The US Securities and Stock Exchange Commission (SEC) postponed its decision for Ethereum Stock Exchange Investment Fund (ETF) options. The institution has identified April 9 as a new date by extending the examination period of 60 days.

Third postponement for Ethereum ETF options

In a statement on February 7, the SEC announced on the third time he had postponed his decision on the approval of Ethereum ETF options. Previously, similar postponement was made between September and November 2024. The Commission said it needs more time to evaluate the potential impacts on the market and collect feedback from the public.

In this context, a 21 -day period was opened to the public. SEC, the extension of the decision of the decision, the proposed rules of change offers the opportunity to evaluate more comprehensively, he said. Postponement affects the applications of big companies such as Bitwise, Grayscale, Ethereum Mini Trust and Blackrock.

Market expectations and possible effects

SEC’s postponement decision, CBOE BZX Exchange Inc. It also includes a proposal presented on behalf of Fidelity. This suggestion requires approval for Fidelity’s options connected to the Spot Ethereum ETF to list and process. Option contracts give investors the right to buy or sell assets at a certain price, and these financial instruments play an important role in risk management.

Analysts think that the approval of Ethereum ETF options can accelerate institutional adoption and increase market efficiency. There are already similar regulatory frameworks for Bitcoin ETFs and commodity -supported assets such as gold. Bloomberg ETF analyst Eric Balchunas said that the approval will ultimately take place, but the management changes in the SEC could slow down this process.

Crypto -Friendly Regulatory Approach Hope

Paul Atkins, a former commission member of the SEC, is expected to be appointed to replace Gary Gensler. This appointment is seen as the beginning of a crypto -friendly regulatory approach. Analysts interpret this process as a harbinger of a more positive period.

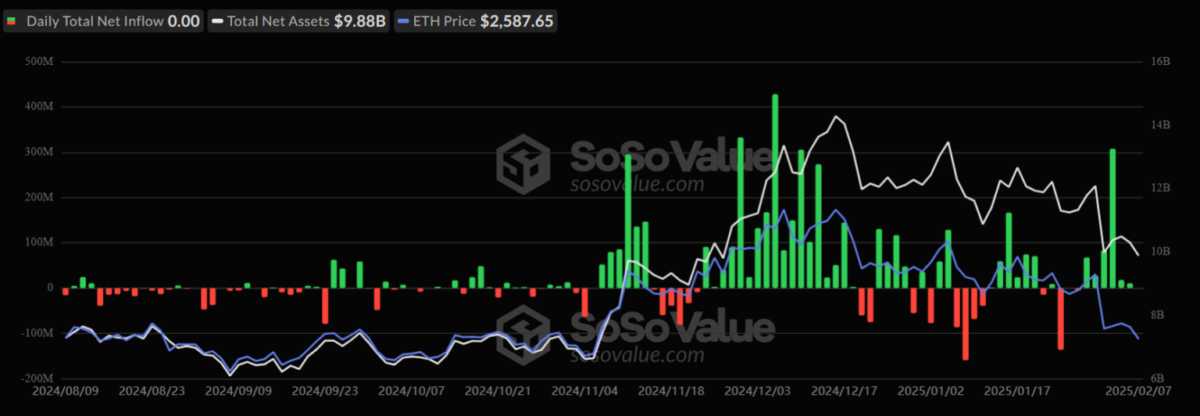

Despite all these uncertainties, the demand for Ethereum Spot ETFs is increasing. According to Soso Value data, these funds have recorded a successive entry in the last five days and total investments exceeded $ 3 billion. Despite the delay of approval, the market’s interest in these products continues to grow.