As we approach the halfway mark for 2023, the year has been difficult to characterize for both equities and digital assets. Ongoing debates about the macroeconomic picture, both at home and internationally, have analysts wondering when the next shoe will drop. In March, when I wrote about the U.S. banking crisis, digital assets were rallying to annual highs, touted as a safe-haven asset and hedge against financial Armageddon.

Since then, almost any meaningful headline has been shrugged off as unimportant. In the face of bank instability, the ongoing war between Russia and Ukraine, a 25-basis-point rate hike in May, a looming global recession and the U.S. debt-ceiling fight (that may or may not be resolved), digital assets (and equities) have seemingly lost interest in all conventional narratives that would normally spark a reaction from investors.

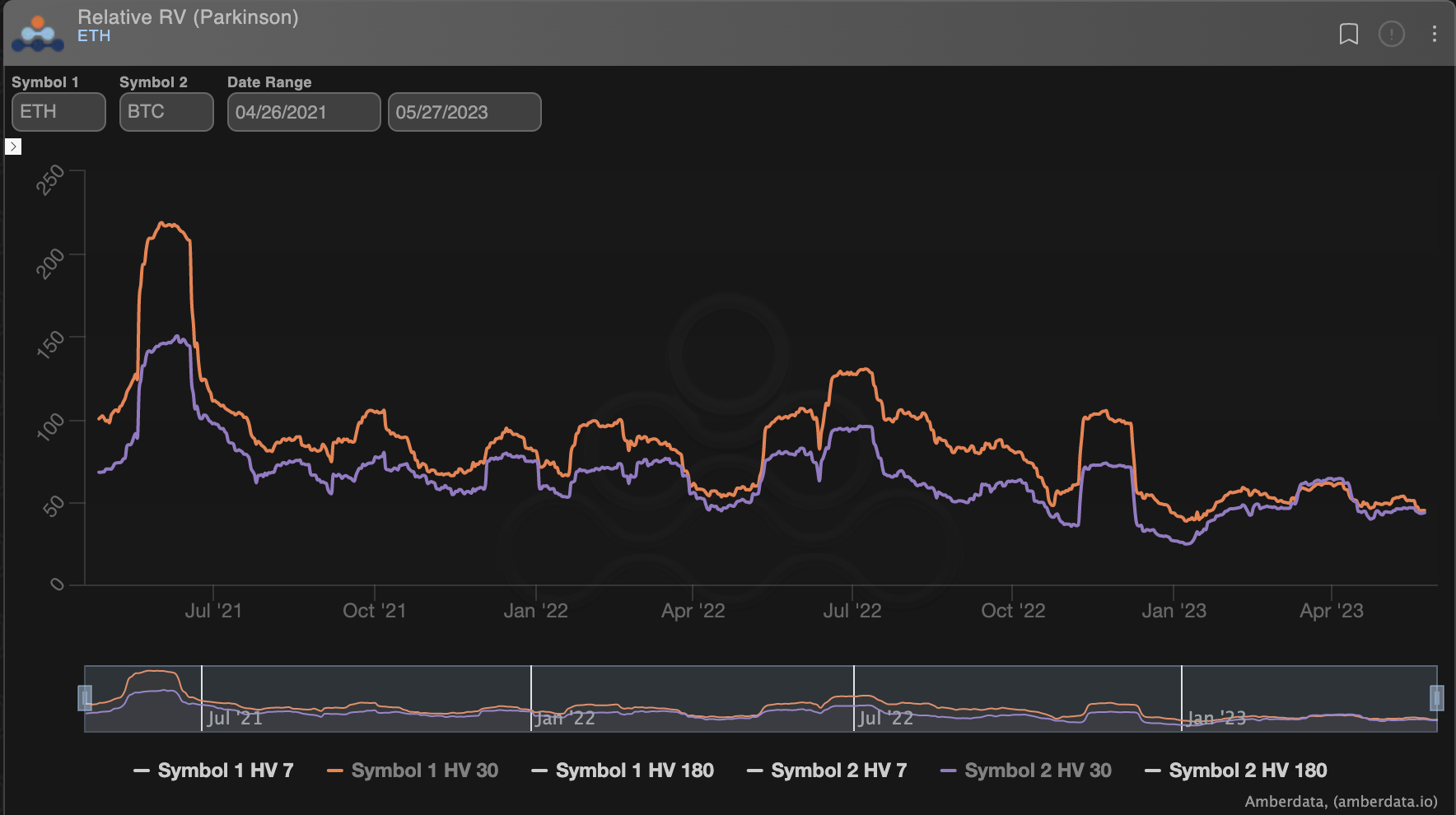

In trading terms, both realized and implied volatility have drifted into all-time-low territory. Bitcoin’s (BTC) range over the past two weeks has been reduced to 6.3% with 30-day realized volatility at 42.1 (4th percentile on a one-year lookback) and ether (ETH) stuck in a narrow 7.1% range, with 30-day realized vol at 41.9 (1st percentile over a one-year lookback).

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

(Amberdata)

To take advantage of the ever-decreasing volatility in digital assets, traders are pressing short vol bets, wagering that the current conditions will persist, and with major market makers like Jane Street and Jump Capital reportedly slowing their crypto trading, maybe they are right.

