Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), focused on cryptocurrencies with a proof-of-stake (PoS) consensus mechanism. This category, which includes cryptocurrencies such as Cardano (ADA), Solana (SOL), Ethereum (ETH), ALGO, XTZ, MINA, INJ, CELO; It stated that it could meet the definition of a security under the Howey Test. Thus, he reiterated that he could place the coins under their own regulatory authority. Here are the details…

Gary Gensler targets Cardano, Solana and more

Speaking to reporters after a commission vote Wednesday, Gensler said securities laws could be triggered because investors expect a return when they buy tokens backed by a PoS consensus mechanism. Gensler explained that securities laws could be triggered in this situation, as investors expect profits when purchasing tokens under the Proof-of-Stake mechanism. He emphasized that the introduction of a protocol and the locking of tokens within the protocol must comply with regulations, similar to intermediaries. Gensler used the following statements:

What they are promoting and putting in a protocol, locking their token into a protocol, each of these token operators must comply with the law, just like brokers.

Gensler’s remarks follow last week’s remarks by Rostin Behnam, chairman of the US Commodity Futures Trading Commission (CFTC), talking about ETH as a commodity. cryptocoin.com As we have also reported, Benham argued that these coins should be regulated by the CFTC. The securities argument in general has been frequently used by the SEC in recent legal actions, including FTX’s FTT token, Do Kwon and Terraform Labs, Mango Markets trader Avraham Eisenberg, Kraken’s staking service, Genesis.

CFTC and SEC dispute continues

The two regulators have long disagreed over which institution should take priority in regulating the crypto markets. Gensler said that while Bitcoin is a commodity, he is reluctant to relinquish control, or at least the possibility of future control, over any other cryptocurrency, including Ethereum. Gensler claimed that “the vast majority” of the thousands of cryptocurrencies available are securities.

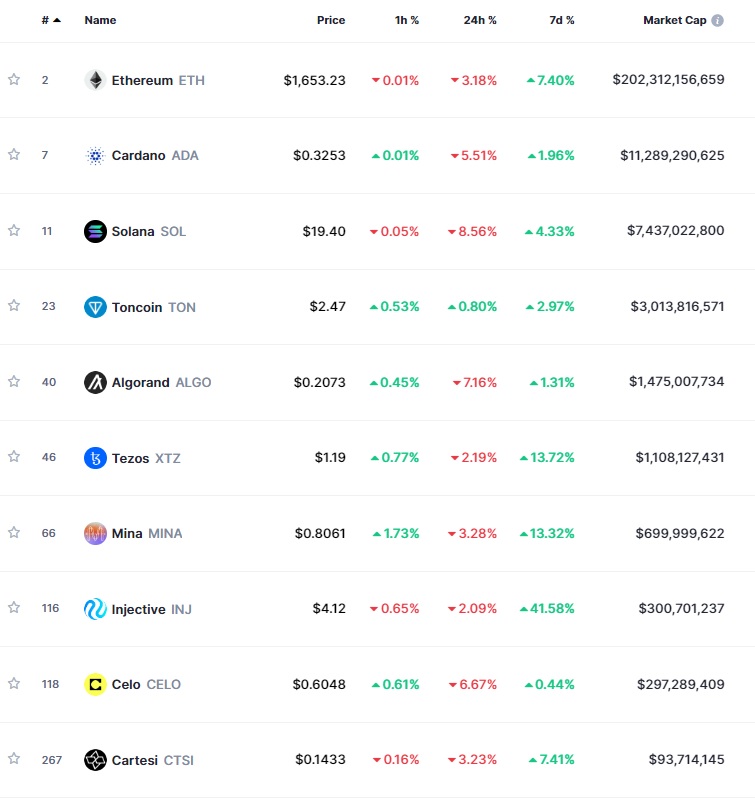

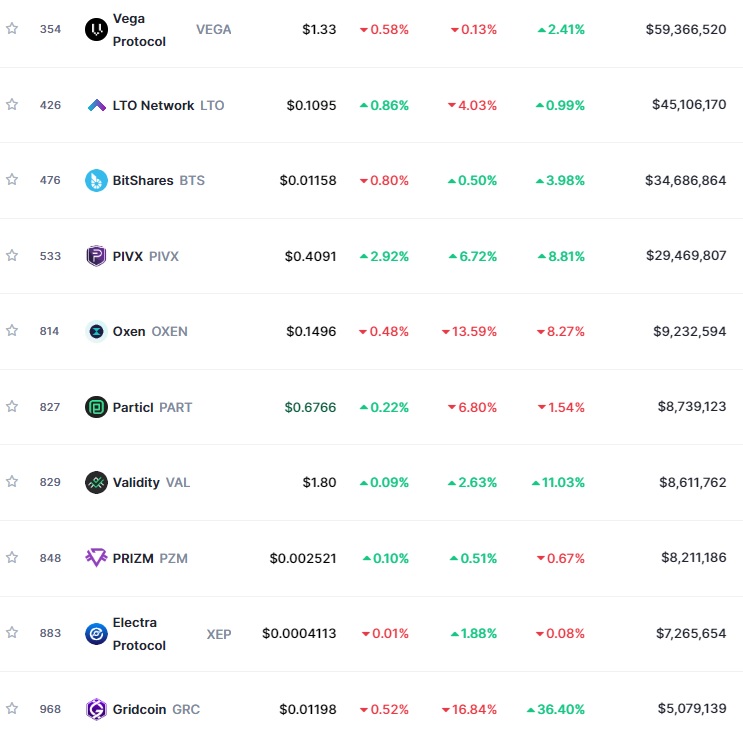

In September 2022, after the Ethereum Blockchain’s PoS upgrade known as Merge, Gensler suggested that PoS tokens could be investment contracts that subject them to securities laws. You can see the biggest tokens in the PoS category below:

Last week, Gensler’s claim that proof-of-stake tokens are securities received unexpected support with a lawsuit filed by the New York Attorney General’s (NYAG) against crypto exchange KuCoin. Attorney General in the case; He argued that the Seychelles-based exchange violated US securities laws by offering tokens (including ETH) that meet the security definition, without registering with the appropriate regulatory authorities. Despite Gensler and Behnam’s statements, the NYAG became the first regulator to claim ETH as a security in court, albeit in a state court rather than a federal court.