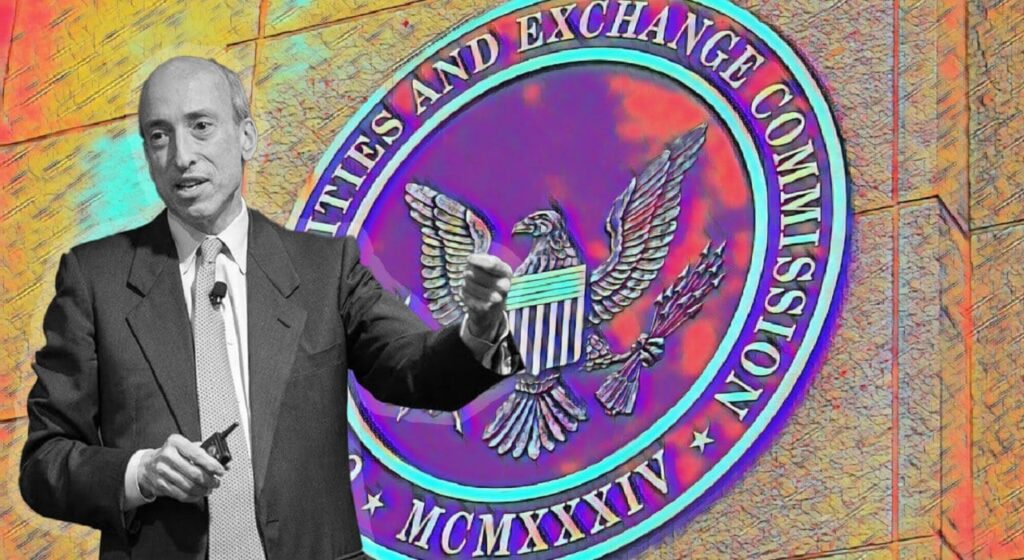

SEC Chairman Gary Gensler said that it is the responsibility of cryptocurrency firms to comply with current regulations. Gensler opposed lawmakers who said the SEC should rein in crypto companies and prevent them from trading in client assets. Furthermore, Gensler noted that the SEC had successfully blocked crypto exchanges prior to the failure of crypto giant FTX.

Gensler: Casinos where the public is looking for a better future!

Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), on Wednesday countered criticism that the agency failed to enforce rules that prevent abuse by cryptocurrency firms, such as the illegal trading that led to the collapse of cryptocurrency exchange giant FTX. In an interview, Gensler noted that the SEC has filed more than 100 enforcement cases in the crypto space.

In November, Senator Elizabeth Warren of D-Mass. urged the SEC to ‘adapt’ after the FTX failure. “We are already in a good position,” Gensler said. He also argued that the SEC is ‘lagging behind’ the crypto industry. Members of the House Financial Services Committee also urged Gensler to reveal what they knew about the collapse of FTX. The head of the SEC said that crypto firms should be held accountable for complying with existing rules. In this context, he made the following statement:

You can think of them as casinos where the investing public is looking for a better future. And most of these tokens are securities. So, this means that casinos must abide by our time-tested laws. Their business model right now, they say, offers the public an interest in crypto… Nowhere else in finance is these conflicts allowed and segregated.

Warning to cryptocurrency lending platforms from Gensler!

Alameda Research, the firm of former FTX CEO Sam Bankman-Fried, used billions of dollars in FTX client assets for the trade. One practice Gensler says violates a federal law. cryptocoin.com As you requested, FTX filed for bankruptcy on November 11. Additionally, Bankman-Fried stepped down as CEO as the firm faced a liquidity crisis.

Lawmakers observed that federal oversight of FTX was blocked due to the company’s headquarters in the Bahamas. Gensler said the SEC has successfully deterred other suspicious crypto firm activities. He cited as an example the charges against Poloniex and Coinbase for unauthorized transactions. Based on this, he made the following assessment:

We have filed lawsuits against cryptocurrency lending platforms, including BlockFi. We will continue to be a strong securities regulator. But I advise these brokers, these showcases, these casinos to really adapt and work with the SEC. Segregate these businesses to ensure compliance.

In addition, Gensler said that the SEC will impose further sanctions if cryptocurrency exchanges do not comply. However, he did not elaborate on what would happen. In this regard, he stated:

We can use some exemption powers to tailor things. However, this does not mean abandoning basic protections. I mean separating these businesses as a separate exchange.