On-chain data source Santiment has realized that whales are uninterested in an altcoin project as the cryptocurrency market rebounds from bottoms. According to the firm’s analysts, this could be a bearish signal.

Santiment says alt whales are losing their appetite

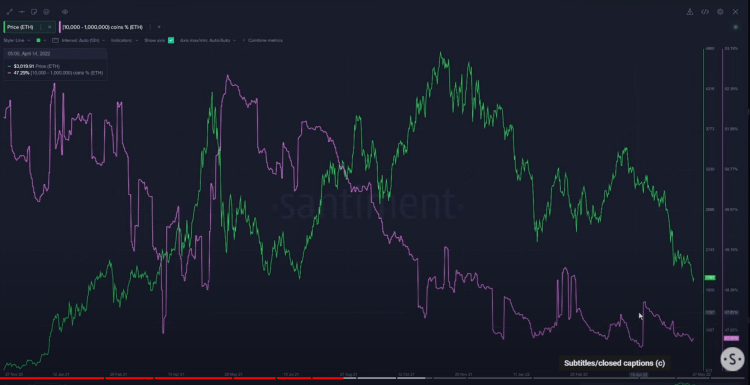

According to the closely followed blockchain analytics firm, the largest Ethereum whales on record are currently showing relatively little interest in accumulating ETH at current prices. Santiment suggests in a new report that it has been tracking whales with 10,000 to one million ETH, and giant wallets are on the sidelines even as the ETH price has dropped to almost a year low.

The lack of excitement among the biggest Ethereum whales and the 60% drop in ETH price is a bleak picture for the mainstream smart contract platform, according to Santiment. he draws. In a recent Youtube post, analysts lost sight of Santiment data:

Prices may drop a little more until whales feel it’s low enough to take action and buy back into Ethereum from all the weak hands that are effectively recovering and returning their assets to exchanges. We have to be careful about it.

Merge is approaching, what can be expected from Ethereum?

Whales’ disinterest aside, the highly anticipated Ethereum “merge” looks closer than ever before. The Ropsten testnet on the Ethereum network is ready to lay the groundwork for the “first dress rehearsal” of the “merge” to adopt the PoS consensus mechanism. Core Ethereum developer Tim Beiko shared this news on his social media platform on May 31. As you can follow from Cryptokoin.com news, the final test of the merge is expected to be “around June 8”.

📣 Ropsten Merge Announcement 📣

Ethereum's longest lived PoW testnet is moving to Proof of Stake! A new beacon chain has been launched today, and The Merge is expected around June 8th on the network.

Node Operators: this is the first dress rehearsal💃https://t.co/0fDHObLOmn

— Tim Beiko | timbeiko.eth 🐼 (@TimBeiko) May 30, 2022

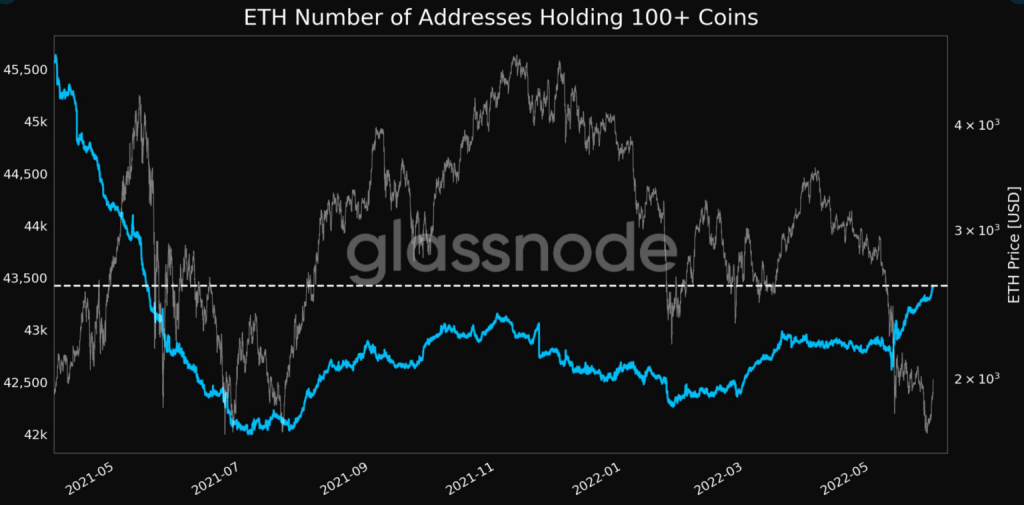

Just a few minutes after this development, The number of addresses holding more than 100 coins of ETH reached 43,425, a 1-year high.

At the same time, Ethereum price continued to find support above the $1,850 level. At the time of writing, it is trading at $1,971, up about 5% in 24 hours. This could also be a positive trigger for investors who are currently certain about the altcoin. Meanwhile, ETH reached $4,891.70 in November when the 2021 bull ended.