But can it really be that simple? “Sell volatility in May and go away?” Or are investors ignoring meaningful signals that could push bitcoin and ether out of their recent boundaries?

The June 1 debt-ceiling deadline emerged recently as the obvious candidate for a binary volatility event. And for good reason: A default would send shockwaves through markets worldwide.

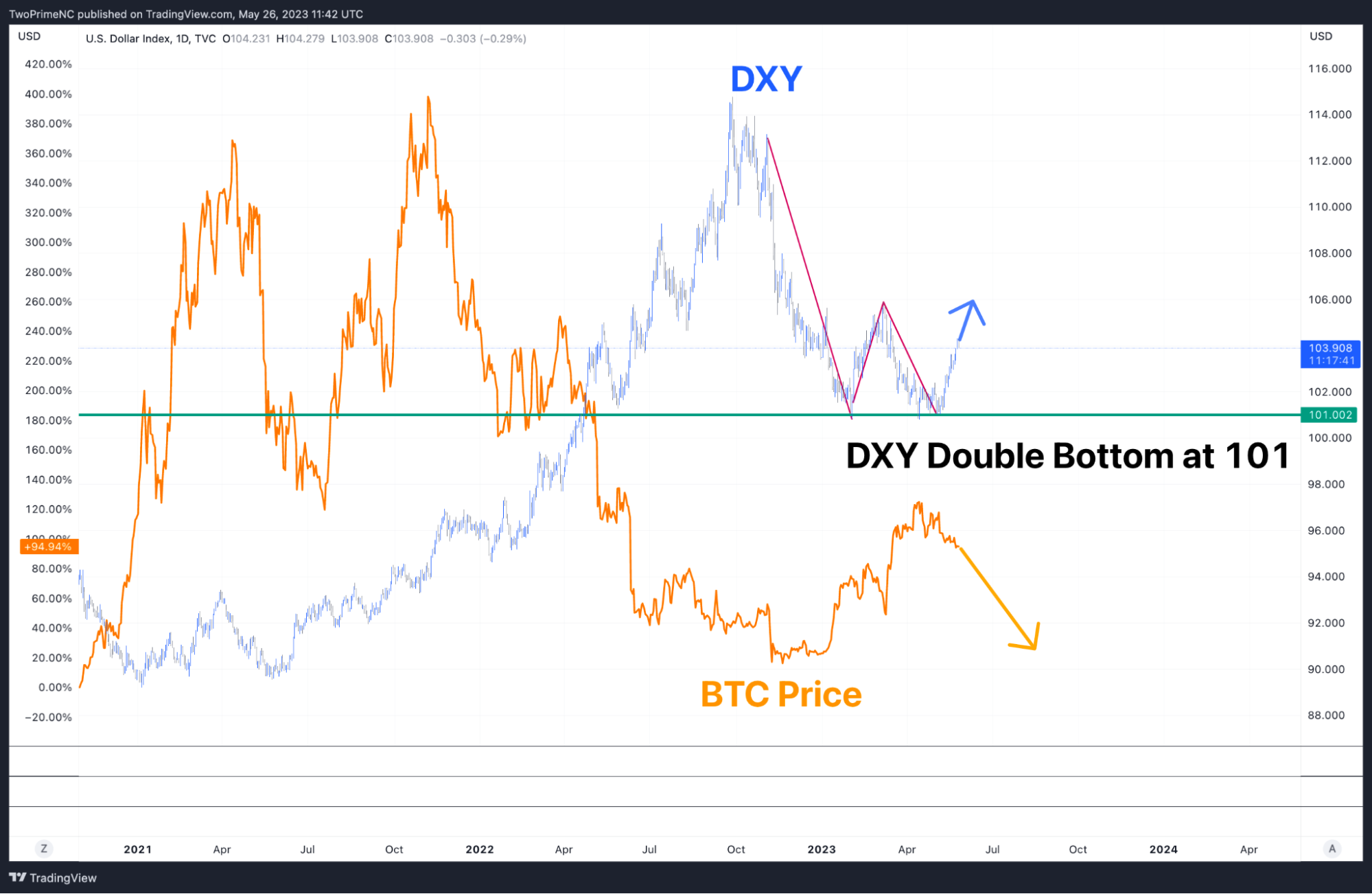

(TradingView)

In response to the uncertainty around this, bond markets have been pricing in risks, with 2- and 30-year Treasury yields rising sharply in May. And the U.S. Dollar Index (DXY) has initiated a strong double bottom rally off the 101.0 level. Typically, holding above this level hasn’t been good for bitcoin. A simple look at the chart below gives some perspective on the inverse correlation between bitcoin and DXY.

Suffice to say, the recent calm in bitcoin and ether volatility should not lull market participants into a false sense of security. As the winds of macroeconomic change continue to blow, and underappreciated narratives start to play out, we could witness the sharp return of volatility that these assets are known for. If the “higher for longer” narrative continues to play out, expect a sticky dollar index above 101, and ongoing pressure for digital assets as investors navigate these murky waters.