The U.S. Security and Exchange Commission (SEC) lawsuits against the two largest crypto exchanges by market volume last week will likely have a chilling effect on 19 tokens mentioned in the filings, possibly forcing them to resettle their businesses to other parts of the world, legal experts told CoinDesk.

But the experts warn that the ultimate impact remains uncertain. In the interim, the prices of the native cryptocurrencies from some of the industry’s best-known protocols, have suffered with all but one of them plunging by double digits over the past seven days.

“I’m not sure the lawsuits are a surprise to anyone following the SEC’s current playbook,” Sean Farrell, head of digital asset research at data firm FundStrat, said, adding: “They want to stifle the onramps with costly legal burdens such that everyone moves overseas.”

Last week, the SEC accused Binance and Coinbase of offering unregistered securities to the general public, among other allegations. The suits highlight ongoing questions about whether cryptos are a security, commodity or otherwise. Securities are investments that can be exchanged and used to raise capital.

Early warning

The SEC first warned Coinbase it might sue the exchange earlier this year, sending a Wells Notice, to which Coinbase responded in April. A Wells Notice is a notification that the agency is planning enforcement action against a business. The SEC has been scrutinizing Binance for years.

The suit against Binance addresses the platform’s BNB token and the Binance-linked BUSD stablecoin. Crypto analysts have speculated that major U.S. exchanges might have been steering clear of a BNB listing for fear of running afoul of regulators. “Exchanges probably do not list BNB as they see it as a security given the centralization of their network,” said one analyst.

Both lawsuits also stated that a number of other tokens are securities, including Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI) and Algorand blockchains (ALGO), Filecoin network (FIL), Cosmos (ATOM), Sandbox platform (SAND), Axie infinity (AXS) and Decentraland (MANA), BNB (BNB), Voyager Token (VGX), Chiliz (CHZ), NEAR protocol (NEAR), Flow (FLOW), Dash (DASH, NEXO (NEXO) and Internet Computer (ICP).

“The status of these tokens is now somewhat in limbo,” said Jesse Overall and Steve Gatti, attorneys at the UK-based law firm Clifford Chance. “This creates uncertainty and certain risks in the U.S. for markets and other market participants transacting in the token, as well as potentially the creators, pending a judicial determination,” they added.

Gatti and Chance noted that the SEC has sued the exchanges for listing the tokens, rather than going after token creators.

Overseas

Some analysts think that if the SEC wins, crypto exchanges will have to leave the U.S. market.

“The question is whether this will make its way to court and if so, many in the crypto sector believe a judge will be more objective than the SEC in settling the question of whether crypto currencies are securities,” SEC legal expert Ron Geffner told CoinDesk.

“If the SEC wins, exchanges, issuers and many service providers will have to revisit whether they want to continue to conduct business in the United States and if they do, they will need to determine whether and how best they can comply with the federal securities laws, both in connection with activity previously taken and future transactions.”

Echoing Geffner, Farrell does not expect the tokens to be listed in the U.S. if the SEC wins. Farrell said he hopes that Congress eventually passes “ legislation that will create a safe harbor for teams to launch tokens that can decentralize over a given time period.”

Protocols respond

The Solana Foundation told CoinDesk in a statement that it believes SOL is not a security. “SOL is the native token to the Solana blockchain, a robust, open-source, community-based software project that relies on decentralized user and developer engagement to expand and evolve.”

Similarly, the NEAR Foundation wrote last week in a blogpost that it disagrees with the SEC’s inclusion of the NEAR in the complaint, and said “we believe the Foundation has not violated any applicable US securities laws.”

“The Foundation is regulated in Switzerland and the NEAR token has been characterized as a payment token (and not as a security) under Swiss law,” said the blogpost.

The Cardano development company IOG dismissed the SEC’s contention that ADA, the blockchain’s native token, is a security too. “Under no circumstances is ADA a security under U.S. securities laws. It never has been,” IOG said following the lawsuit.

Polygon Labs said MATIC was “developed outside the U.S., deployed outside the U.S.,” and “available to a wide group of persons, but only with actions that did not target the US at any time.”

However, crypto exchange Robinhood announced Friday it will delist ADA, SOL and MATIC on June 27. Other U.S. based exchanges that list these tokens have not yet taken actions.

The Coinbase and Binance lawsuits might propel other exchanges to delist certain tokens to avoid similar charges in the future. According to Joshua Ashley Klayman, U.S. head of fintech and head of blockchain and digital assets at multinational law firm Linklaters LLP, “the SEC complaint against Binance and CZ likely provide a roadmap for the types of charges that other trading platforms and market participants may face in the future.”

Price

All 12 tokens mentioned in the Binance suit have traded down over the past week, Decentraland and The Sandbox have been hardest hit, dropping 26% and 27% respectively.

