The regulator’s crypto enforcer has made broad claims that the SEC has more in store for the crypto industry. Still, David Hirsch acknowledged that the agency’s current caseload is heavy. So he admitted that the SEC can’t go after everything.

David Hirsch: Binance and Coinbase are just the beginning for the SEC!

cryptokoin.com As you follow from , the US Securities and Exchange Commission (SEC) is increasing the pressure on crypto. David Hirsch, Chief of the SEC’s Crypto Assets and Cyber Unit, spoke at the Securities Enforcement Forum in Chicago on Tuesday. In his speech, Hirsch made statements that will soon concern the crypto world. Hirsch says that apart from Coinbase and Binance, there are other exchanges and DeFi altcoins that violate the law. Additionally, the SEC’s crypto chief states that the agency is not letting go of these projects.

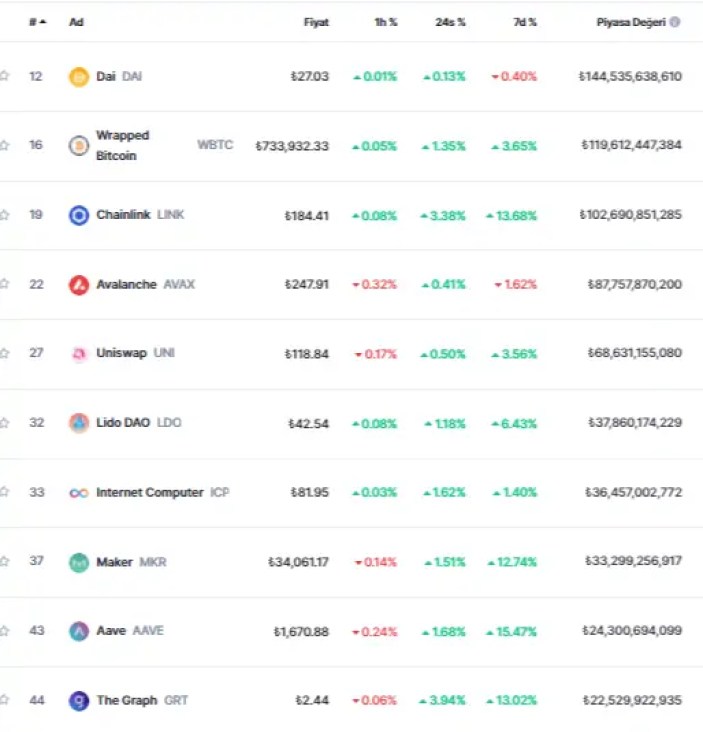

The 10 largest DeFi altcoin projects by market cap. Source: CoinMarketCap

The 10 largest DeFi altcoin projects by market cap. Source: CoinMarketCapDavid Hirsch says the enforcement agency, which is filing cases at an unusually rapid pace for the SEC, is aware of and investigating other firms involved in much the same activity seen on these two major platforms. He also emphasizes that the industry’s compliance violations “apply far beyond these two organizations.” In this context, the SEC’s crypto chief makes the following statement:

We will continue to bring these charges. The agency is already embroiled in a number of complex crypto cases in federal courts. Moreover, it is not always completely successful (as seen in its effort to appeal a recent Ripple decision). We will continue to be active regarding intermediaries. This may be brokers, dealers, exchanges, clearing houses or others active in this field, within our jurisdiction, who have failed to fulfill their obligations through registration or failure to provide adequate or complete disclosure.

SEC’s crypto chief: DeFi projects do not escape our attention!

David Hirsch says that DeFi altcoin projects will not escape the attention of the enforcement unit. In this regard, he said, “We will continue to conduct investigations. We will be active in this area. “Also, adding the DeFi label will not be something that will deter us from continuing our work,” he says.

The U.S. securities regulator was previously accustomed to a relatively calm enforcement approach in which it targeted wrongdoing at regulated businesses — often large Wall Street firms with extensive legal departments — and quickly began negotiating settlements. Since accusations against crypto asset companies routinely threaten their existence, they tend to take the agency to court.

Is it possible for the organization to fully cover the crypto world?

The SEC has a limited enforcement budget. This budget is typically less than the financial giants he is accustomed to dealing with, so bandwidth is limited. “We have a lot of cases going on,” Hirsch admits. “You feel like you have the capacity,” says event moderator A. Kristina Littman, who before Hirsch served as chief of the SEC’s crypto enforcement and now works at Willkie Farr & Gallagher. Hirsch admits the SEC can only reach so far. In this regard, he makes the following statement:

There are more tokens than the SEC or any agency has the resources to track directly. I think it could be 20,000, 25,000 from what I last read. Similarly, there are a number of centralized platforms, some of which act as unregistered exchanges.