The leading altcoin price has slumped by about 11 percent this week. Currently, Ethereum is trading at $1,718. The Fed refused to raise interest rates for the first time in a year. After that, long-term holders moved their supply. Institutions have already been skeptical about ETH this month. So they were probably the long-term holders moving the supply.

A bearish sign for Ethereum

cryptocoin.com As you follow, the altcoin price, along with Bitcoin, the leader of cryptocurrencies, recorded a pullback despite the US Federal Reserve (Fed) holding interest rates steady this month. This downward trend mostly affects institutions that consider it appropriate to step back for now, instead of keeping their hopes for recovery.

The status quo from the Fed should have resulted in an increase in the performance of the crypto market. However, the announcement of two more rate hikes in upcoming policies this year has caused ETH to drop by almost 11% in a week. Thus, it caused it to approach the March low of $1,431.

ETH 1-day chart

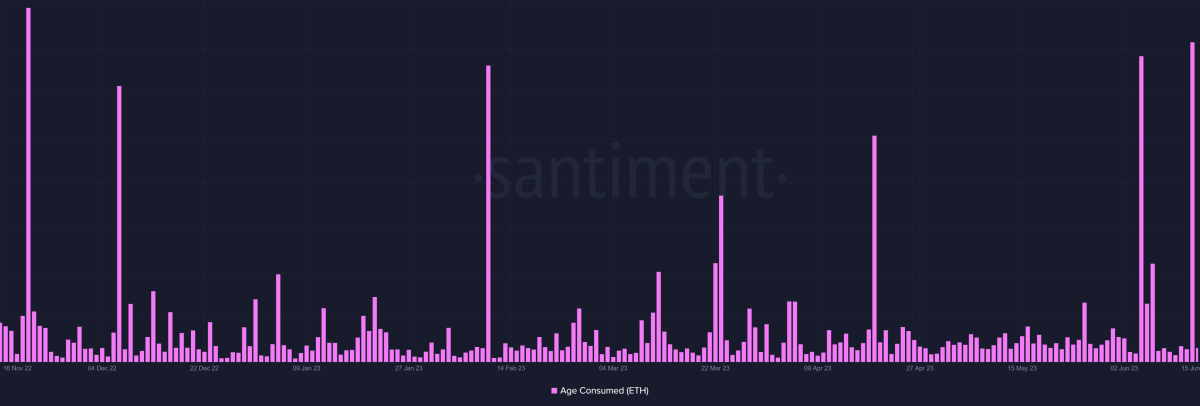

ETH 1-day chartOne of cryptocurrency’s most loyal groups has displayed skepticism this week. Therefore, this situation seems to have frightened ETH holders considerably. Long-term holders whose supplies have not been touched for more than 12 months moved their supplies this week. In doing so, they pointed to an increase in the age of coins consumed, which is a bearish sign for altcoins in weak markets.

Age of Ethereum consumed

Age of Ethereum consumedThe leading altcoin still has the support of its investors largely

