SEC Drops Enforcement Case Against Cumberland DRW

The U.S. Securities and Exchange Commission (SEC) has announced that it will be discontinuing its enforcement action against Cumberland DRW, the cryptocurrency trading division of the Chicago-based trading firm DRW. This significant decision was made public in an announcement from the company on Tuesday.

Last October, the SEC initiated a lawsuit against Cumberland DRW, alleging that the firm operated as an unregistered securities dealer. The agency accused the company of selling over $2 billion in unregistered securities, referencing a range of tokens including Polygon (POL), Solana (SOL), Cosmos (ATOM), Algorand (ALGO), and Filecoin (FIL) as part of a “non-exhaustive” list of tokens it considered to be securities.

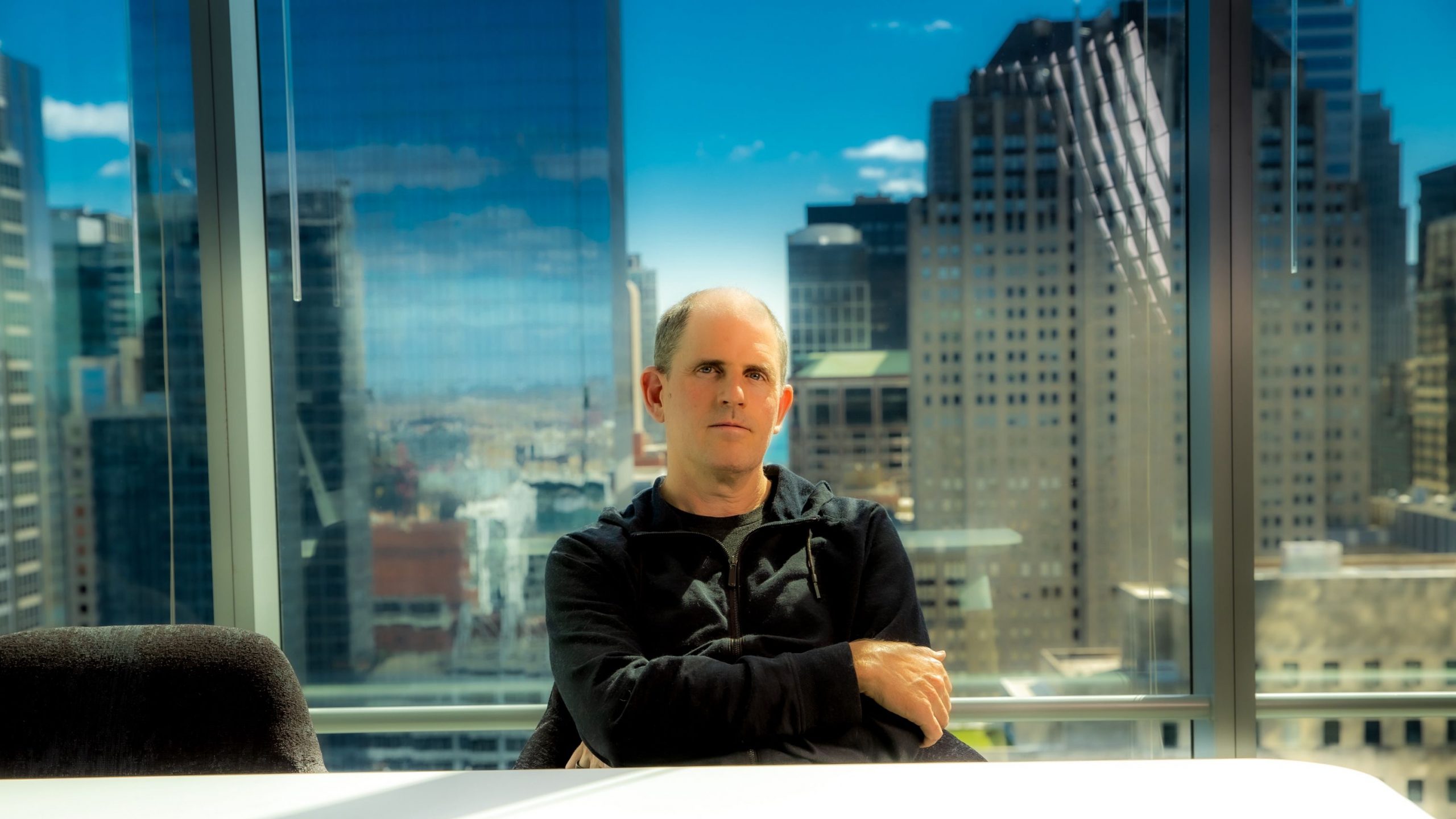

Upon the filing of the suit, Cumberland DRW and its CEO, Don Wilson, expressed their commitment to contesting the allegations. In an interview with CoinDesk the same month, Wilson highlighted the firm’s attempts to register as a securities dealer with the SEC, which ultimately fell short. He suggested that the ambiguity surrounding regulatory expectations for cryptocurrency entities under the previous chair, Gary Gensler, was not merely a flaw but rather a deliberate aspect of the agency’s regulatory posture. Wilson remarked, “This dynamic put the SEC in a position where they could say everyone is breaking the rule, and we’re just going to go after whoever we want to.” He further likened the situation to themes in Atlas Shrugged, stating, “If everybody is breaking the law, they get to selectively harass whoever they want to.”

Only five months later, with new leadership under Acting Chair Mark Uyeda, the SEC has notably shifted its stance. The decision to abandon the lawsuit against Cumberland DRW aligns with a broader trend of the SEC retracting various enforcement actions. This includes dropping cases against Coinbase, as well as agreeing to halt proceedings against ConsenSys and Kraken. Additionally, the agency has closed multiple investigations into other crypto companies such as Gemini, OpenSea, Robinhood Crypto, and Yuga Labs. Similar to the agreements made with ConsenSys and Kraken, the SEC’s settlement with Cumberland is still pending approval from a majority of the three commissioners currently serving on the panel. Notably, the Commission voted to dismiss its case against Coinbase just last week.

In its announcement, Cumberland stated, “As a firm deeply committed to the principles of integrity and transparency, we look forward to continuing our dialogue with the SEC to help shape a future where technological advancements and regulatory clarity go hand in hand, ensuring that the U.S. remains at the forefront of global financial innovation.” A representative from Cumberland DRW opted not to provide further comments beyond the firm’s post on X.

As of now, the SEC has not responded to CoinDesk’s request for comments regarding this development.