Binance lawsuit listed tokens, (Lyllah Ledesma/Messari)

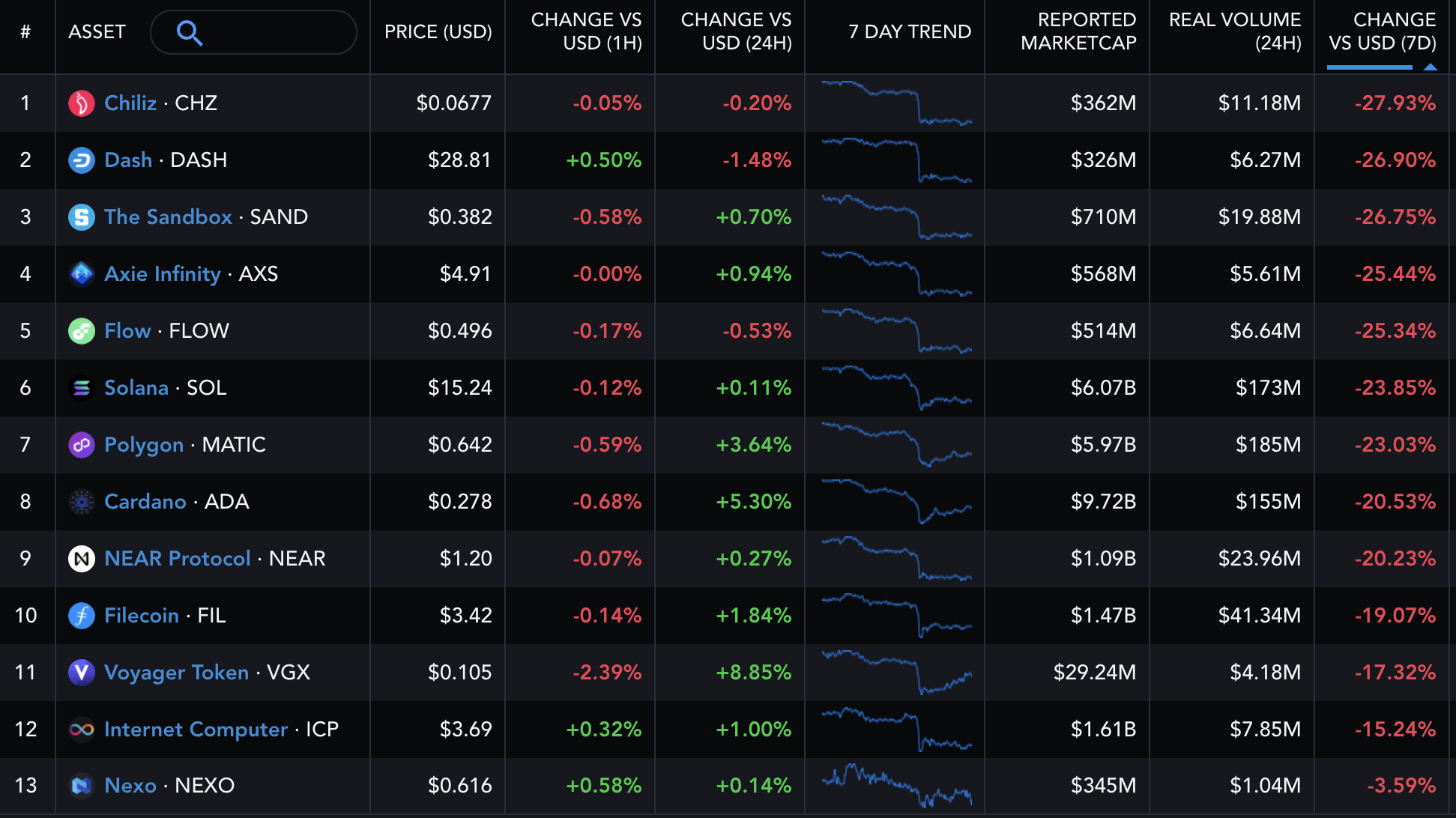

The tokens listed in the Coinbase lawsuit have also been trading in the red, with Chilliz’s CHZ token plummeting almost 30%.

Coinbase lawsuit listed tokens (Lyllah Ledesma/Messari)

Farrell said the token price drop might offer a good opportunity for investors to buy. “These suits and their subsequent drawdowns in prices could pull some selling forward and actually create some solid reentry points in the coming days.”

Sheraz Ahmed, managing partner at STORM, said that a short-term sell-off was to be expected and he predicts a recovery. “It’s worth remembering that many of these tokens are tied to blockchains premium projects; I predict a robust recovery to follow, similar to what has happened with the stock price of Coinbase, which saw a 13% drop before quickly recovering to its previous levels as if to brush off the incident all together.”

Uncharted territory

Clifford Chance’s Overall and Gatti said that how creators or users react to the complaints is uncertain. “Will users of the token stop using them in the various apps and protocols for the purposes for which the tokens are designed?,” they said.

“We are in somewhat unchartered territory legally as these assets are not traditional securities and there is little judicial precedent addressing how the federal securities laws apply to secondary transactions in objects that may have initially been offered as part of an investment contract arrangement, or how such objects should be treated pending a judicial determination of the issue,” Overall and Gatti added.