI before the Ethereum price bounce. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and decide whether to accumulate or sell an asset. Data above 50 and an upward trend indicates that the bulls still have the advantage. However, data below 50 indicates the opposite.

A bullish divergence occurs when a price decline is accompanied by an increase in momentum. As has been the case with Ethereum so far, it often leads to a reversal of the uptrend. If the increase continues, ETH could reach the next resistance at $1,820. This would mean an 11% increase from its current price.

ETH Daily Chart. Source: TradingView

ETH Daily Chart. Source: TradingViewDespite this bullish ETH price prediction, a close below the long-term ascending support line would invalidate the bullish structure. In this case, it is possible for the ETH price to decline by 12% to the next long-term support at $1,430.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!