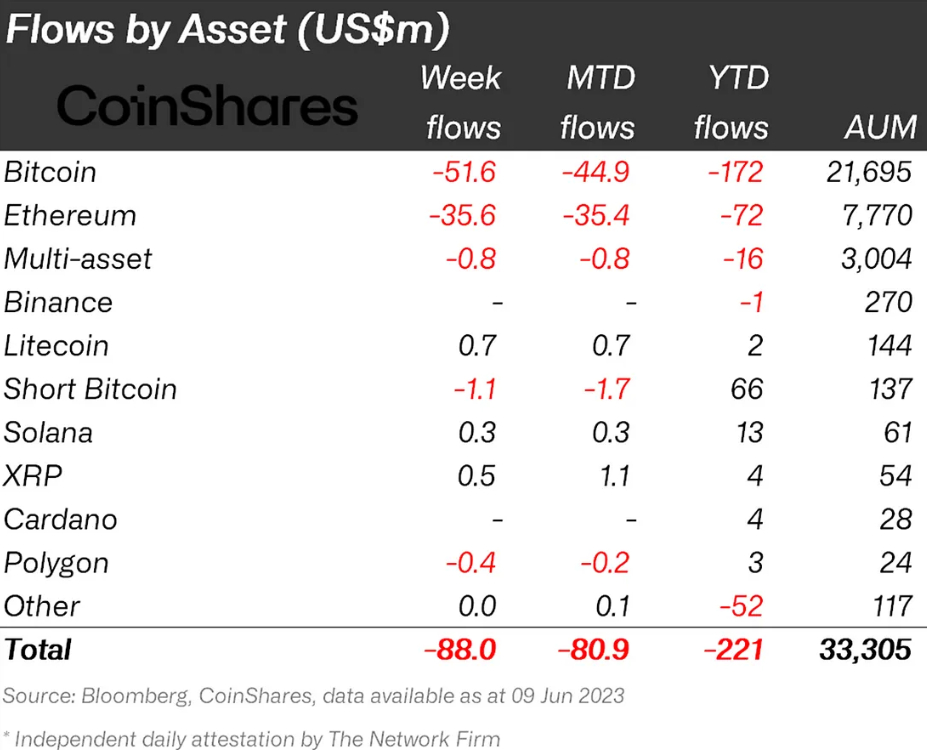

Apparently, this could have been a corporate move. That’s because the increase came just before the Fed withdrew its proposal to raise interest rates. As such, institutional investors were horrified. It is possible to see this situation in the outputs recorded for the week ending June 9th.

Ethereum saw around $35.6 million worth of outflows in the week ending June 9. These exits accounted for close to half of the total exits recorded for ETH to date. Therefore, it may take some time for institutions to return to the bullish side. Because for now, it seems like it will take some time for prices to recover.

Net flows of institutional investors

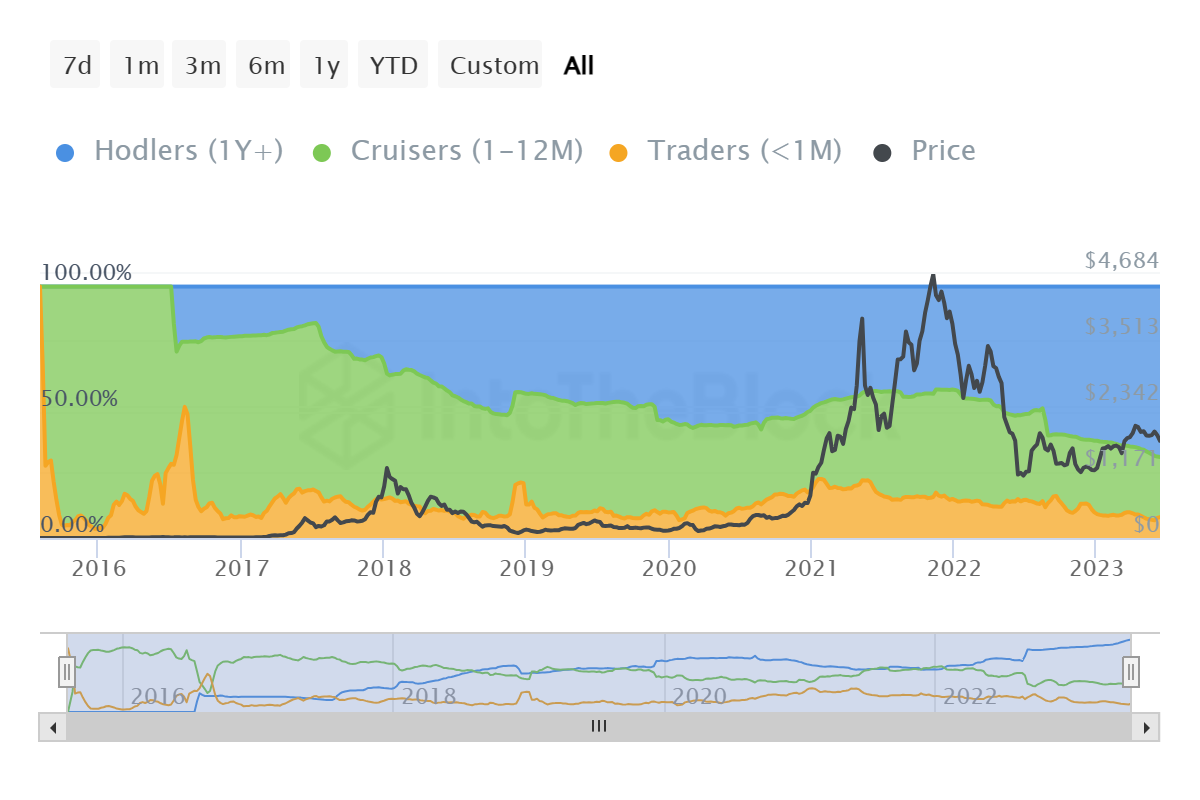

Net flows of institutional investorsHowever, long-term holders did not sell much, despite significant supply moving. These investors control about 73% of the entire circulating supply of ETH. Also, this situation remained mostly unchanged despite the volatility this week.

Ethereum supply distribution

Ethereum supply distributionTherefore, ETH still largely has the support of its investors. However, it is possible that this support will decline if the second-generation cryptocurrency hits the aforementioned March lows.