A popular analytics firm that studies whale behavior has shared which cryptocurrencies are bought by major wallets selling Bitcoin.

Bitcoin whales prefer to buy these altcoins

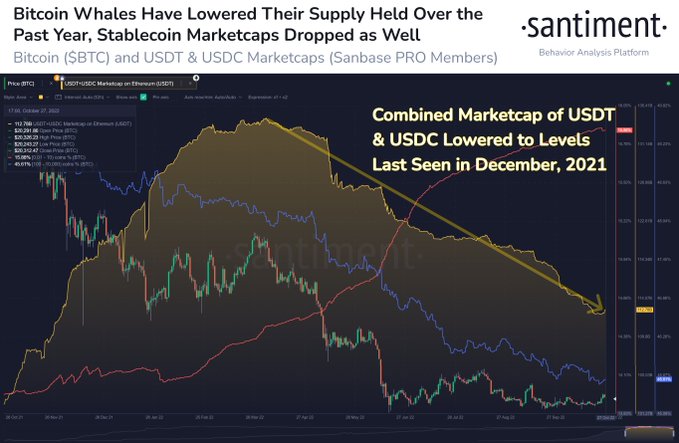

Analytics platform Santiment reveals where major Bitcoin investors keep their cash. The updated metrics came at a time when bears dominated the cryptocurrency market. According to Santiment, the Fed’s rate hikes and the bleak economic environment are causing crypto whales to invest in US and international government debt. According to Santiment analysts:

One of the things that encouraged investors was that major stablecoin market caps increased through May of this year. But when fears of Federal Open Market Committee (FOMC) rate hikes and recession really began to take over the speculative decisions of investors, it became much harder for big investors to justify holding such a large amount of dollar-pegged crypto on the sidelines.

Santiment also said that whales are moving away from the cryptocurrency market. Firm analysts say this is due to the uncertain macroeconomic environment:

“The outcome is very likely that these big institutions and whales keep their money in US and world treasuries instead. Crypto is not very attractive to them (for now) with so much uncertainty going on through 2022.”

Volume of stablecoins at buy month’s low

Santiment stated that the total market cap of the market’s largest stablecoins, Tether (USDT) and USD Coin (USDC), is at 10-month lows. Analysts say their rebound will mean a rally for Bitcoin and Ethereum:

“Bulls will want to watch and see if the biggest stablecoins start to see a rise in their market capitalization once again. If they do, Bitcoin and crypto prices could justify an increase even if the whale supply of BTC and Ethereum remains low.”

🐳 #Bitcoin whales have dumped this past year. But typically, dumped $BTC will largely be in #stablecoins until prices are intriguing enough for them to jump back in. Our latest insight touches on where their money has likely been moving since May. https://t.co/8hVXhENthZ pic.twitter.com/fUpBhw66EZ

— Santiment (@santimentfeed) October 28, 2022

cryptocoin.com As you follow, BTC is currently trading at $ 20,700. It has remained stable over the last 24 hours. 8% green since last week. The market’s total value is consolidating just below the $1 trillion threshold.